Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Nov, 2022

By Sanne Wass

European and North American banks are poised for a 10% boost to annual revenues by the end of the decade as they start to "play offense" in ESG, new research has found.

The global annual revenue pool for banks related to environmental, social and governance products and services will reach €295 billion, or $300 billion, by 2030, according to estimates by consultancy Alvarez & Marsal. Close to half of that amount will benefit banks in Europe and North America, it found.

While banks have so far been "playing defense" in ESG by focusing on risk mitigation and meeting regulatory requirements, they are increasingly turning their attention to "the return angle of ESG," said Fernando de la Mora, managing director at Alvarez & Marsal.

Some 122 banks have now committed to reaching net-zero emissions in their lending and investment activities by 2050 through the Net-Zero Banking Alliance.

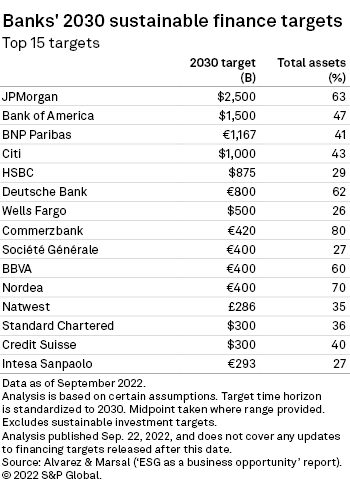

Financial institutions have also promised to raise their green financing levels. Alvarez & Marsal's analysis of the largest 25 European and U.S. banks found that sustainability targets amount to €13 trillion by 2030, representing 37% of their total assets.

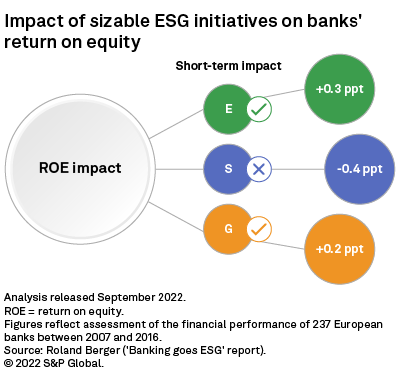

Environmental measures have already been found to have a positive impact on banks' profitability. Recent research from Roland Berger, which assessed the financial performance of more than 200 European banks between 2007 and 2016, found that banks that implemented sizable environmental practices saw a positive impact on return on equity of 0.3 percentage points on average within one to three years.

This was driven by new business opportunities in lending, investing and services, as well as greater efficiency and better risk management.

New or old revenues

The global transition to a net-zero economy by 2050 will cost $9.2 trillion annually, $3.5 trillion more than what is spent today, according to estimates by consultancy McKinsey.

This will generate new financing needs that banks can tap into by expanding their green product propositions and allocating more capital toward sectors in transition. Alvarez & Marsal has estimated the energy transition will bring about a €19 trillion financing opportunity for loans and bonds toward 2030, which could translate into €215 billion in bank revenues in the form of credit spreads on green and sustainable lending products.

Other revenue sources include fees on green and sustainable debt capital market activities, carbon markets trading solutions and advisory services on climate investments. Most of the pool is concentrated in energy, transportation, industry and real estate, the sectors that would need the most capital to transition, Alvarez & Marsal said.

The consultancy named Barclays PLC as one of the leading practice examples for having defined a green product offering across retail, small and medium-sized enterprises, and corporate, covering debt and equity capital markets, corporate lending and consumer lending products. JPMorgan Chase & Co. was highlighted for having the largest sustainable financing target in the industry.

The 2030 ESG revenue pool represents a new revenue stream that will recur annually once banks have hit their financing targets, and the opportunity could be even bigger if efforts accelerate, de la Mora said. But banks could also lose revenue elsewhere as they start to scale down support for sectors or companies that do not align with banks' net-zero plans.

NatWest Group PLC, for example, has started to exit major oil and gas producers that do not have a credible transition plan. At the same time, the U.K.-based lender is enjoying higher revenues in products and asset classes where it is allocating more capital, such as offshore wind, said Solange Chamberlain, COO for commercial and institutional at NatWest.

"It's always hard to estimate exactly how much is new revenues rather than replacing [existing] revenues," said Chamberlain.

NatWest last year set a target to provide £100 billion of sustainable financing by the end of 2025, which is driving revenues, Chamberlain said.

For some climate initiatives it is hard to quantify the revenue impact, but the offerings and expertise are helping the bank deepen relationships with customers, Chamberlain said. For example, NatWest has deployed a carbon tracking tool to help retail clients estimate the carbon footprint of their monthly spend, and it has also put senior leaders and relationship managers through climate training, she said.

Alvarez & Marsal found in its research that U.K. banks are broadly outperforming their European and U.S. peers when it comes to capitalizing on climate opportunities, with NatWest coming out at the top of the ranking. This can be put down to strong investment and commitment across capability areas evaluated, including green product offerings, as well as alignment targets, client orientation and involvement in transition execution.

Ensuring profitability

The challenge for banks is to ensure they turn their green products into an effective commercial proposition, said Nunzio Digiacomo, partner at McKinsey. Lenders are pushing product adoption by lowering the price, which could compromise the overall revenue pool, Digiacomo said, speaking at the Sibos conference Oct. 11.

But banks could find other commercial opportunities related to their sustainability products, for example, to "upsell and cross-sell" and lock in new clients, Digiacomo said. A sustainable supply chain finance program, for example, gives banks access to suppliers of a customer, he said.

Discounting loan rates could be costly, but banks may also see it as a "seed investment into a much bigger growth plan," which can help them get crucial "boots-on-the-ground-experience," said Gill Lofts, global financial services sustainable finance leader at EY.

"There's an element here of weighing up profitability with experience and credentials," Lofts said.

Banks have also started to think of decarbonization as a "new currency" that they receive from their clients in return for leniency on margins or capital costs, said Peter Beardshaw, global financial services sustainability lead at consulting firm Accenture. This new currency may not show directly in the banks' profits and losses but will be reflected in their emissions profile, he said.