Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Nov, 2022

By Tom Jacobs

|

Dry grasses surround a sign in Kagel Canyon near Los Angeles that encourages homeowners to clear vegetation that could fuel a wildfire from around their properties. |

The pricing of potential discounts for homeowners is among the points of contention surrounding a recently enacted California regulation that requires carriers to incentivize wildfire mitigation for policyholders on their properties.

The regulation, which went into effect on Oct. 14, lays out those mitigation actions in the Safer from Wildfires strategy published by the California Department of Insurance, or CDI, and developed in partnership with the Golden State's emergency response and preparedness agencies.

The items on the CDI's menu for mitigation are split into two categories: protection of the structure and protection of its immediate surroundings. A third element covers the tasks communities should undertake to prevent the spread of wildfires.

Structural tasks include having a roof rated Class-A for fire resistance, maintaining ember-resistant zones around the home and having ember- and fire-resistant vents. Among the tasks for the surrounding property are clearing of vegetation and debris from under decks, moving combustible sheds to at least a distance of 30 feet, and trimming trees and removing brush.

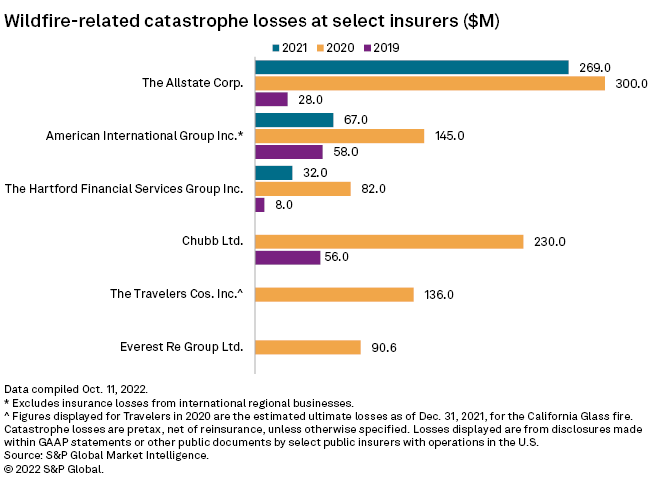

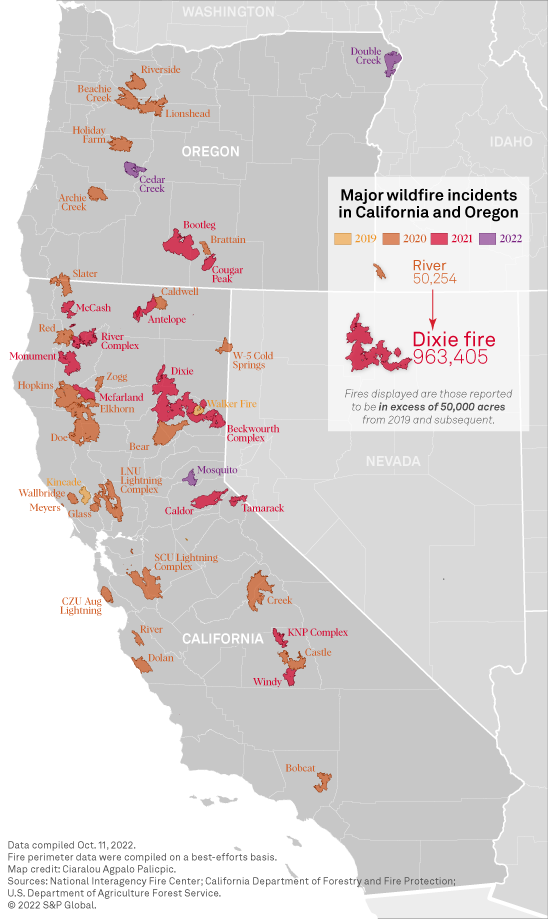

The new regulation comes as wildfire-related catastrophe losses have spiked in California in recent years, with 2020 being particularly high.

