Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Apr, 2021

By Michael Lustig and Gaurang Dholakia

.

|

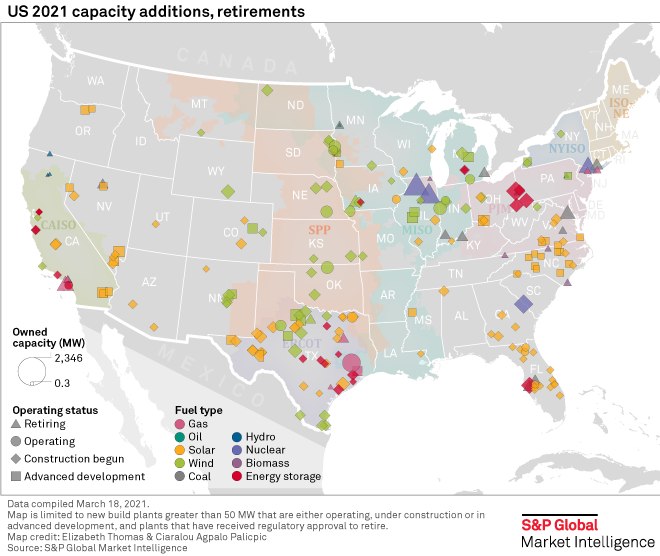

Nearly one-third of the power generation resources planned to come into service in the U.S. in 2021 is located in the Electric Reliability Council Of Texas Inc. market, according to an S&P Global Market Intelligence analysis.

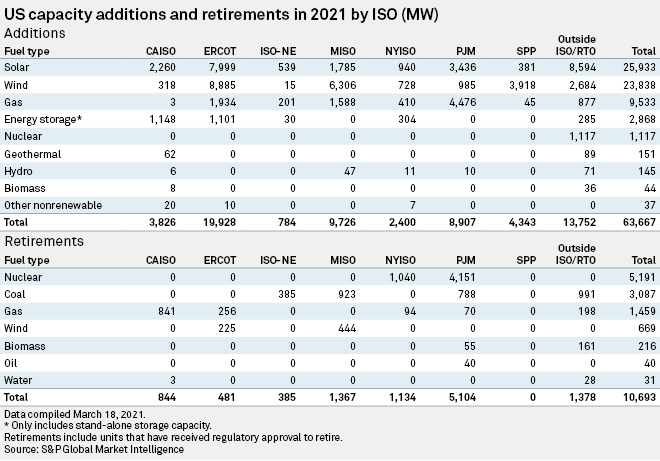

Overall, 63,667 MW of new resources are projected to come into service, while 10,693 MW are set to be retired, leaving a net gain of 52,974 MW. More than three-quarters of the new capacity is from solar and wind, with slightly more solar than wind, while about half of the capacity to be retired comes from three nuclear plants.

The U.S. could this fall see its first new nuclear plant in operation in more than five years if the 1,117-MW Unit 3 at the Alvin W. Vogtle Nuclear Plant under construction in Georgia can maintain its targeted in-service date in November. In March, plant developers identified additional necessary construction remediation work that they said would likely push back the projected in-service date by a month.

Project developers are Southern Co. subsidiary Georgia Power Co., Oglethorpe Power Corp., the Municipal Electric Authority Of Georgia and the city of Dalton, Ga.

Meanwhile, three U.S. nuclear plants, totaling 5,191 MW of capacity, could close. Entergy Corp.'s 1,040-MW Indian Point 3 plant in New York is set for shutdown at the end of April, following a settlement with the state. In Illinois, Exelon Corp. has said it will shut its 2,346-MW Byron and 1,805-MW Dresden plants later this year because of market conditions, and indicated that two other Illinois nuclear plants are also at risk of early closure.

The ERCOT region, covering most of Texas, is expected to see the greatest amount of new capacity in 2021, with 19,928 MW comprised mostly of wind and solar resources, but also gas and stand-alone energy storage. Areas outside an organized ISO or RTO, including the southeastern U.S. and the western U.S. excluding the California ISO region, are projected to see 13,752 MW added, the majority of which will come from solar resources. In the middle of the country, the Midcontinent ISO and Southwest Power Pool regions are together expected to add more than 10,000 MW of wind alone.

More than half the capacity expected to be retired this year is in the PJM Interconnection region, made up largely of the two Exelon nuclear plants, but also some coal-fired capacity. Overall, nearly 3,100 MW of coal-fired capacity is slated for retirement in 2021.

The largest plants to be retired and begin operating this year are the nuclear units. Among the largest plants expected to begin operating is the 1,132-MW gas-fired South Field Energy facility in Columbiana County, Ohio, in the PJM region, owned by a consortium of largely Japanese investors. The largest coal-fired plant to be retired, the 683-MW Chalk Point 1 and 2 plant in Prince George's County, Md., owned by GenOn Holdings Inc., is also in the PJM region.

In Florida, Emera Inc. subsidiary Tampa Electric Co. is contributing to both new capacity and retirements, adding 784 MW with its gas-fired Big Bend CT unit while retiring the two oldest units, totaling 790 MW at the coal-fired Big Bend plant, all in Hillsborough County, Fla.

After a year's reprieve, AES Corp. intends to retire its 841-MW gas-fired Redondo Beach plant in Southern California at the end of the year.

Among the renewable resources to be added this year, the largest solar facility is the 514-MW Aktina Solar Project (Ramsey) (Plainview) in Texas, acquired last year by Tokyo Gas Co. Ltd. The largest expected wind facility is the 503-MW TB Flats I & II Wind Project in Carbon County, Wyo., owned by Berkshire Hathaway Energy utility PacifiCorp.