Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Nov, 2022

By Kiran Shahid and Dylan Thomas

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Private equity executives are sounding much less cheery on earnings calls.

Sentiment scores on earnings call transcripts have sunk lower with each passing quarter of 2022 for Apollo Global Management Inc., Blackstone Inc. and KKR & Co. Inc., three of the four largest publicly traded alternative asset managers. Sentiment scores nudged up slightly in the third quarter for the quartet's fourth member, The Carlyle Group Inc., which was also the only one of the four to see the value of its private equity holdings increase in the quarter ended Sept. 30.

The scores are derived from natural language processing, a computer analysis of the words used on the calls. The ratio of positive words to negative words on the transcript is one factor in the score, as is the complexity of the language used by executives and analysts. For a more in-depth explanation of the technology, check out this post on the S&P Global Market Intelligence blog examining second-quarter transcript sentiment scores for S&P 500-listed companies.

Not surprisingly, average transcript sentiment scores for the four largest listed private equity firms hit a peak on fourth-quarter 2021 earnings calls, when executives reported results for what was by several measures the industry's best-ever year.

Read more about the transcript sentiment scores for the four firms and some of the trends that could be behind those sentiments.

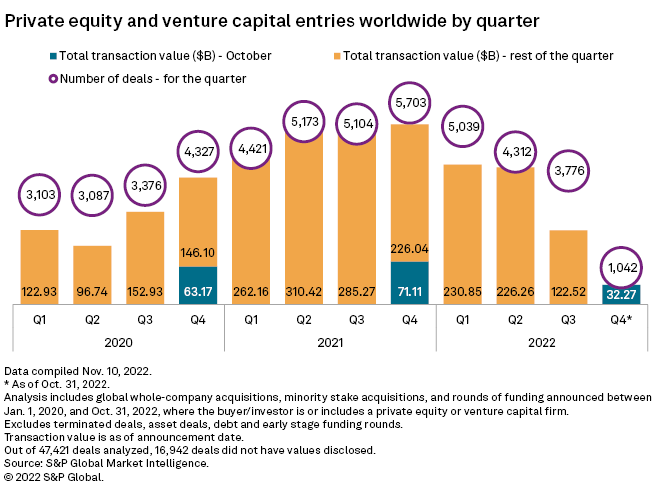

CHART OF THE WEEK: Private equity entries extend their skid

⮞ Global private equity and venture capital entries declined in both volume and value for the third consecutive quarter, to 3,776 deals with an announced value of $122.52 billion in the third quarter.

⮞ Announced deal value in October amounted to its lowest monthly total of the year — just $32.27 billion, down 54.6% from $71.11 billion in October 2021.

⮞ Aggregate transaction value for 2022 stood at $611.89 billion through the end of October, down 34.1% year over year from a record-setting 2021 but still ahead of the pace set in 2018, 2019 and 2020.

DEALS AND FUNDRAISING

* Blackstone Inc. is buying a 51.67% stake in digital IT services provider R Systems International Ltd. for $359 million, through Blackstone Capital Partners Asia II LP and an affiliated fund. The firm will buy the majority stake from a group of shareholders for 245 Indian rupees per share and launch a conditional delisting offer priced at 246 rupees apiece.

* The Carlyle Group Inc. agreed to purchase a majority interest in London-based digital marketing firm Incubeta UK Ltd.

* Bain Capital Pvt. Equity LP is acquiring a majority stake in Japanese apparel maker MASH Holdings Ltd. for about ¥200 billion. The private equity firm will purchase all shares owned by Mash President Hiroyuki Kondo, who will then reinvest in the business.

* Brighton Park Capital Management LP pulled in $1.8 billion for Brighton Park Capital Fund II LP and associated vehicles. The fund targets growth-stage software, healthcare and technology-enabled services companies.

* Venture capital firm Energy Impact Partners LLC raised $485 million for EIP Deep Decarbonization Frontier Fund I LP. The oversubscribed vehicle will invest in climate technologies, with a focus on companies that have obtained early technical validation but have not yet reached full-scale maturity.

ELSEWHERE IN THE INDUSTRY

* Centerbridge Partners LP and Bridgeport Partners LLC purchased banking technology company Computer Services Inc. in an all-cash transaction valued at about $1.6 billion, with a $58-per-share purchase price per share.

* MiddleGround Management LP added safety equipment manufacturer SixAxis LLC to its portfolio.

* BDT Capital Partners LLC's affiliated funds are buying a minority stake in Germany-based Exyte GmbH. The target company designs and builds high-tech manufacturing facilities.

FOCUS ON: RENEWABLE ENERGY

* The Carlyle Group Inc. launched a platform to develop renewable energy projects in the U.K., France, Spain and Germany, with plans to later expand into other European markets. Telis Energy has a target project pipeline of more than 10 GW in place by 2030.

* Boston-based MassMutual Ventures LLC launched a $100 million fund, known as MMV Climate Tech Fund, to invest in 15 to 20 early-stage and growth-stage climate technology companies across the U.S.

* Ara Partners Group LLC made a majority investment in Lincoln Terminal Holdings LP, a renewable fuel logistics and infrastructure business. Ara has also committed additional capital to support the company's expansion of its renewable fuel infrastructure footprint.

* ICG, or Intermediate Capital Group PLC, bought Madrid-based renewable energy platform Dos Grados Capital SA, which controls a 900-MW portfolio of solar and wind projects across Spain and Portugal. The investment was made through ICG Infra I.