Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Jul, 2021

By Calvin Trice and Husain Rupawala

Liberty Mutual Holding Co. Inc.'s proposal to buy State Auto Financial Corp., and the entire State Auto Group, contains the second-highest share price premium for a publicly traded North American insurance underwriter in the last 10 years, according to an S&P Global Market Intelligence analysis.

Only State Farm Mutual Automobile Insurance Co.'s acquisition of GAINSCO Inc. in 2020 tops the 201.27% one-day stock price premium that Liberty Mutual has offered to bring State Auto into its fold. State Farm's buy laid a 222.95% premium for GAINSCO.

The pricing run for P&C insurance during the last year has made many of the top writers flush with capital, Piper Sandler analyst Paul Newsome said in an interview. Mutual insurers have fewer options to deploy that capital since they cannot set up share repurchases the way publicly traded companies can, making them more likely to spend it on acquisitions, Newsome said.

"The mutuals can either sit on it, and a lot of them do," the analyst said. "Or they can lower prices, which is not terribly economic. Or they can make an acquisition."

With the industry fetching higher premium prices, fewer companies are failing and more potential buyers are sitting on higher capital levels than they historically have had at their disposal, Newsome said.

Liberty Mutual's deal premium includes the purchase of State Auto Group's mutual holdings, which is not reflected in the company's public share price, he noted.

Keefe Bruyette & Woods analyst Meyer Shields does not expect competing offers for State Auto, but thinks the deal does signify raised competitive stakes in the P&C industry.

"This proposed acquisition implies sustained competition in personal lines, particularly independent agency-distributed personal auto, which accounted for 27.2% of [State Auto's] 2020 [net written premium]," Shields wrote in a July 12 research note to clients.

In a statement accompanying the deal announcement, Liberty Mutual cited State Auto's strong position among independent agents as one of the lures to the transaction.

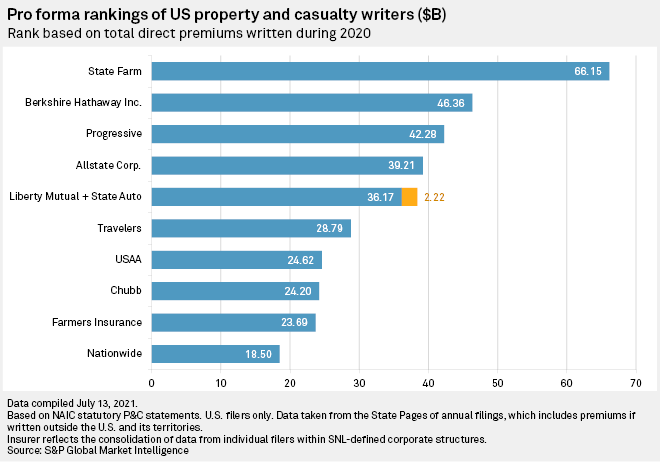

The proposed acquisition would not change Liberty Mutual's fifth-place standing on the table of the top domestic P&C writers by total direct premiums written on a pro forma basis, according to an S&P Global Market Intelligence analysis based on 2020 figures. The deal would, however, nudge it significantly closer to fourth-ranked The Allstate Corp.

The property and casualty subsidiaries of Allstate booked $39.21 billion in direct premiums written in 2020. Liberty Mutual logged $36.17 billion in such premiums during that year, while State Auto reported $2.22 billion, which would combine for $38.39 billion.

Only two other acquisitions of public insurance underwriters in the U.S., Canada or Bermuda were inked with triple-digit percentage share price premiums in the last decade. Nassau Insurance Group Holdings LP's purchase in 2015 of Phoenix Cos. Inc. had a 187.8% stock price premium, and Aquarian Investors Heritage Holdings LLC's 2017 deal to buy Investors Heritage Capital Corp. brought with it a 154.99% premium to the latter's closing price the day before the transaction was announced.