Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Aug, 2021

By Karl Decena

BHP Group's decision to proceed with the Jansen potash mine development in Saskatchewan and merge its petroleum assets with Woodside Petroleum Ltd. reflects the mining giant's pivot to future-facing commodities, CEO Mike Henry said during an Aug. 17 earnings call.

BHP agreed to spend $5.7 billion on stage-one development of the Jansen mine, including port infrastructure, as it anticipates an increase in demand for potash needed for sustainable agriculture to meet increased food production amid a growing global population.

The Woodside deal will combine the two companies' oil and gas businesses through an all-stock transaction. The expanded Woodside is expected to be 48%-owned by existing BHP shareholders and 52%-owned by existing Woodside shareholders, and it will remain listed on the Australian Securities Exchange, while BHP will end its dual-listing in London.

The company made the announcements as it reported a 42% year-on-year increase in attributable profit to $11.30 billion for its fiscal 2021 ended June 30. Diluted EPS grew to $2.23 year on year from $1.57.

Henry said the portfolio changes will help BHP increase focus on products needed for a decarbonized economy. The company also produces copper and nickel used in batteries for electric vehicles, as well as iron ore and metallurgical coal used in steelmaking.

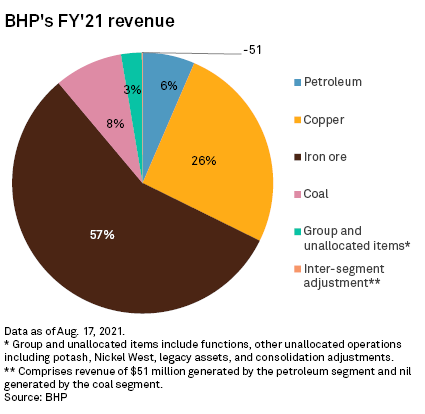

The miner's iron ore segment raked in $34.48 billion in revenue for fiscal 2021, comprising 57% of BHP's total annual revenue of $60.82 billion. Henry said management will monitor market developments before deciding on any new iron ore investments.

BHP's copper division generated $15.73 billion in revenue, or 26% of the annual total. The company's "group and unallocated" items, which include potash and the Nickel West operation in Western Australia, recorded $1.57 billion in revenue, or 3% of the total.

Coal revenues of $5.15 billion and petroleum revenues of $3.95 billion accounted for 8% and 6%, respectively, of the group's annual revenue. BHP recently signed a deal to sell its 33.3% interest in the Cerrejon coal mine in Colombia to Glencore PLC for $294 million and said the divestment process is progressing for its interests in BHP Billiton Mitsui Coal Pty. Ltd. and New South Wales Energy Coal, which includes the Mount Arthur coal mine.

"The increased focus and awareness reinforce our conviction that the mega-trends of decarbonization, electrification, population growth and higher living standards will drive strong demand for many of the commodities we produce," Henry said.

BHP outlined its new strategic focus amid pressure from shareholders over its emissions. Activist shareholder group Market Forces recently urged the company to disclose ramp-down plans for its fossil fuel assets. Another shareholder group, The Australasian Centre for Corporate Responsibility, said the BHP-Woodside merger announcement is "disastrous" for the climate as it will result in Woodside doubling its oil and gas exposure.

Henry said a merged BHP-Woodside will have more resources to deploy sustainable technologies to help the energy transition while allowing BHP to double down its focus on future-facing commodities.

"This was all about creating a higher-value, more resilient kind of a top-10 company that will be better able to navigate the energy transition," Henry said. "We also give shareholders greater choice, and we create a better ability to allocate capital within BHP towards investments in those longer-term, multi-decade opportunities in future-facing commodities and more support for returns to shareholders."