Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Nov, 2022

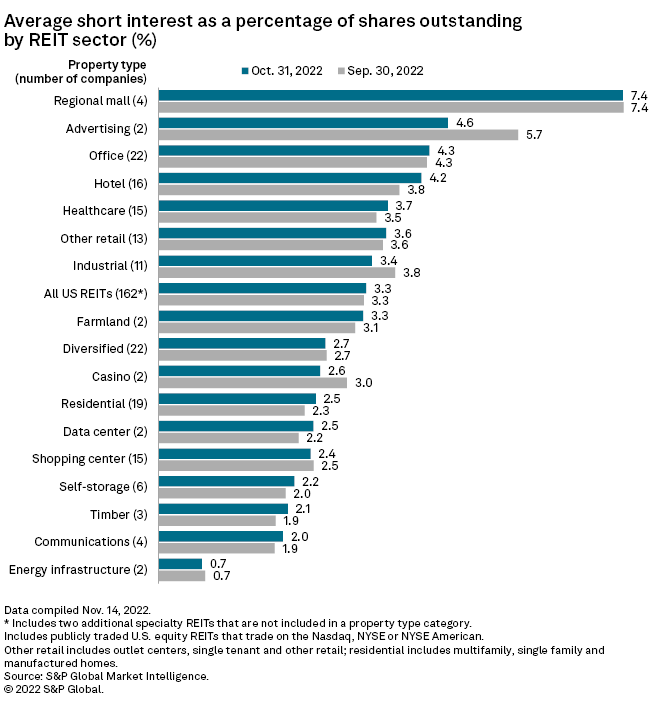

U.S. equity real estate investment trusts posted a slight increase in average short interest in October, with a 4-basis-point rise to 3.3% of shares outstanding, according to S&P Global Market Intelligence data.

Service Properties Trust leads as hotels gain in average short interest

Hotel REITs booked the largest gain in average short interest across all property types, with a 35-basis-point increase from the previous month to 4.2% of shares outstanding as of Oct. 31.

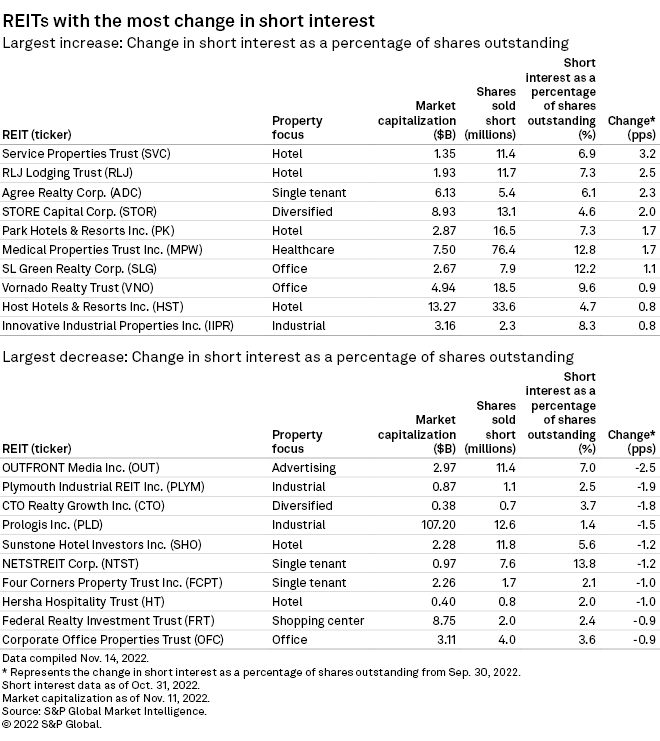

Hotel landlord Service Properties Trust had the greatest hike in short interest across all U.S. REITs at 3.2 percentage points to 6.9% of its shares outstanding as of October-end. This recent increase landed the company within the top 20 most shorted REIT stock by month-end. On Oct. 13, Service Properties Trust announced a massive increase to its quarterly cash dividend to 20 cents per share from 1 cent per share as a result of the company's improved portfolio performance.

Three other hotel REITs made the list of 10 REITs with the biggest short-interest gains relative to shares outstanding. RLJ Lodging Trust registered the second-highest increase, both within its sector and across all U.S. REITs, with 2.5 percentage points to 7.3% of its shares outstanding as of Oct. 31.

Park Hotels & Resorts Inc. logged a 1.7-percentage-point increase to 7.3% of its shares outstanding, and Host Hotels & Resorts Inc. got an 84-basis-point hike to 4.7% of its shares outstanding.

The datacenter sector saw the next-largest increase, posting a 24-basis-point hike in average short interest to 2.5% of shares outstanding as of October-end.

* Click here to set email alerts for future Data Dispatch articles.

* Click here to download data featured in this story in Excel format.

* Read some of the day's top real estate news and insights from S&P Global Market Intelligence.

The advertising sector had the largest decline in average short interest across all property types, dropping 1.1 percentage points over the preceding month to 4.6% of shares outstanding as of Oct. 31.

The steep fall was mainly due to the plunge in OUTFRONT Media Inc.'s short interest relative to shares outstanding by 2.5 percentage points to 7.0% as of October-end, the largest decline across all U.S. REITs for the month.

Another advertising REIT, Lamar Advertising Co., had a 26-basis-point increase in short interest over the same period to 2.3% of shares outstanding.

Most shorted US REITs

Regional mall REIT Pennsylvania REIT was the most shorted U.S. REIT stock, with 876,455 shares sold short as of Oct. 31, or 16.3% of its shares outstanding. Single-tenant retail REIT NETSTREIT Corp. and healthcare-focused Medical Properties Trust Inc. followed, with short interests at 13.8% and 12.8% of shares outstanding, respectively.