The regulation tells a homeowner what needs to be done, but insurers "have not yet figured out the relative value of all of these steps," according to Mark Sektnan of the American Property Casualty Insurance Association.

"Part of the equation is missing," Sektnan said in an interview.

However, Carmen Balber, executive director of Consumer Watchdog, in an email to S&P Global Market Intelligence said the claim that companies are struggling with pricing is "unfounded." Balber, whose organization was instrumental in securing the passage of Proposition 103, pointed out that, according to the CDI, 40% of the insurance companies doing business in the state provide discounts for mitigation.

Insurers already providing discounts include The Allstate Corp., Mercury General Corp., Nationwide Mutual Insurance Co. and Cincinnati Financial Corp.

Some or all?

Sektnan said industry skepticism also lies not in the mitigation measures themselves but in the number of tasks homeowners must complete to qualify for discounts. The regulation could lead homeowners to believe that they can pick any option to qualify for a discount, he said.

He cited research conducted by the Insurance Institute for Business and Home Safety that concluded all of the recommended actions must be completed to properly mitigate a property. For example, if a homeowner covers the vents on the home but still has a cedar roof, Sektnan said there is no real mitigation value there.

"The expectation that a homeowner can do an individual item picked off the menu and get an insurance discount is going to be frustrating for most homeowners when they find out that's not really what is scientifically based," Sektnan said.

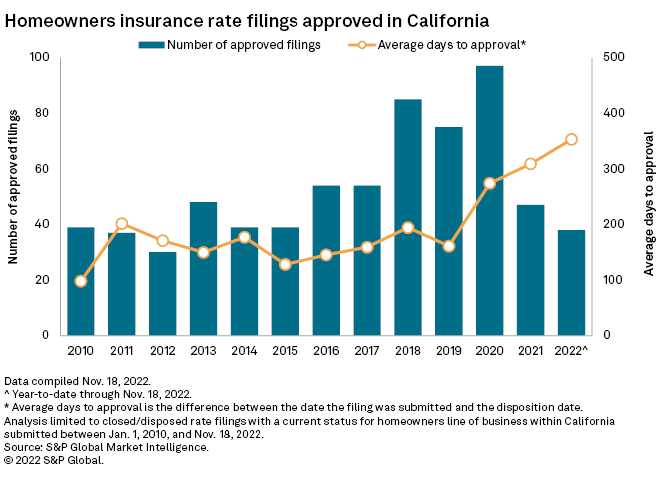

A Market Intelligence analysis of rate filings for homeowners insurance in California shows that the number of approved filings has decreased in each of the last two years, and the average wait time for the approval of those filings has increased dramatically.

The state regulator in 2021 approved 47 rate filings with an average wait time of 309 days, compared with 97 filings approved in 2020 with an average wait time of 274 days. So far in 2022, CDI has had 38 rate approvals, and the average wait time for those approvals jumped to 353 days.

Deputy Commissioner Michael Soller said in an emailed response to Market Intelligence that the CDI "believes 180 days is appropriate and we will move quickly to review and approve these [rates]."

Modeling issues remain

Computing the discounts and rates resurrects a persistent conflict between insurers and the regulator. Carriers in California are required to take the average of actual losses for the previous 20 years to set their rates, instead of using catastrophe models.

Janet Ruiz of the Insurance Information Institute said insurers are always working with modeling companies that provide risk analysis on factors such as climate change.

"We're all embracing the fact that there are climate risks, as do the Department of Insurance of the governor's office," Ruiz said in an interview. "If the Department of Insurance will embrace modeling ... then I think we could help people be able to afford insurance and get more insurance with admitted carriers."

Soller said the focus of the regulation is to make people safer and lower the risk.

"Catastrophe models don't do that, and that is why Commissioner [Ricardo] Lara has not endorsed them," Soller said. "There's no benefit for the consumer."