Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 May, 2021

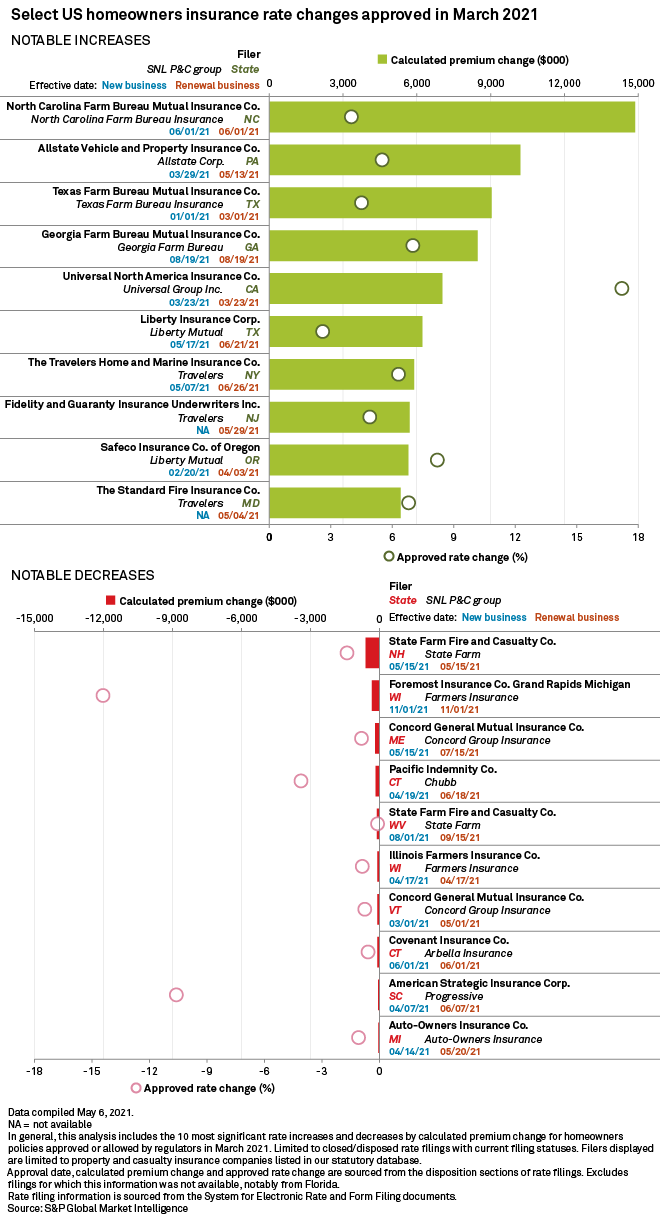

The Travelers Cos. Inc. obtained 17 approvals across ten U.S. states to raise homeowners insurance rates during the month of March.

Travelers, which was listed three times in the top 10 most-notable rate increases, could see its homeowners premiums rise by $35.6 million. Nearly 70% of the calculated increase is expected to result from eight rate hikes approved by state regulators in New York, New Jersey and Maryland.

The Allstate Corp. is expected to see the second-largest aggregate premium increase at almost $22 million, thanks to 16 rate hikes approved during the month. Almost 47% of that increase would come from a single rate hike in Pennsylvania.

The most impactful single rate increase approved during the month looks to be the 4% rate hike obtained by North Carolina Farm Bureau Mutual Insurance Co. as it could boost the group's written premium by nearly $15 million.

Regulators signed off on a pair of rate-cut requests by State Farm Mutual Automobile Insurance Co. that were both included in the top five most-notable decreases for March. With these, the company could see the largest aggregate premium decrease by around $720,000.

Farmers Insurance Group of Cos. also secured two approvals to lower rates which could reduce its calculated premiums by nearly $437,000. The company was included twice in the top 10 most-notable decreases in March and is anticipated to see the second-largest aggregate premium decrease during the month.

This S&P Global Market Intelligence analysis covers 381 homeowners rate change requests approved during March. Out of these, 230 were expected to result in premium increases, 36 could lead to rate cuts, and the rest would have no effect on calculated premiums.