Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Jan, 2022

By Phoebe Magdirila and Darakhshan Nazir

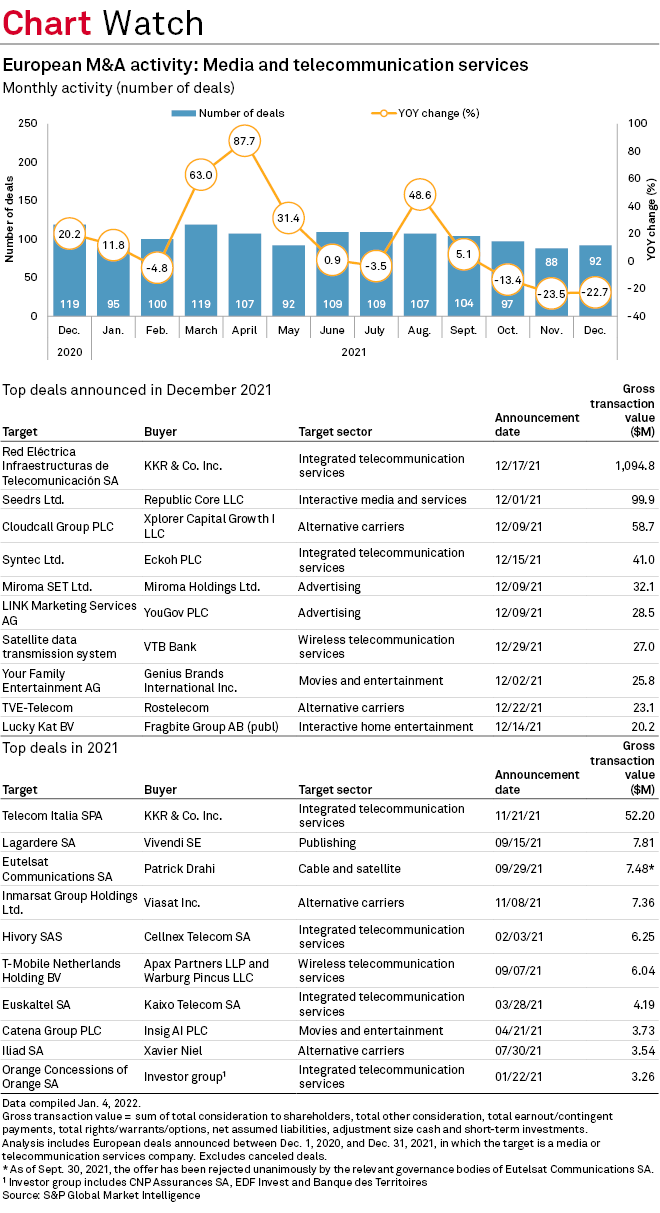

Deal-making in Europe's media and telecom sectors slowed in the last quarter of 2021, with December seeing only a single transaction reach the $1 billion mark.

The number of deals totaled 92 in December, down 22.7% year over year. This was just above November's 88 deals, the lowest monthly figure for 2021.

December was the third month in a row with the volume of deals falling compared to 2020, the data compiled by S&P Global Market Intelligence shows.

The largest deal in December was KKR & Co. Inc.'s purchase of a 49% stake in Red Eléctrica Infraestructuras de Telecomunicación SA for about $1.09 billion. UBS Group AG and Barclays PLC acted as financial advisors to Red Eléctrica.

Four transactions involving U.K. targets made it to the top 10 deals for the month. These include U.S.-based IT company Republic Core LLC's acquisition of crowdfunding platform Seedrs Ltd. for $99.9 million; Xplorer Capital Growth I LLC's purchase of multi-channel communications company Cloudcall Group PLC for $58.7 million; Eckoh PLC's agreement to acquire telecom network Syntec Ltd. for $41 million; and Miroma Holdings Ltd.'s deal to buy the remaining 81.01% stake in advertising company Miroma SET Ltd.

No December deals made it to the top 10 for the year. KKR's approximately $12.34 billion indicative and nonbinding bid for Telecom Italia SpA was the largest media and telecoms transaction in Europe in 2021. The private equity company recently invited Saudi wealth fund the Public Investment Fund to join its bid, according to a Bloomberg report.