Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Nov, 2022

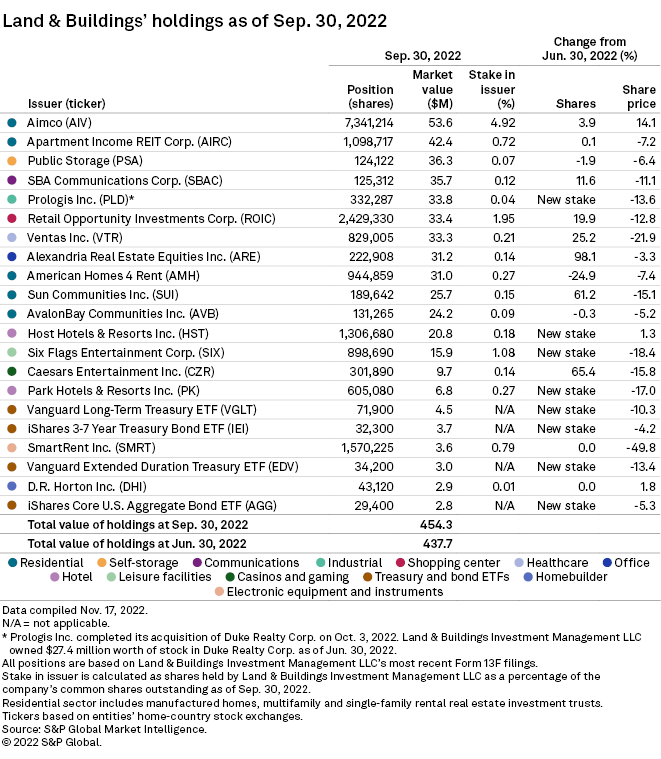

Land & Buildings Investment Management LLC nearly doubled its share count in office real estate investment trust Alexandria Real Estate Equities Inc. during the third quarter while increasing its stakes in seven other stocks, according to the firm's most recent Form 13F filing.

Position increases

The activist investor upped its share count in casino and gaming company Caesars Entertainment Inc. by 65.4% and increased its stake in manufactured home REIT Sun Communities Inc. by 61.2%.

Other notable share-count expansions included a 25.2% boost in healthcare REIT Ventas Inc. and a 19.9% increase in shopping center REIT Retail Opportunity Investments Corp. The firm also boosted its stake in communications REIT SBA Communications Corp. by 11.6%.

* View Land & Buildings' holding history here.

* Click here to set email alerts for future Data Dispatch articles.

* Read some of the day's top real estate news and insights from S&P Global Market Intelligence.

Land & Buildings likewise increased its stake in Aimco by 3.9% during the quarter, then later disclosed Oct. 28 that it owns a 5.8% stake in the REIT, implying further stock purchases after quarter-end. In its Oct. 28 letter, Land & Buildings pushed for change at Aimco's board and encouraged the REIT to explore monetization strategies, including a full or partial sale of the company. As of Sept. 30, Aimco was the firm's largest holding by market value, at $53.6 million.

Position sales

On the other hand, Land & Buildings shed roughly a quarter of its share count in single-family rental REIT American Homes 4 Rent.

The investment firm also exited its stakes in hotel REIT Ryman Hospitality Properties Inc., healthcare landlord Healthcare Realty Trust Inc., advertising-focused OUTFRONT Media Inc. and collaborative office-oriented WeWork Inc.

Highest exposure to residential REITs

As of Sept. 30, Land & Buildings held the highest exposure to the residential REIT sector, at $176.9 million, the majority stemming from investments in multifamily REITs at $120.2 million. The firm's single-family rental REIT positions totaled $31 million and its manufactured home REIT holdings totaled $25.7 million.

The self-storage REIT sector followed, at $36.3 million.