Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Dec, 2022

By Anser Haider

Microsoft Corp. is looking for a way to settle a U.S. Federal Trade Commission lawsuit that would preserve the company's $68.70 billion acquisition of Activision Blizzard Inc.

The FTC sued to block the deal over concerns about potential anti-competitive behavior. The agency's lawsuit suggests that the acquisition would allow Microsoft to restrict or degrade Activision's gaming content on rival platforms such as Sony's PlayStation.

Although the FTC's resistance is likely to complicate Microsoft's plan to buy Activision, analysts are convinced the company will press to negotiate a conditional deal approval that still allows Microsoft to take control of Activision's lucrative gaming franchises. They also pointed to some potential holes in the regulators' anti-competitive concerns that could bolster the company's case in court. Microsoft aims to use Activision's intellectual property to grow its gaming business.

"It's never over till it's over," said Wedbush analyst Michael Pachter. "The FTC is 'seeking' to block the deal, which means Microsoft can still reach an agreement to change their minds."

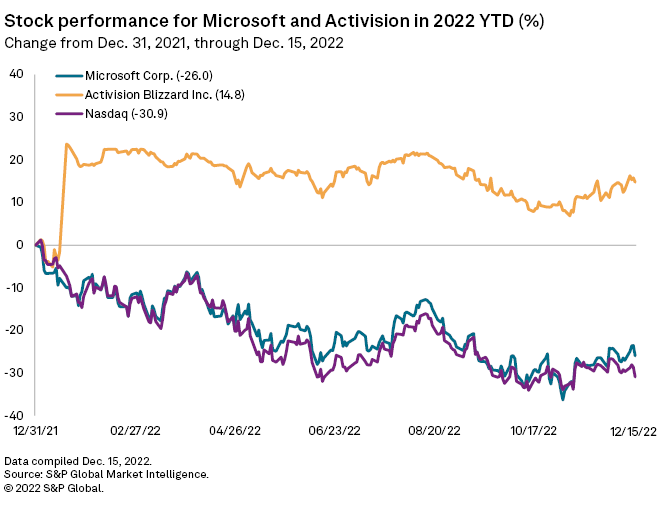

Microsoft's stock was down 26% for the year-to-date as of Dec. 15, slightly outperforming the tech-heavy Nasdaq index, which had fallen 30.9%. By contrast, Activision's stock was up 14.8% over the same period.

Gaming competition

To allay regulators' concerns about the deal, Microsoft had offered to sign a legally binding agreement guaranteeing it would provide Call of Duty to its gaming competitors. The offer was made before meetings with FTC commissioners and before the agency sued to block the deal, Microsoft President Brad Smith said during the company's annual shareholder meeting on Dec. 13.

"I'm disappointed that the FTC didn't give us the opportunity to even sit down with the staff to talk about our proposal to see if there was a solution there," Smith said.

The executive also voiced concerns about the FTC's focus on Sony, whose PlayStation console outsells Microsoft's Xbox and has 286 exclusive games compared to the Xbox's 59.

"Sony has 70% of that [global gaming] market, and we have 30%," Smith said. "So the first thing a judge is going to have to decide is whether the FTC lawsuit is a case that will promote competition, or is it really instead a case that will protect the largest competitor from competition."

A spokesperson for the FTC declined to comment when contacted by S&P Global Market Intelligence. A Microsoft spokesperson reiterated a previous statement by Smith: "While we believed in giving peace a chance, we have complete confidence in our case and welcome the opportunity to present our case in court."

A key differentiator among the console manufacturers is the exclusivity of games on their respective consoles, and Microsoft taking control of Activision's titles would benefit both the Xbox as well as the company's Game Pass subscription service, said Wedbush's Pachter.

"What the FTC's complaint fails to note is that Microsoft's service is the only one that offers a subscription without requiring subscribers to purchase its underlying console," said Pachter. "Microsoft's proposal to bolster Game Pass with Activision content would actually lower the price of access to only $15 per month for a library of over 200 games."

Sony has made more than a dozen acquisitions in the last 20 years that provided the company with exclusive content for the PlayStation with no objections from regulators, Pachter said. The analyst also noted that the agency has passed on attempting to block other major deals where the buyer made the library content of the acquired company exclusive to its own service, such as Disney with Fox, Amazon with MGM and Warner Bros. with Discovery.

"The FTC's complaint in the Activision acquisition is dripping with hypocrisy," Pachter said. "Unlike the video streaming subscription business, the multi-game content library subscription business is in its infancy."

Even if the FTC had not raised concerns about competition, it was always unlikely that Microsoft would restrict access to Call of Duty for PlayStation users, as that would be detrimental to the franchise, said Ross Gerber, CEO and founder of Gerber Kawasaki Wealth and Investment Management.

"Why would Microsoft cut off a third of Call of Duty's player base? It would destroy the value of the game, and then people wouldn't play it," Gerber said. "The whole argument that there's some sort of competitive issue here is absurd."

Closing the deal

Both Microsoft and Activision are confident that the deal will overcome regulatory hurdles and close on schedule by June 2023.

Microsoft's "more personal computing" segment, which includes revenue from hardware as well as gaming, saw two straight years of strong double-digit growth due to COVID-19 but started slowing down in 2022. This slowdown in demand for devices should negatively impact sales of Windows OEM and Surface laptops, but the Activision acquisition would boost future growth, said Dan Morgan, vice president and senior portfolio manager of Synovus Trust Co.

"I think they will continue to aggressively pursue this deal till it's done, because adding Activision's very popular games to their platforms will add a much-needed growth driver to that segment going forward," Morgan said.

Wedbush analyst Pachter expects Microsoft will likely respond to the FTC's complaint no later than the end of December, with both parties expected to reach a mutual agreement on concessions no later than the end of January. Those concessions could include assurances by Microsoft to never price Activision's games lower on the Xbox than the competition or degrade their experience on competing platforms, said Pachter.

Regardless of whether the deal goes through, the FTC's lawsuit could set a troubling precedent, said Gerber.

"Any big companies that want to grow and expand are scared to buy anybody, because they're going to end up spending billions in breakup fees," he said.