Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 May, 2021

By RJ Dumaual and Husain Rupawala

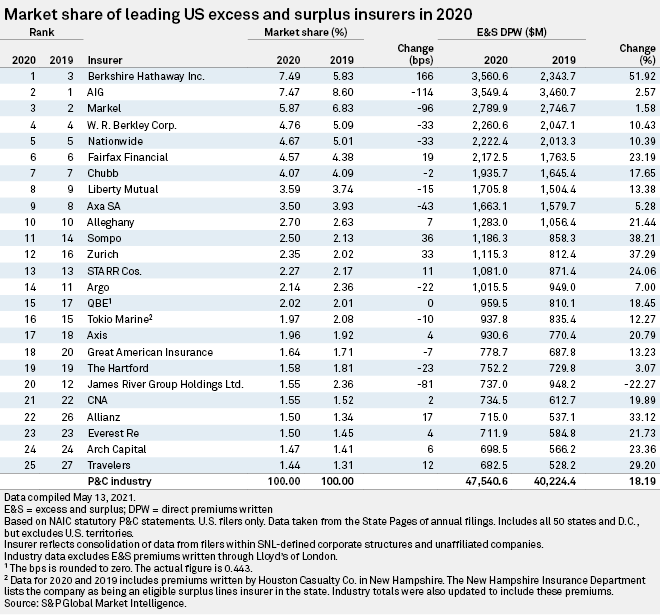

Warren Buffett's Berkshire Hathaway Inc. capped off a steady rise over the past few years to become the largest U.S. excess and surplus line writer in 2020.

Berkshire now has a 7.49% market share after growing its direct premiums written by 51.92% to $3.56 billion from $2.34 billion in 2019. Berkshire's National Fire & Marine Insurance Co., which accounts for most of the conglomerate's E&S business, saw direct premiums written in that segment soar 61.2% to $2.90 billion from $1.80 billion a year earlier. National Fire & Marine is largest individual company in the E&S space, posting market share of 6.1% in 2020, up from 4.4% in 2019.

American International Group Inc. lost its perch at the top, slipping to a close second after seeing its market share drop to 7.47% from 8.60%. The company posted direct premiums written of $3.55 billion in 2020, up from $3.46 billion a year ago. Markel Corp. came in third with a 5.87% market share, seeing its premiums rise year over year to $2.79 billion from $2.75 billion.

James River Group Holdings Ltd. tumbled to 20th place from 12th with a 1.55% market share after its direct premiums written declined to $737.0 million in 2020 from $948.2 million in 2019. A majority of that premium decline looks to have come from the commercial auto business.

CEO Frank D'Orazio expressed for the E&S segment in the company's first-quarter earnings call, saying the business' gross written premiums grew 35.6% year over year in the period and achieved substantial rate increases. He added that prevailing rates suggest that the current market conditions have not yet begun to moderate in the markets James River serves.

"Our core E&S division, which has grown by 86% over the last two years, enjoys an industry leadership position in its space and should be approaching a $1 billion segment by the end of 2022, a major milestone for the company," D'Orazio said.

Overall, the U.S. E&S market saw direct premiums written increase by 18.19% on a yearly basis to $47.54 billion in 2020.