Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Sep, 2021

By Tom Jacobs and Hassan Javed

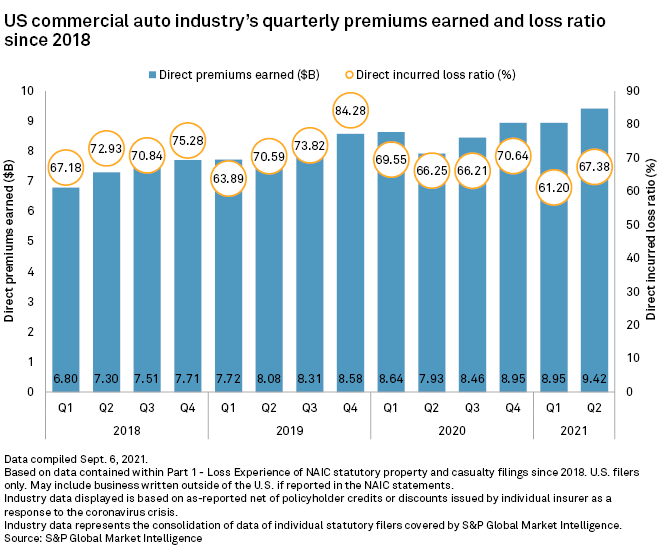

U.S. commercial auto insurers saw second-quarter premiums soar 29.7% year over year to $10.48 billion, according to an S&P Global Market Intelligence analysis.

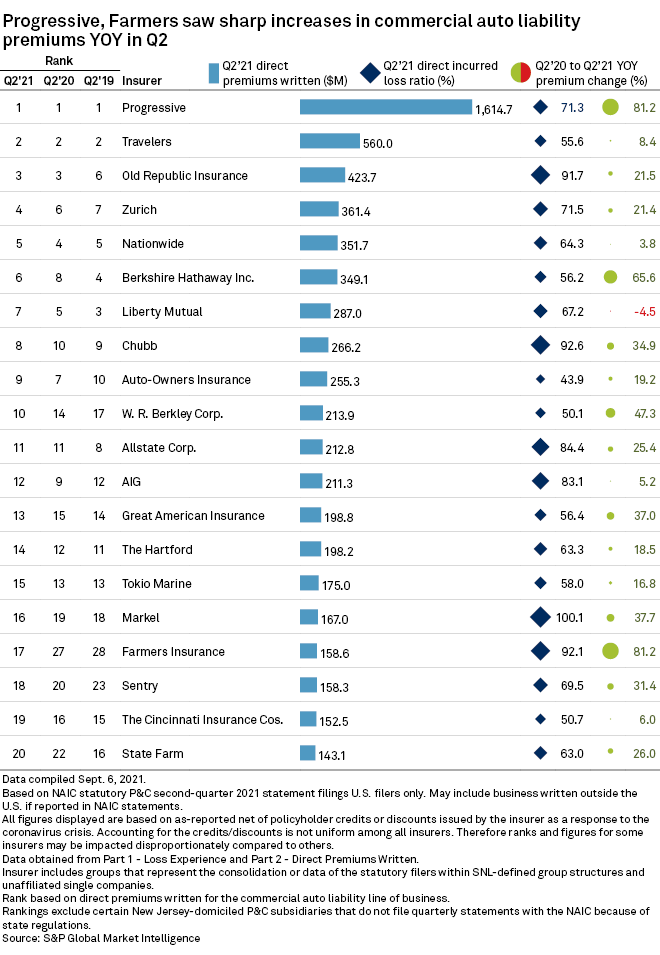

The Progressive Corp. maintained its dominance in the market, booking an 81.2% increase in direct premiums to $1.61 billion in the second quarter from $891 million a year ago. The company recorded a loss ratio of 71.3%.

Progressive plans to move "further upstream" in the fleet market, which is where the acquisition of Protective Insurance Corporation. comes into play, Jochen Schunter, the company's commercial lines controller, said during a second-quarter earnings call. With Progressive as the market leader in small-fleet coverage and Protective's status as a leader in the medium- and large-fleet markets, they will be able to serve the commercial auto market in its entirety, Schunter said. The deal was focused on "growing addressable markets" and revenue together beyond what each company would have been able to achieve alone, Schunter added.

Farmers Insurance Group of Cos. also had an 81.2% year-over-year spike in premiums to $158.6 million, as 15 of the top 20 companies in the analysis had double-digit percentage increases.

The Travelers Cos. Inc. was at No. 2 in the analysis, well behind Progressive with $560 million in premiums written, an 8.4% increase over 2020. Old Republic Insurance Group jumped 21.5% to $423.7 million.

Berkshire Hathaway Inc. had the third-largest improvement in premiums among the biggest insurers at 65.6%, followed by W. R. Berkley Corp. at 47.3% and Markel Corp. with a 37.7% increase.

There was a different look to the remainder of the top 10 as three companies improved their positions and one moved up into the top 10.

After logging $361.4 million in commercial auto liability premiums written in the period, Zurich Insurance Co. Ltd improved to fourth from sixth, while Berkshire Hathaway rose to eighth from sixth. Chubb Ltd., which was No. 10 a year ago, improved to eighth, and W. R. Berkley moved into the top 10 after being No. 14 in the year-ago period.

Markel, which saw its premiums written climb to $167 million, was the lone company in the top 20 with a triple-digit direct loss ratio at 100.1%.