Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Dec, 2022

By Brian Scheid and Annie Sabater

Consumer discretionary stocks carried more short interest than any other U.S. sector in mid-November, extending a streak of bets against home furnishers, carmakers and other companies as short sellers believe that persistently high inflation will continue to eat into consumer demand.

Short interest, which measures the percentage of outstanding shares held by short sellers, in consumer discretionary stocks has averaged 5.16% across all major U.S. stock exchanges since the end of December 2021, according to the latest S&P Global Market Intelligence data. By comparison, short interest in the S&P 500 has averaged 2.22% since late December 2021. Short sellers borrow shares to sell, hoping to profit by repurchasing them at a lower price.

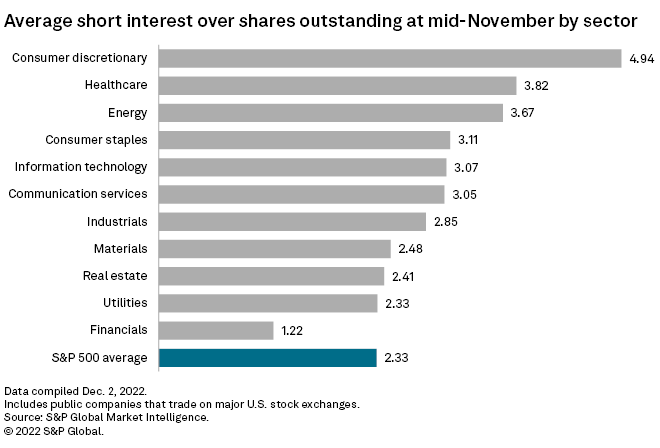

While short interest in the consumer discretionary sector fell from 5.13% at the end of October to 4.94% as of mid-November, it remains the most shorted sector by 112 basis points. Healthcare was the second-most shorted sector with 3.82% short interest as of mid-November.

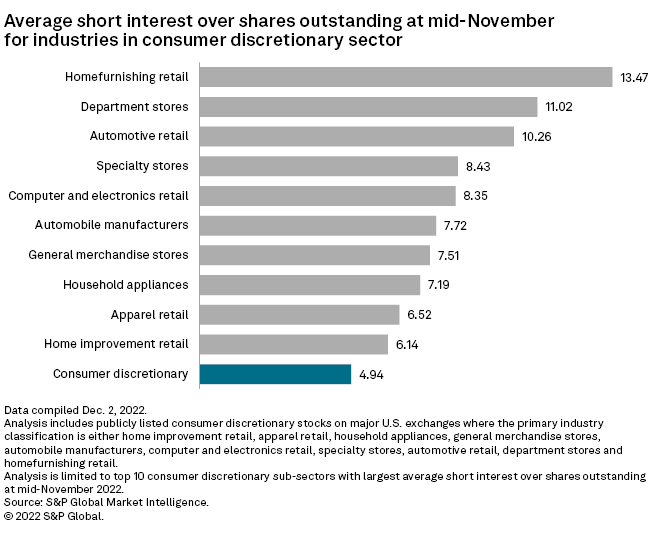

Home furnishing most shorted in sector

Within the consumer discretionary sector, short sellers have targeted home furnishing retail stocks with an average 13.47% short interest as of mid-November. Department stores, with 11.02% short interest, and automotive retail, with 10.26% short interest, were the second- and third-most shorted consumer discretionary industries, respectively.

Most shorted stocks

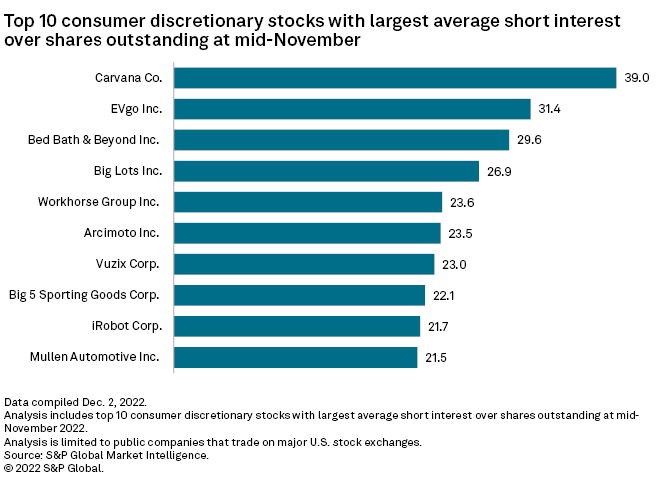

Carvana Co. was the most-shorted consumer discretionary stock as of mid-November with short interest of 39%. Shares of Carvana, an online used car retailer, have fallen nearly 98% from their high in August 2021.

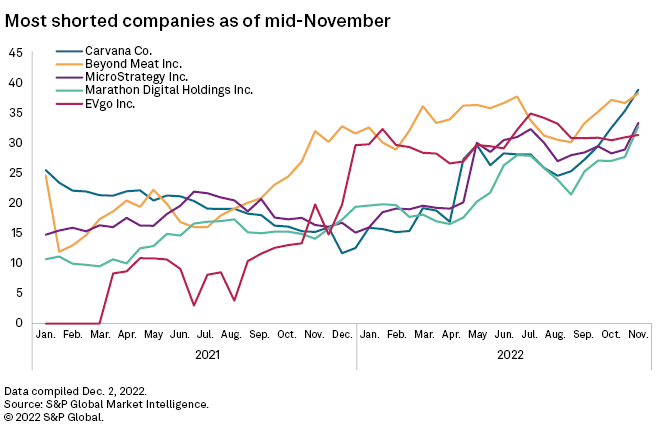

The company was also the most-shorted stock across sectors as of mid-November, followed by plant-based food company Beyond Meat Inc., with 38.4% short interest, and software company MicroStrategy Inc., with 33.44% short interest.