Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Jun, 2021

By Bill Holland

With little fanfare, Maine became the first state in the U.S. to legislatively require its public employee pension fund to divest from fossil fuel stocks after the Democratic governor signed the measure into law, according to the governor's website.

On June 16, Gov. Janet Mills signed the measure, LD 99, without comment after it passed both Democratically-controlled houses of the legislature on largely party-line votes. Mills' office made no public comment on the signing, and her office has not returned calls for comment.

|

The executive director of the Maine Public Employees Retirement System, or MainePERS, opposed the requirement to sell off fossil fuel investments, on the grounds that it would be outside the fund's directive to manage funds for growth and income for present and future retirees.

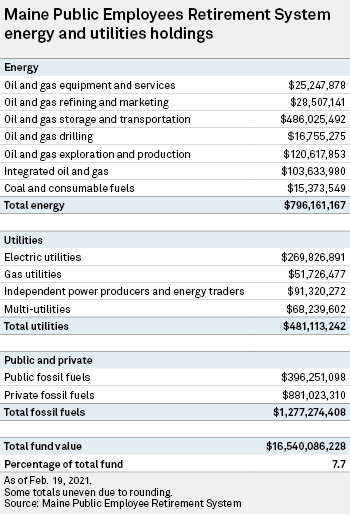

The bill gives MainePERS five years to sell stocks in the largest 200 publicly traded fossil fuel companies as judged by the size of their reserves, as well as any stock in the 30 largest utilities using coal for power. The bill also directs the fund to divest itself of any companies that build or operate fossil fuel infrastructure.

According to fund data, nearly $1.3 billion, or about 7.7%, of its $16.5 billion in assets at the end of 2020 were invested in fossil fuel producers and utilities. State retirement managers are not actively picking stocks, MainePERS Executive Director Sandra Matheson said in written testimony. Instead, part of the fund's assets are invested in directly owned shares reflecting the Russell 3000 Index, while the rest — the majority of the assets — are invested with private fund managers that are judged on financial performance.

That money could be reinvested in renewable resources with a better return, according to Sierra Club Maine Executive Committee member David Gibson. "With the freed-up funds, the pension fund can invest in climate solutions, doing double duty of earning profits for the fund while safeguarding our future," Gibson said in a statement.

In testimony before the state Senate in February, Matheson said the law violates the fund's purpose — to earn money for current and future retirees — while doing little to affect climate change.

If the state sheds its shares in fossil fuel companies, it will lose the ability to direct companies to reduce carbon emissions, Matheson had testified. "As stock owners, we can use our voice to further advocate for corporate transparency and responsibility on climate," Matheson said. "This type of advocacy, called engagement, is in the best interest of everyone, including our members and retirees."