Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Jan, 2022

By Tom Jacobs and Husain Rupawala

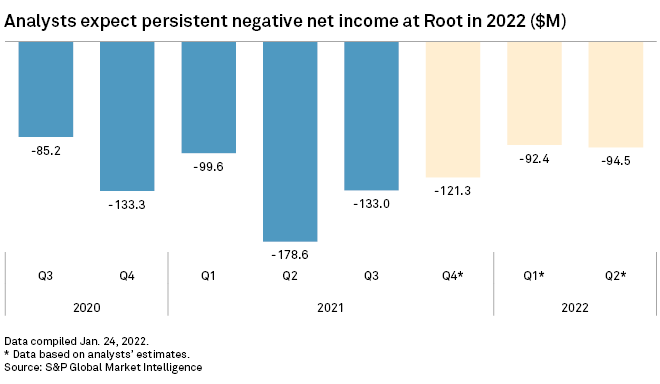

Root Inc.'s persistent underwriting struggles look to have played a key role in its decision to lay off about 20% of its staff.

Insurtech Advisors analyst Kaenan Hertz said Root still has not "tamed the economics of insurance." Root's policy count indicates it does a good job with customer acquisition, but not so well with retention, according to Hertz.

"They have to spend that much more money to replace those lost policyholders and still grow and gain policyholders," Hertz said in an interview. "More importantly, they haven't figured out how to appropriately underwrite and price the risk."

In a letter to employees, Root CEO and co-founder Alex Timm said the layoffs were a part of an organizational realignment that would improve efficiency and increase focus on the Columbus, Ohio-based company's strategic priorities.

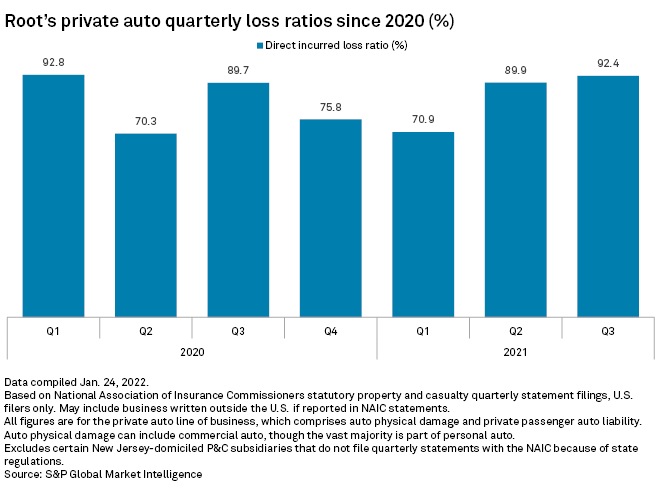

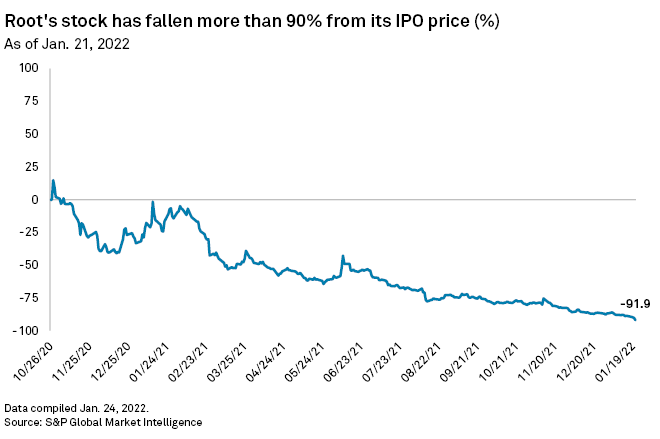

Wells Fargo analyst Elyse Greenspan in a note said Root's goal is to conserve expenses and cash for what could be "a prolonged period of elevated loss trends." Greenspan said the admission of those loss trends would put pressure on the company's shares, which dropped 29.37% for the week ending Jan. 21. Root in October 2020 priced its IPO at $27; its shares stood at $1.89 at the close of trading on Jan. 24.

Pricing problems

Timm said Root's strategic priorities include making pricing changes to deal with rising insurance costs while building its embedded insurance product. In a third-quarter 2021 letter to shareholders, Root said it was rolling out a new pricing model, a year after announcing the "third iteration" of that model.

Hertz said the continuing changes to Root's pricing models indicate the company has yet to master the process.

"Most of the carriers, including the other telematics-based programs, they're not on ... major overhaul number four," Hertz said. "They don't tweak it at the margins."

Root had no comment when asked about its underwriting issues. In an emailed response, spokesperson Stephanie Teuscher said the company would provide additional details during its Feb. 24 earnings call.

Root is not alone in the insurtech space when it comes to earnings and stock price struggles. Lemonade Inc., for instance, priced its IPO at $29 in July 2020 and has seen its stock trade as high as nearly $164 per share. But since touching that all-time high in early 2021, Lemonade's stock has plummeted more than 80%. It finished the Jan. 24 trading day less than $1 above its IPO price.

Lemonade's value grew as the company acquired renters insurance policyholders, Hertz said, but it was not "profitable growth." Lemonade has since learned to handle loss ratios but is not yet pricing to compensate for its loss experience and remain profitable.

Hertz said Lemonade's underwriting issues will continue with its move into the homeowners and private-passenger auto markets, which are much more volatile in terms of loss experiences.