Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Nov, 2022

By Nick Albicocco and Robert Clark

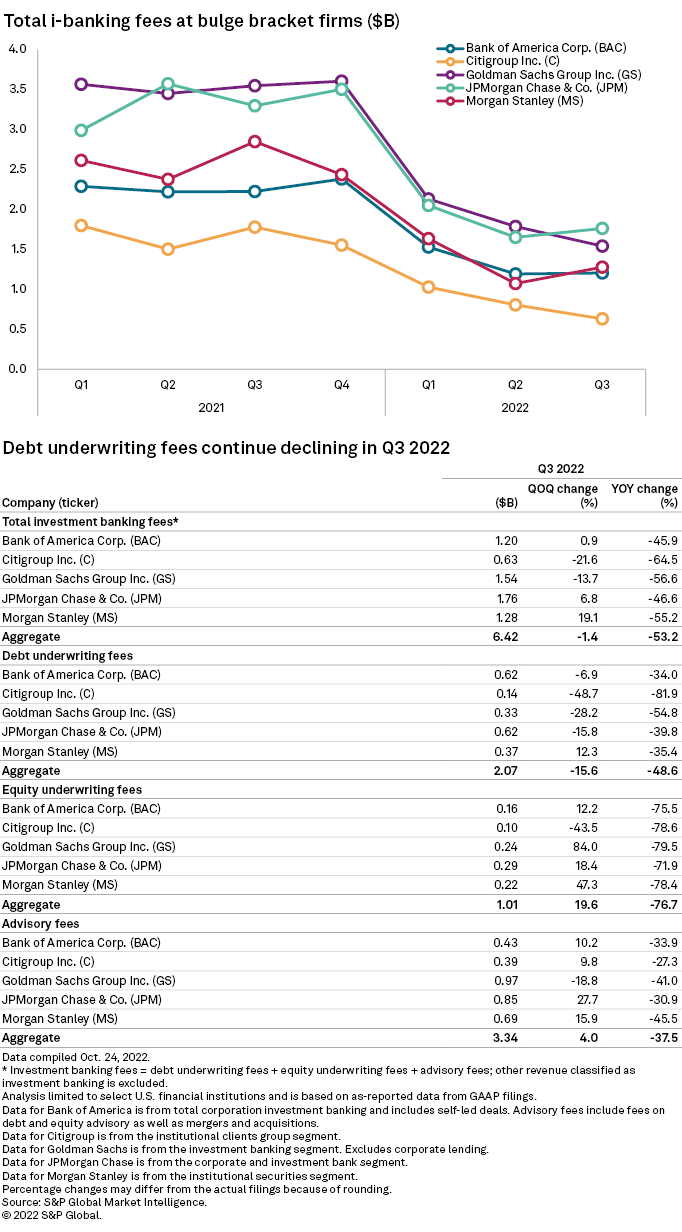

Investment banking fee revenue grew at three bulge bracket firms in the third quarter but continued falling at two others, following a steep industrywide drop in the first two quarters of 2022.

The sequential gains in i-banking fees at Morgan Stanley, JPMorgan Chase & Co. and Bank of America Corp. were driven in large part by quarter-over-quarter growth in advisory fees at all three firms, with JPMorgan posting the strongest growth at 27.7%. Goldman Sachs Group Inc.'s advisory fee revenue fell by 18.8% sequentially, and its total investment banking fees fell by 13.7%.

At Citigroup Inc., advisory fee revenue grew by 9.8% sequentially but total investment banking fees fell by 21.6%, amid sharp drop-offs in equity and debt underwriting fees. CFO Mark Mason attributed the dip in revenue to "heightened macro uncertainty and volatility" during a third-quarter earnings call.

In the aggregate for the five firms, advisory fee revenue grew by 4.0% sequentially while total investment banking fees fell by 1.4%. The group was still well off its 2021 pace, with total investment banking fees down 53.2% year over year based on substantial declines in all segments.

Top gainers

JPMorgan Chase brought in the most investment banking revenue in the third quarter with $1.76 billion. The company led all five banks in quarterly debt and equity underwriting revenue and had the largest quarter-over-quarter increase in advisory revenue. Its revenue in the category was roughly $848 million, nearly half of its total third-quarter i-banking revenue.

JPMorgan Chase Chairman and CEO Jamie Dimon sought to temper expectations for future growth in a third-quarter earnings call, telling analysts, "I would put in your model lower IB revenues next quarter than this quarter based on what we see today."

Morgan Stanley led the group with a 19.1% quarter-over-quarter increase in i-banking revenue. More than half of the revenue came from its advisory business, which had a 15.9% increase in revenue to roughly $693 million. The company's pipelines are "solid" across "a diversified base of different companies," CFO Sharon Yeshaya said during a third-quarter earnings call.

Bank of America, which had the third-largest quarterly increase in i-banking revenue, likewise had the third-largest quarterly increase in advisory revenue. The company posted a 10.2% increase to roughly $432 million in advisory revenue.

CFO Alastair Borthwick said in an Oct. 17 earnings call that he expects investment banking fees to be "kind of flattish," with hopes for an increase at some point, but not necessarily in the fourth quarter.

Mixed underwriting results

Goldman Sachs posted an 84.0% sequential increase in equity underwriting revenue in the third quarter, the largest in the group. The strong performance in the category saved the firm from an even worse decline in i-banking revenue, since Goldman Sachs reported sequential declines in debt underwriting and advisory fees.

Chairman and CEO David Solomon expressed concerns for the future in a third-quarter earnings call, telling analysts, "I expect a more cautious or a bumpier capital markets and M&A environment as we head into 2023."

JPMorgan Chase and Citi reported double-digit sequential decreases in debt underwriting revenue in the third quarter, while Bank of America posted a 6.9% decrease.

Citi was ravaged by a group-worst 48.7% decline in debt underwriting revenue, along with a group-worst 43.5% decrease in equity underwriting revenue. Morgan Stanley was the only firm in the group to report a sequential gain in debt underwriting fees, with an increase of 12.3%.