Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Aug, 2021

By Allison Good

DCP Midstream LP is looking to build out its carbon capture and sequestration business after the pipeline company rolled out plans to cut emissions, Chairman, President and CEO Wouter van Kempen said.

|

"CCS is really going to be adjacent to the core" of DCP's strategy, van Kempen explained during the company's Aug. 5 second-quarter earnings conference call. "We're already doing a significant amount of carbon capture and sequestration in our southeast New Mexico business today, and we have additional opportunities … in New Mexico, in Colorado, in Michigan. If you think about it, gas processing plants are fairly significant aggregation points for carbon."

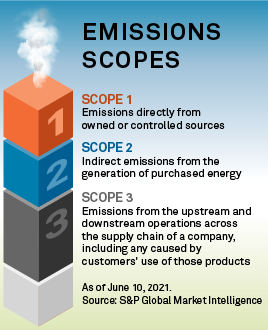

On Aug. 2, the company announced targets to reduce Scope 1 and Scope 2 greenhouse gas emissions by 30% from 2018 levels and to achieve net-zero in 2050. DCP Midstream also disclosed that it revised a $350 million accounts receivable securitization facility to account for key environmental, social and governance performance indicators such as the change in emissions intensity, following a similar initiative from Enbridge Inc.

"Our goal is to demonstrate accountability for improving our sustainability performance," the CEO said.

If federal and state regulations and incentives fall into place, "you can build a good-returning business there where we would earn above a weighted average cost of capital … and take Scope 1 emissions out of the footprint," van Kempen continued.

Extended Section 45Q tax credits are offered to industrial manufacturers that capture carbon emissions and either store them permanently or use them in applications that reduce life cycle emissions. The Biden administration plans to make the tax credits more accessible to developers.

On the regulatory side, Kinder Morgan Inc. recently told investors, sequestration projects have a three- to five-year timeline because of the U.S. EPA's permitting process. However, the Texas Legislature is looking to transfer primacy for permitting geologic sequestration wells to the Railroad Commission of Texas to help speed the process.