Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Apr, 2021

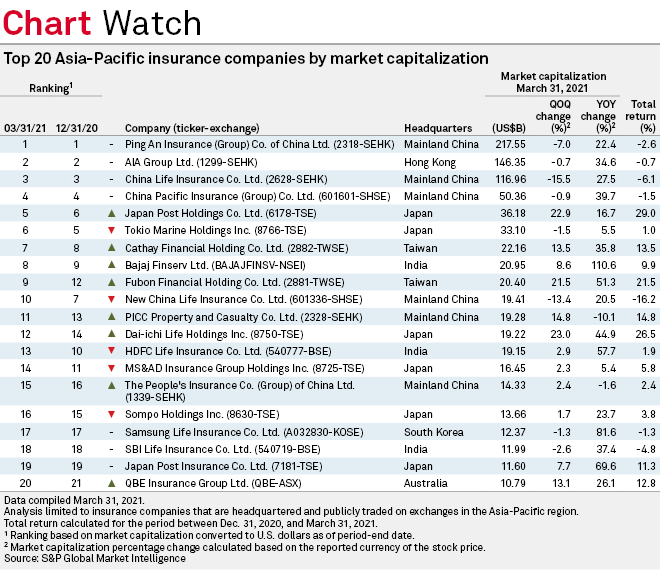

Insurers in Japan and Taiwan registered some of the biggest gains in market capitalization in Asia-Pacific in the three months ended March 31, in part driven by rallies in their domestic stock markets, according to data compiled by S&P Global Market Intelligence.

Japan's Dai-ichi Life Holdings Inc. marked the highest gain with a 23% quarter-over-quarter increase, climbing to the 12th spot on the list with a market cap of $19.22 billion. Japan Post Holdings Co. Ltd. came in second in terms of the highest gain with a 22.9% quarter-over-quarter increase, taking over the fifth spot on the list with a market cap of $36.18 billion.

Taiwan's Cathay Financial Holding Co. Ltd. and Fubon Financial Holding Co. Ltd. recorded higher market capitalizations for the quarter as well of $22.16 billion and $20.40 billion, respectively, up 13.5% and 21.5% quarter on quarter, respectively.

The increase in the market cap of Japanese and Taiwanese insurers came amid rallies in their domestic stock markets in the first quarter. Japan's TOPIX Index, also known as the Tokyo Price Index, rose 8.27% to 1,954.00 on March 31 from the Dec. 30, 2020, close of 1,804.68. Similarly, Taiwan's TAIEX Index closed at 16,431.13 on March 31, up 11.53% from the end 2020.

China's PICC Property and Casualty Co. Ltd. and Australia's QBE Insurance Group Ltd. logged increases of 14.8% and 13.1%, respectively, in their market cap in the quarter. As a result, QBE re-entered the ranking list and sat on the 20th spot.

Meanwhile, China Life Insurance Co. Ltd. logged the largest quarter-over-quarter decline of 15.5% in the quarter but kept its third position on the ranking list. New China Life Insurance Co. Ltd. saw a 13.4% drop and fell three notches to the 10th spot.

The top four spots remained unchanged, with Ping An Insurance (Group) Co. of China Ltd. retaining its position as the region's largest insurer with a market cap of $217.55 billion despite recording a decline of 7% from the prior quarter.

Looking forward, M&A potential could be another driver of their share prices in 2021, analysts say.

"Despite the COVID-19 pandemic, Asia-Pacific saw a rise in the number of mergers and acquisitions involving re-insurance and insurance businesses in the first half of 2020", Joyce Chan, partner at global law firm Clyde & Co., said in the firm's annual insurance report.

"We expect that investor appetite will bounce back in 2021 and that it will do so more quickly in the region than elsewhere", Chan added.