Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Oct, 2022

By Tom DiChristopher and Siri Hedreen

|

The California Legislature led U.S. statehouses in introducing legislation to support the low-carbon hydrogen industry, according to a review of dozens of bills by S&P Global Commodity Insights. |

Federal funding and tax incentives have dominated the U.S. hydrogen policy conversation over the past two years, but many state lawmakers have also been developing legislation to support the low-carbon fuel.

|

Dozens of state bills introduced in recent legislative sessions would incentivize hydrogen production and consumption through regulatory reform, research initiatives, tax breaks and funding programs, a review by S&P Global Commodity Insights found.

The legislative activity illustrates how lawmakers are positioning their states to participate in the emerging hydrogen economy. It also offers a window into policymaking priorities as states prepare to hold elections and embark on new legislative sessions.

"A lot of the decisions and discussions are yet to be had," Frank Wolak, president and CEO of the Fuel Cell and Hydrogen Energy Association, said in an interview. "When companies and state entities begin to digest the federal initiatives, it will trickle down into what states do. And then you'll start to see the regulatory wheels begin to [turn]: 'What do I have to do in my state? My region?' That is just beginning to happen now."

S&P Global Commodity Insights reviewed 78 hydrogen bills introduced in 25 state legislatures in the past two years. The list did not reflect every attempt in state legislatures to spur hydrogen production and uptake, but the review shows major trends.

Hub program opens the floodgates

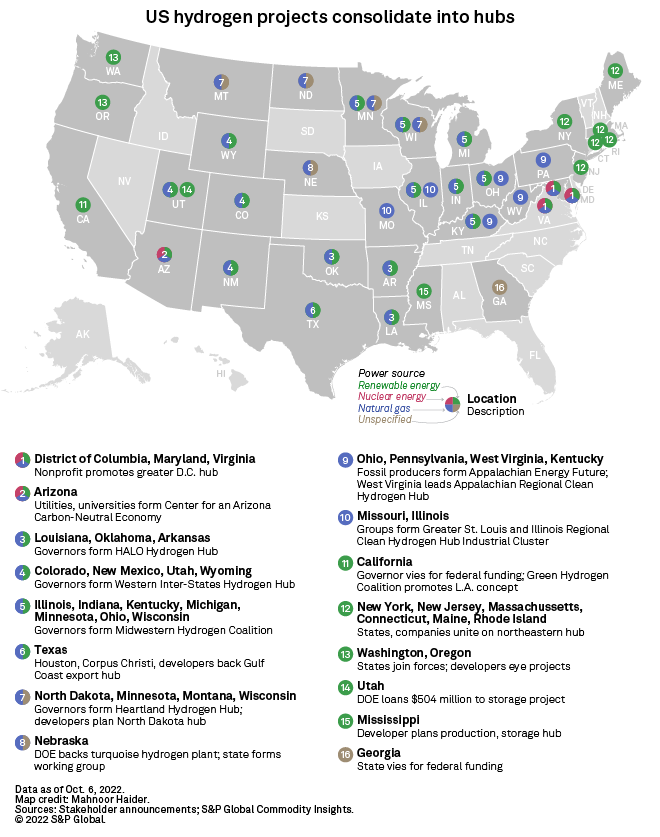

Congress got things moving with the passage of the bipartisan infrastructure law in 2021, appropriating $8 billion to develop regional hydrogen hubs. Since then, dozens of states and private organizations have partnered to apply for funding.

"The fact that the government has put this hydrogen hubs initiative in place is really powerful because it has catalyzed those discussions," Laura Parkan, vice president of Air Liquide's Americas hydrogen energy division, said in an interview.

Lawmakers in several states introduced legislation to develop hydrogen hubs and support applications for U.S. Department of Energy funding.

In a sign that low-carbon hydrogen is an emerging industry, about 22% of the bills directed state agencies to conduct research initiatives. Many of those would establish hydrogen task forces and would order studies on in-state hydrogen production and consumption potential.

More than a third of the bills attempted to support the hydrogen industry through regulation. They included language defining zero- and low-carbon hydrogen, applying existing regulations and exemptions to hydrogen production and end uses, and establishing new regulatory frameworks.

In several states, lawmakers directed utility regulators to allow gas utilities to recover the cost of purchasing low-carbon hydrogen as part of their supply portfolio. California and Illinois lawmakers put forward legislation that would establish minimum targets for the companies to procure hydrogen and other renewable gas.

States boost federal incentives

The recently signed Inflation Reduction Act marked the second major federal investment in hydrogen, providing tax credits for hydrogen-related purchases such as electrolyzers and for low-carbon hydrogen production.

Some state lawmakers have also proposed financial incentives. In 19% of the bills, lawmakers sought to underwrite hydrogen production, transportation and end-use through funding mechanisms such as rebate and grant programs.

About 25% of the bills focused on providing tax breaks for hydrogen production, distribution and end-uses. About half of those bills offered tax credits for purchasing fuel cell electric vehicles, which use a fuel cell to convert hydrogen into the electricity that drives the electric motor, or to build hydrogen vehicle fueling infrastructure like refilling stations.

Across five categories of bills, about a third of the bills focused on supporting hydrogen use in transportation, which the private sector is already embracing.

California leads states in hydrogen lawmaking

California alone introduced 10 bills related to hydrogen use in the vehicle market. The state, which often serves as an energy policy lab for the nation, is home to the Low Carbon Fuel Standard, a transportation sector-oriented market that provides a way for companies around the U.S. to monetize the environmental attributes of alternative fuels.

California lawmakers introduced 20 of the bills identified in Commodity Insights' review, the most of any state legislature. Those included seven bills in the regulatory realm and five bills each in funding and research.

States considering hydrogen legislation and regulation for the first time would do well to emulate California, Air Liquide's Parkan said. "I would say that a lot of what we've seen in California, as a general statement, is helping move that hydrogen economy forward."

Most other states in Commodity Insights' review had just one or two hydrogen-focused bills, but some states had more. Hawaii and New Jersey introduced several bills, with most focused on fuel cells and hydrogen use for transport. Five out of nine bills introduced in Oklahoma would establish regulations, while Utah lawmakers put forward three tax incentive bills.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.