Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Apr, 2021

By Tom Jacobs

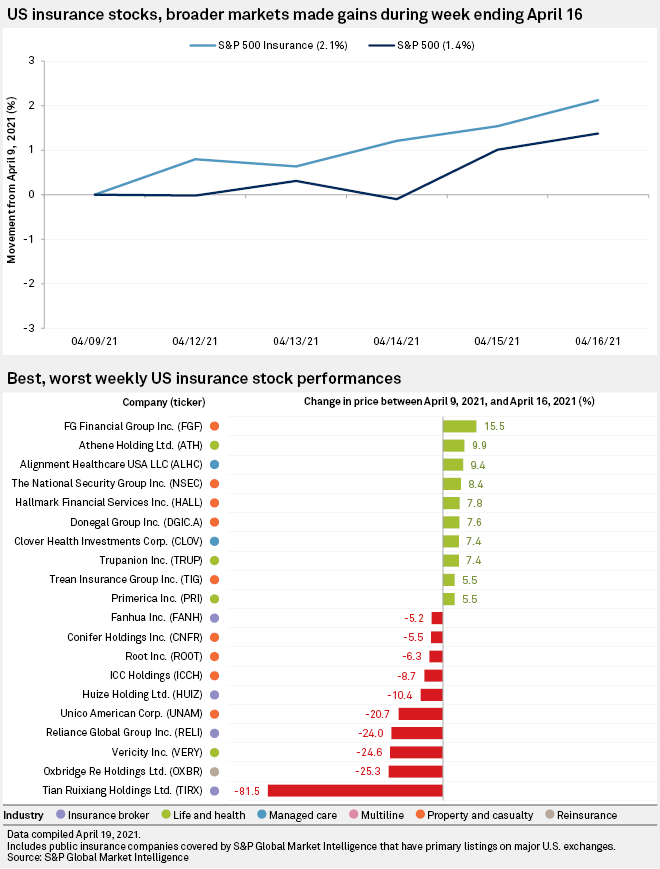

U.S. insurance stocks rallied and the broader market reached record highs this week in the wake of better-than-expected macroeconomic reports and the initial foray into first-quarter earnings.

The Commerce Department reported April 15 that retail sales jumped 9.8% in March, the largest increase since May 2020. The rise was credited to pandemic relief checks and the easing of COVID-19-related restrictions across the country. Also, new jobless claims fell to 576,000, their lowest level since the pandemic took hold in the U.S., and much better than the forecast 700,000.

The S&P 500 rose 1.37% to 4,185.47 for the week ending April 16, while the SNL U.S. Insurance Index gained 2.65% to 1,375.32.

Bloomberg News reported earlier this week that Prudential Financial Inc. is looking to sell its full-service retirement business for more than $2 billion and is working with a financial adviser to find potential suitors. The company had no comment on the report.

Market reaction in the wake of the report was modestly positive. Prudential's share price rose a little over 2% on April 14 and finished the week up 4.80%.

The full-service business, if sold, should generate value "substantially above $2 billion," Credit Suisse analyst Michael Zaremski said in a note. He said the business likely generates a majority of Prudential's retirement segment's after-tax earnings.

"Given that recent retirement transactions have gone for up to 20x existing earnings, we think Prudential could generate substantial value from divesting this business," Zaremski said.

Barclays analyst Tracy Dolin-Benguigui said a potential sale would not translate into buybacks, which could explain the market's reaction. She said the full-service retirement business seems lower on the pecking order relative to other capital-intensive businesses. Prudential has already signaled that it plans to return $10 billion of capital to shareholders in the next three years, Benguigui said in an interview.

"At the same time, they're looking to reallocate $5 to $10 billion of capital in the higher growth businesses, so we would translate that to think inorganically within [Prudential Global Investment Management] in emerging markets," she added.

Athene Holding Ltd. was a top performer for the week in the life sector, jumping 9.91%. Piper Sandler analyst John Barnidge in an interview said banks that handle alternative investments have been reporting solid earnings, which is good news for Athene's portfolio. He also noted that the price difference for the merger between Apollo and Athene has narrowed, which has had a positive effect.

Elsewhere in the life space, Unum Group was up 5.32% and Lincoln National Corp. increased 3.68%

Positive start in P&C

The Progressive Corp. led off earnings season reporting a 114% year-over-year increase in net income to $1.48 billion, or $2.51 per share, from $692.7 million, or $1.17 per share, a year ago.

Net income attributable to the company for the month of March jumped year over year to $567.9 million, or 96 cents per share, from $318.6 million, or 54 cents per share, in the prior-year period.

Progressive added 3.22% on the week.

The Allstate Corp., which rose 4.36% for the week, announced estimated pretax catastrophe losses of $252 million for March. The losses were composed of six events at an estimated combined cost of $208 million, plus increased prior-period reserve estimates of $44 million.

UnitedHealth sets pace for managed care

UnitedHealth Group Inc.'s first-quarter earnings report highlighted what was a strong week for managed care insurers. The company logged net earnings attributable to common shareholders of $4.86 billion, up from $3.38 billion a year earlier. It also increased its full-year net and adjusted earnings outlooks.

Stephens analyst Scott Fidel in a note said the positive results "will reset investor expectations for an even stronger managed care earnings experience than previously expected."

UnitedHealth's stock climbed 3.91%, this week, while Humana Inc. rose 4.20% and Anthem Inc. gained 4.05%.