Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Aug, 2021

By Maera Tezuka and Madeleine Farman

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Long seen as ripe for consolidation, the fund administration sector is in the middle of another flurry of private equity-backed M&A.

Sanne Group PLC, for example, announced Aug. 25 it has accepted a £1.51 billion takeover offer from Genstar Capital LLC-backed Apex Group Ltd., following a £1.42 billion offer made by buyout house Cinven Ltd.

In an emailed comment Aug. 26 following the announcement, Peter Hughes, CEO and founder of Apex Group, said Genstar's backing of the company in 2017 "has been crucial to enabling us to grow both organically and via strategic acquisitions." Further investment from TA Associates Management LP, The Carlyle Group Inc. and sovereign investor Mubadala Investment Co. PJSC announced earlier this year "has enhanced our credibility and it is also easier to execute transactions like this as a strategic investor with institutional investor backing."

The top fund administration players consolidating the industry — a number of which are backed by buyout houses — expect the large to continue to get larger.

Private equity firms are still buying businesses to scale, but for those businesses starting at zero, it is difficult to gain market share in the fund administration space, Hughes said in an earlier interview. "You'll be able to pick up some smaller clients or some riskier clients generally if you're starting in the industry now and so there are significant barriers to entry, but some are able to get traction."

There is still room for opportunity, however. Simon Burgess, head of alternative investments at Ocorian, a consolidator backed by Inflexion Pvt. Equity Partners LLP, does not see investment interest in the sector abating, but it could evolve. "If there are opportunities to create efficiency by bringing businesses together, [investment is] probably what we'll see at all levels."

Read more about private equity's push into the fund administration sector here.

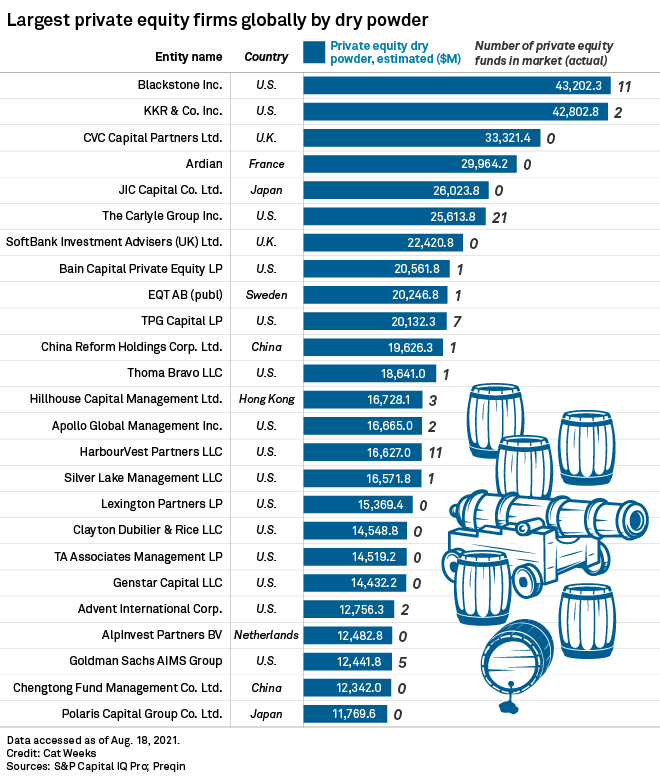

CHART OF THE WEEK: Full coffers

➤ Globally, 25 private equity firms hold $509.81 billion in dry powder, marking 22.3% of the record $2.286 trillion in total global dry powder, according to data from S&P Global Market Intelligence and Preqin.

➤ North American firms hold about 50% of the dry powder total, Asia about 27% and Europe 18%, Preqin data shows.

➤ Six of the firms from the list have invested 5% or more in at least one special purpose acquisition company, data from S&P Global Market Intelligence shows: Blackstone Inc., KKR & Co. Inc., SoftBank Investment Advisers (UK) Ltd., Bain Capital Pvt. Equity LP, TPG Capital LP and Apollo Global Management Inc.

FUNDRAISING AND DEALS

* TPG tapped JPMorgan Chase & Co. and Goldman Sachs Group Inc. to run its planned IPO, Dow Jones reported, citing people familiar with the matter. The private equity firm intends to file confidentially in the coming weeks, and its shares could commence trading by 2021-end, some people said.

* CVC Capital Partners Ltd. completed its acquisition of non-life insurer RiverStone Europe from Fairfax Financial Holdings Ltd. and Canadian pension fund OMERS Administration Corp.

* Advent International Corp. wrapped up the sale of its controlling stake in AI Dream to Hillhouse Investment Management Ltd.

* Bain Capital LP is selling a 46.9% stake in South Korean cosmetic drug company Hugel Inc. to an investor group led by CBC Group.

ELSEWHERE IN THE INDUSTRY

* The Jordan Co. LP amassed over $1.3 billion in capital commitments for The Resolute II Continuation Fund LP at final close.

* Zürich-based shoe company On Holding AG, which is backed by Hillhouse, filed for an IPO of an undisclosed amount of its class A ordinary shares on the NYSE.

* The sale of BRL Trust Investimentos Ltda. to Apex Group was completed.

* Onex Corp. injected capital into Wealth Enhancement Group LLC, joining TA Associates Management LP as an investor in the wealth management firm.

FOCUS ON: MACHINERY

* Blackstone Inc. is close to acquiring Singaporean precision components company Interplex Holdings Ltd. from Baring Private Equity Asia for approximately $1 billion, people familiar with the matter told Bloomberg News.

* Rosewood Private Investments sold MultiCam Inc. to OpenGate Capital LLC-backed Kongsberg Precision Cutting Systems.

* Deutsche Beteiligungs AG will purchase up to a 14% interest in Dantherm Group A/S, which makes heating, cooling and ventilation products, from a Procuritas Capital Investors VI Holding AB-managed fund.

* Norwest Venture Partners led a $207 million series B financing round for construction technology company Icon Technology Inc.