Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 May, 2021

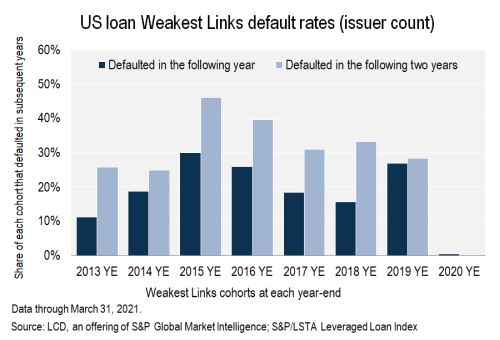

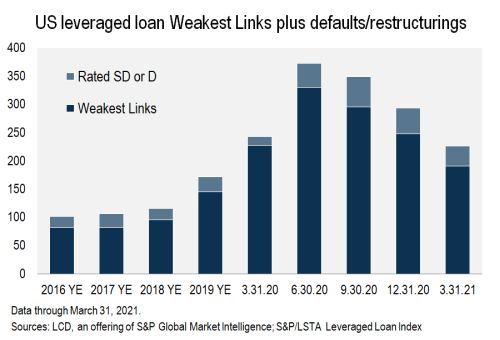

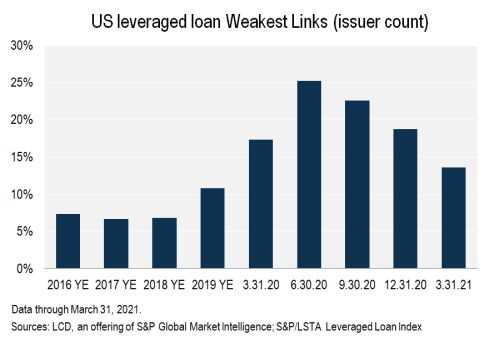

Favorable funding conditions for riskier companies and a strengthening U.S. economy have helped bring the count and share of U.S. leveraged loan Weakest Links down to pre-pandemic levels. By the end of March, the number of leveraged loan Weakest Links, as tracked by LCD, fell to 191 issuers, the third consecutive quarterly decline from the pandemic peak of 329 in June 2020. While the current reading is higher than year-end 2019 (145 issuers), it is below any quarter in 2020.

As a result, the loan Weakest Links share of the market declined to 14% as of March 31, the lowest level since the end of 2019 (11%) and a sharp drop from the 25% peak in June 2020.

LCD's Weakest Links are loans in LCD's universe that have a corporate credit rating of B- or lower and a negative outlook from S&P Global Ratings. The loan Weakest Links composite can change historically as LCD's coverage expands the universe of loans it tracks for the purpose of this analysis.

The universe of loan Weakest Links shrinks when more loans exit the cohort — either due to a default, a ratings upgrade, an improvement in outlook or a ratings withdrawal — than join the cohort. The biggest driver of the decline in Weakest Links in 2021's first quarter was the improvement in outlook on 55 issuers. While these companies are still rated B- or triple-C, the majority now have a stable outlook. This cohort also includes 14 borrowers that were upgraded, in addition to an outlook change, but that remain within the B- or lower bucket.

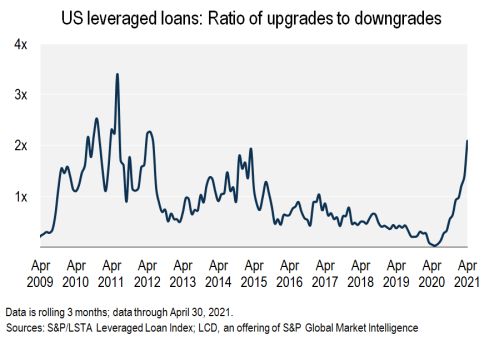

The pace at which loan borrowers are becoming Weakest Links has slowed markedly as upgrades began to overtake downgrades this year. In the three months ending April 30, the ratio of upgrades to downgrades in the S&P/LSTA Leveraged Loan Index exceeded 2x. In fact, LCD added just eight issuers to the Weakest Links cohort in 2021's first quarter. To put this number in perspective, a whopping 137 borrowers joined the Weakest Links ranks in the second quarter of 2020 amid a pandemic-induced downgrade wave.

