Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

2 Aug, 2021

By Adrian Jimenea and Rehan Ahmad

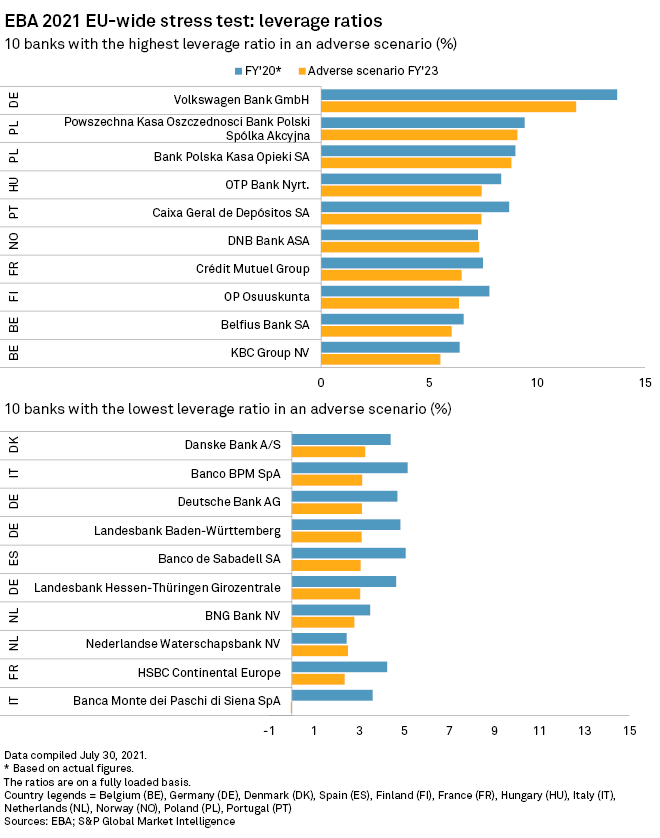

Banca Monte dei Paschi di Siena SpA's leverage ratio would fall into negative territory under an adverse scenario envisaged in the European Banking Authority's 2021 stress test.

The EBA's exercise assessed the health of 50 EU-based banks, covering roughly 70% of the bloc's banking sector. An adverse scenario incorporates a prolonged impact of the COVID-19 pandemic, along with a lower-for-longer interest rate environment and a cumulative 3.6% contraction of the bloc's GDP between 2021 and 2023.

The leverage ratio of troubled Monte dei Paschi stood at 3.59% at the end of 2020 and would drop to negative 0.04% in an adverse scenario, suggesting that the Italian bank's capital would be virtually wiped out in the event a severe downturn. The 363-basis-point decline of Monte dei Paschi's ratio would also be the sharpest among the banks in the sample.

Monte dei Paschi warned in May of an expected capital shortfall by the end of March 2022 if it cannot find a merger partner or raise fresh capital. But major Italian bank UniCredit SpA recently confirmed that it was in exclusive negotiations with the Italian government for a takeover of Monte dei Paschi.

Germany-based Volkswagen Bank GmbH would have the highest leverage ratio in an adverse scenario of 11.82%. Norway-based DNB Bank ASA's ratio would rise by 6 basis points to 7.32%.

On average, the transitional leverage ratio of all banks in the sample would decline to 4.4% by 2023 in an adverse scenario from 5.7% in 2020. The EBA said the decline would solely be due to lower Tier 1 capital as leverage exposure would remain constant.

Along with Monte dei Paschi, the leverage ratios of Dutch lenders BNG Bank NV and Nederlandse Waterschapsbank NV and France-based HSBC Continental Europe SA are also estimated to fall below the Basel III minimum requirement of 3%.

HSBC Continental Europe is being sold by its U.K.-based parent, HSBC Holdings PLC, as part of the group's exit from retail banking in France.

Click here for an Industry Document detailing European banks' leverage ratios.