Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

4 Nov, 2022

By Zeeshan Murtaza and Dylan Thomas

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Gloom hovers over the global economy, but in third-quarter earnings calls executives at some of the world's largest alternative asset managers picked out pinpricks of sunlight.

"Alternatives should shine" at a time of high inflation, rising interest rates and slow economic growth, Apollo Global Management Inc. CEO Marc Rowan predicted when his firm reported earnings Nov. 2, even though those same factors have slowed dealmaking and eroded the value of investment portfolios. After three down quarters, Apollo's group losses on the year totaled $3.8 billion as of Sept. 30.

Underpinning Rowan's optimism is the idea that investors will respond to macroeconomic tumult by shifting more capital into alternatives, which he said offers both diversification and downside protection.

"As an industry, we exist because we produce excess return per unit of risk. And for the first time in a decade, investors are asking not just about the reward but about the risk associated with investments," Rowan said.

Rowan and his peers are also eyeing a growing opportunity set for their private equity businesses, which are loaded with dry powder after record fundraising across the industry in 2021. When KKR & Co. Inc. reported earnings Nov. 1, CFO Robert Lewin said the combination of ample dry powder and access to private credit gives the firm an edge over other acquirers, allowing KKR to take advantage of lower corporate valuations to buy at a discount.

When could deal flow pick up? Follow the links for more on the outlook from Apollo and KKR.

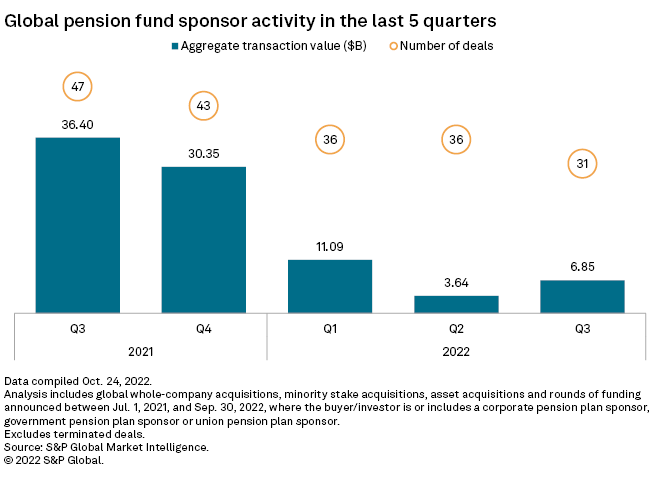

CHART OF THE WEEK: Deep dip in pension fund deals

⮞ Global transactions involving pension fund sponsors posted a major year-over-year decline in the third quarter, dropping by 81% to a cumulative value of just $6.85 billion.

⮞ Just 10 of the 31 global deals in the third quarter had disclosed transaction values, and of that group of deals, four had some private equity involvement.

⮞ Deal values have dropped so much this year that the $21.58 billion aggregate transaction value through three quarters of 2022 does not even equal the $36.40 billion in deal value recorded in the third quarter of 2021 alone.

DEALS AND FUNDRAISING

* A Blackstone Inc.-led consortium agreed to buy a majority stake in Emerson Electric Co.'s climate technologies unit in a deal valuing the target company at $14.0 billion. The unit sells compressors and related products. Other investors included in the deal are GIC Pte. Ltd. and Abu Dhabi Investment Authority.

* Veritas Capital is buying Verisk Analytics Inc.'s energy business, Wood Mackenzie Ltd., for $3.1 billion. Wood Mackenzie provides data, analytics and insights on the energy, renewables and natural resources industry. The deal is expected to close in the first quarter of 2023.

* Thoma Bravo LP invested in SMA Technologies Inc. Existing backer ParkerGale LLC will keep a minority stake in the target company, which provides automation solutions for financial services.

* Align Capital Partners LP closed Align Capital Partners Fund III LP at $620 million in capital commitments. The fund's initial target was $550 million.

ELSEWHERE IN THE INDUSTRY

* Cinven Ltd. agreed to buy Blucora Inc.'s TaxACT, a digital, do-it-yourself tax filing assistance software and service, for about $720 million. The deal is expected to close before 2022-end.

* ThoughtFocus Technologies LLC, a digital services and technology company focused on the financial services market, received a capital injection from H.I.G. Capital LLC. Also, H.I.G closed the acquisition of Avient Corp.'s distribution business for $950 million in cash.

* Aurora Capital Partners closed the purchase of Universal Pure, which provides high-pressure processing, cold storage and related services to food and beverage manufacturers.

FOCUS ON: HEALTHCARE

* Nordic Capital and Five Arrows agreed to sell specialty diagnostics company The Binding Site Group Ltd. to Thermo Fisher Scientific Inc. The deal, expected to close in the first half of 2023, is valued at £2.25 billion.

* GTCR LLC made a majority investment in Biocoat Inc., a medical device contract manufacturing organization. Existing investor 1315 Capital LLC will retain a minority stake in the company.

* Jeito Capital SA led Human Immunology Biosciences, Inc.'s funding round of $120 million. Other investors included Arch Venture Partners LP and Monograph Capital. Human Immunology is a clinical-stage biotech company.