Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Aug, 2021

By Glen Fest

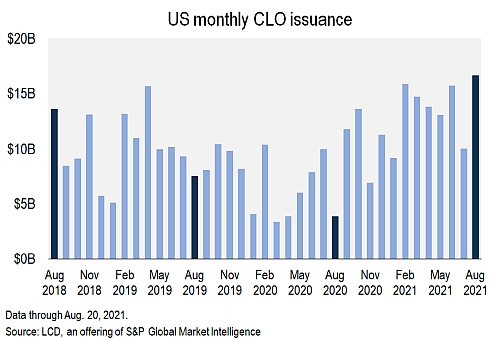

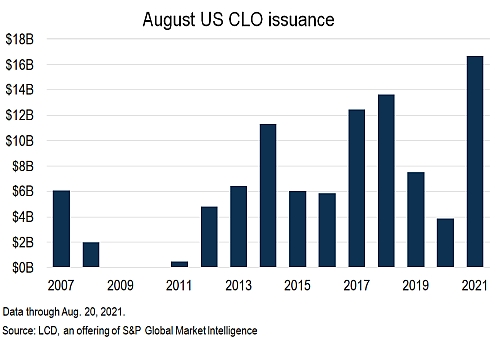

During what is normally the industry's snooze period, bustling CLO managers last week priced 15 deals to propel the U.S. market to a record monthly total of $16.68 billion in deals through Aug. 20.

The August figure has already eclipsed the previous full-month mark of $16.24 billion set in March 2015 — and has topped the more recent totals from February 2021 ($15.89 billion) and June 2021 ($15.73 billion), which were the next highest-ever monthly dollar-volume market levels achieved in the post-financial-crisis era.

August has traditionally been a slow period for CLO issuance. U.S. market activity in August averaged approximately $6.7 billion before 2021 and exceeded $6.4 billion only four times. The previous high mark for August was $13.6 billion in 2018, according to LCD data.

Last week's tally of $9.49 billion in deals included new issues from Oak Hill Advisors, Ares CLO Management, KKR Credit Advisors and The Blackstone Group (Blackstone/GSO Debt Funds Management).

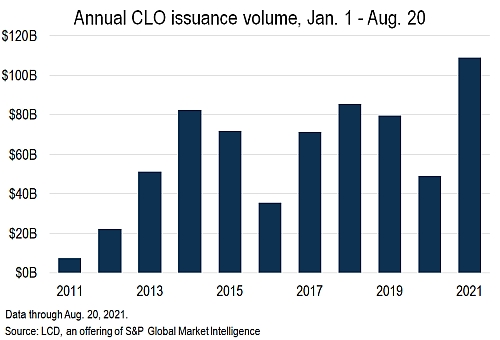

With $109.09 billion across 221 CLO transactions from 103 managers through Aug. 20, the market remains well positioned to break the largest full-year volume level of $128.86 billion in 2018. Last month, S&P Global Ratings revised its projected new-deal issuance level to $140 billion from its prior forecast of $120 billion.

Refinancing and reset volume through Aug. 20 was relatively quiet. The market priced 19 deals totaling $9.18 billion ($3.81 billion in refinancings, $5.37 billion in resets), representing the lowest monthly tally of refinancings/resets since December.

In a research note issued Friday, BofA Securities projected new-issue and refinancing/reset volume to "remain elevated" in September, as managers rush to price deals to Libor-based rates ahead of an expected market shift in the fourth quarter to a new secured overnight financing rate term benchmark.

The Federal Reserve-convened Alternative Rates Reference Committee has formally recommended Sofr.

* Article amended at 12:51 p.m. on Aug. 24, 2021, to clarify that 15 deals priced last week.