However, many of the COVID-19-era Weakest Links came and left with the pandemic and subsequent market recovery. Of the 329 names on the list at the peak in June 2020, 116 borrowers were not in the cohort before the onset of the pandemic, as of December 2019, and are also not in the cohort now. The improving U.S. economic outlook has played a role here, as have favorable funding conditions for lower-rated companies, allowing issuers to manage near-term maturities and/or lower their borrowing costs.

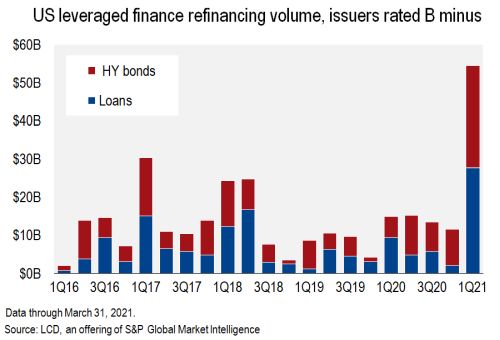

Indeed, in the first quarter of 2021 alone, issuers rated B- raised $54.6 billion in the leveraged finance market to refinance existing debt. This is a record high, close to the full-year tally for 2020 of $55.1 billion and exceeding the full-year total for 2019 of $32.9 billion. This analysis is based on borrowers rated B- or B3 by at least one rating agency.

In addition, the high-yield bond market hosted a record $15.6 billion of refinancing-related paper to companies split-rated B/CCC or lower in the first quarter, up from a $3.5 billion quarterly average in the preceding three years.

Such activity has helped some of the loan Weakest Links leave the cohort. For example, in February, Party City Holdings Inc. placed $750 million of five-year secured first-lien notes to repay the borrower's $720 million term loan B due August 2022 in full. News of the debt raise garnered upgrade actions at S&P Global Ratings and Moody's. The borrower was upgraded by S&P Global Ratings to CCC+ and a positive outlook from CCC and a negative outlook, thus removing it from the list of Weakest Links. Party City joined the list in the first quarter of 2020 at the onset of the pandemic.

More recently, Encino Acquisition Partners LLC completed a $700 million offering of seven-year unsecured notes to repay all of the outstanding borrowings under the company's second-lien loan, with any remaining proceeds earmarked to pay down borrowings under a revolving credit facility. The borrower is currently rated B- by S&P Global Ratings and has been on the list of Weakest Links since last March due to a negative outlook. Last month, S&P Global Ratings revised the outlook to stable following the refinancing effort, and as a result, LCD will remove the borrower from the Weakest Links cohort at the end of the quarter.

Sector analysis

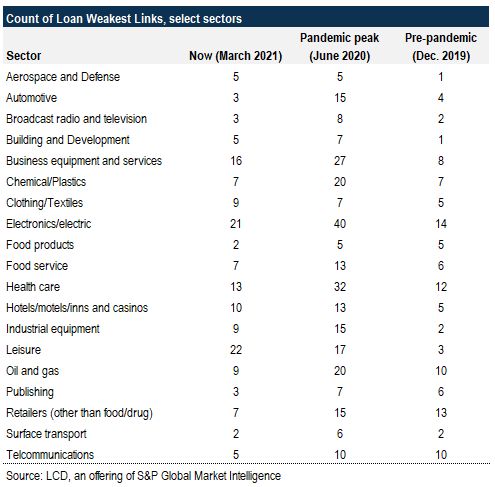

LCD tracked 22 Leisure names in March 2021, five more than in June 2020 and 19 more than before the onset of COVID-19. This cohort expanded rapidly on the back of downgrades related to social distancing measures during the pandemic. At the end of the first quarter, Leisure took over the leading position in the Weakest Links ranks, displacing Electronics/Electric (LCD's proxy for the technology sector), with 21 names.

Retail and Oil & Gas, two sectors that have dominated the corporate default landscape in recent years, now have fewer Weakest Links than they did at the end of 2019. Most of these borrowers have been on investors' distress radars for a while now and had shifted to the default category last year.

Overall, the count of defaults and restructurings in LCD's Weakest Links analysis retreated to 35 borrowers as of March 31, below any quarter in 2020 but above the 27 at the end of 2019. Recall that the count reached 54 borrowers as of Sept. 30, the highest reading since the start date of this analysis in 2013.

More broadly, at the end of April, the default rate of U.S. leveraged loans by amount fell to 2.61%, from 3.15% in March, and is now 156 basis points off the cycle peak of 4.17% in September 2020, per the S&P/LSTA Leveraged Loan Index.