Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Aug, 2021

By Brian Scheid

During a planned speech on Aug. 27, Federal Reserve Chairman Jerome Powell could give some indication of the timing and structure of the central bank's reduction in monthly securities purchases

Source: Win McNamee/Getty Images

For months, investors have been hunting for clues on the Federal Reserve's plan to back off its pandemic-induced, historic bond-buying program, eager to avoid a repeat of 2013's legendary taper tantrum. They may get those clues this week.

Fed Chairman Jerome Powell on Aug. 27 could outline a strategy for reducing the $120 billion in monthly Treasury and mortgage securities — measures that helped support markets since they began in mid-2020 — at the central bank's annual economic policy symposium in Jackson Hole, Wyo.

The upcoming symposium is "an opportunity for Chairman Powell to guide us as to the start date … and set expectations around the pace of tapering, but those are just details at this point," said Michael Crook, deputy chief investment officer with Mill Creek Capital Advisors.

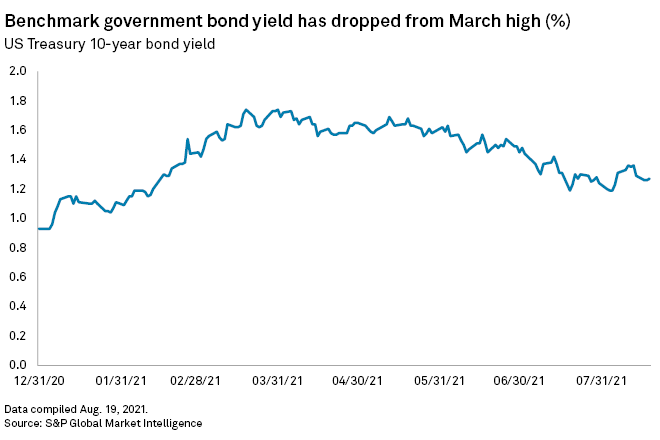

Markets appear to have largely priced in the tapering program as bond yields have risen from pandemic-era lows and stocks continue to hit record highs.

The Fed and investors are keen to avoid a repeat of 2013's "taper tantrum," a period of turmoil that followed an unexpected comment that the central bank would start to ease off securities purchases adopted in response to the 2008-09 financial crisis. The likelihood of history repeating, however, is low because the Fed has largely telegraphed the coming taper, analysts said.

Investors remain closely attuned to potential risks like the worsening of the pandemic, which could derail the economic recovery, or the coupling of the end of the taper with a Fed rate hike. But they are still concerned about a repeat of 2013.

Learning from history

The taper tantrum in 2013 began following then-Fed Chairman Ben Bernanke's remarks before Congress that a reduction in central bank securities purchases was coming. Bond yields move up as prices fall. Coupled with a rise in the dollar higher relative to its peers, the cost of borrowing and U.S. goods both jumped as a result of the tantrum.

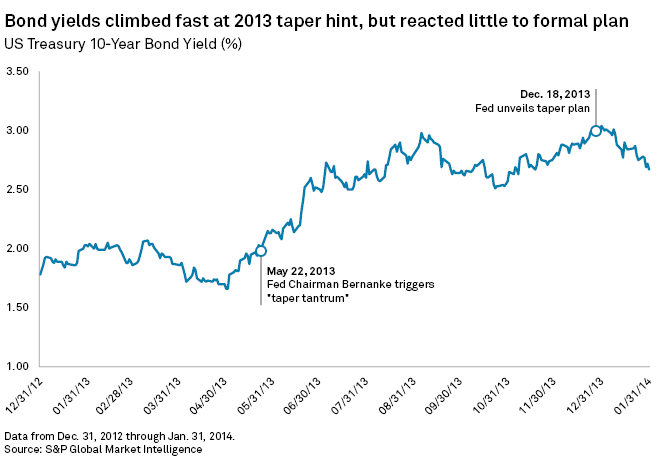

Bernanke's tapering comments before Congress' Joint Economic Committee on May 22, 2013, were unexpected and, ultimately, pushed the benchmark U.S. Treasury 10-year bond yield to climb 165 basis points over the next three months. After the Fed formally unveiled its gradual tapering plan in December 2013, the 10-year yield barely moved.

This time, however, Fed officials have spent months "massaging the message" on tapering, keeping the bond, currency and equities markets on guard for the likely, gradual end to its pandemic bond-buying program, said Alfonso Peccatiello, author of The Macro Compass, a global macro and financial markets newsletter. The market is now ready for it.

"I would argue it's basically impossible there will be a taper tantrum," Peccatiello said.

While the market remains focused on the Fed's tapering plans, it will prove to be of "very little consequence," since it has become one of the most discussed and telegraphed central bank moves over the past decade, George Saravelos, global head of FX research at Deutsche Bank, wrote in an Aug. 16 note.

The volatility around the tapering is due to uncertainty, but tapering is a certainty, it is just a question of precisely when it will begin and how long it may last, Saravelos wrote.

Risks remain

At its most recent meeting in late July, most Fed officials indicated that tapering could start this year, though there is still debate on the timing and structure of how these monthly purchases will be reduced.

"It's more a matter of when than if," Michael Hewson, chief market analyst with CMC Markets, said in an interview. "There may be some interest in composition in terms of how the reductions are made, but unless the U.S. economy starts to deteriorate in the next few months it will probably come sometime in Q4."

Even though the market will likely react little to tapering, one risk is investors associating the end of the taper with an immediate Fed rate hike, Peccatiello with The Macro Compass said. The Fed should specify that an eventual rate hike will be tied to other benchmarks, such as full employment, rather than simply the end of the tapering of monthly bond purchases, Peccatiello said.

Fed officials acknowledged that concern during the most recent FOMC meeting, with many officials noting that the central bank should reaffirm that tapering and an interest rate hike are not linked, according to the minutes of that meeting released Aug. 18.

Officials are also mindful that the delta variant of the coronavirus, which is on the rise in the U.S., could also trigger a shift in course. New daily COVID-19 cases in the U.S. have climbed from just less than 10,000 in mid-June to more than 150,000 as of Aug. 20, according to the Centers for Disease Control and Prevention, though the spike has yet to hit employment gains or derail rising inflation.

"Several participants indicated that they would adjust their views on the appropriate path of asset purchases if the economic effects of new strains of the virus turned out to be notably worse than currently anticipated and significantly hindered progress toward the Committee's goals," the minutes state.