Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Apr, 2021

By Cathal McElroy and Francis Garrido

Spain-based Banco Santander is among the European banks that has seen a surge in usage of its digital banking platforms during the COVID-19 pandemic. Source: Carlos Alvarez/Getty Images News via Getty Images |

If European banks need a silver lining to the interminable COVID-19 cloud, they will likely look to the growth in online banking. Many of the region's major lenders have struggled in recent years to draw retail customers away from capital-intensive branch banking to their less costly digital platforms. The pandemic has changed that.

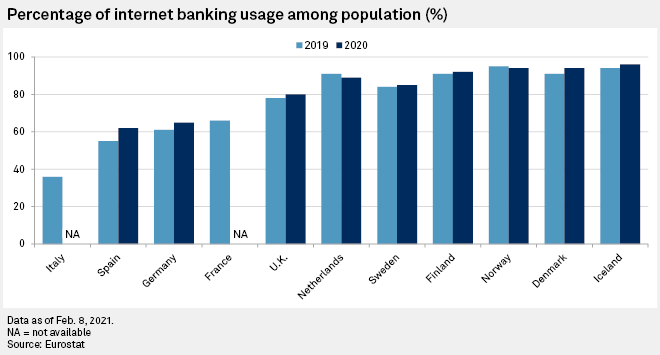

While restrictions on business openings and movement during the COVID-19 pandemic have bruised loan books, they've also helped boost online banking usage in European markets by an average of 3.18 percentage points in 2020 in those markets for which the latest data is available, according to S&P Global Market Intelligence calculations based on figures from Eurostat.

Lenders will be particularly keen to build on the progress made in major markets where digital banking has yet to be fully embraced. Spain and Germany saw year-over-year increases in online banking usage of 7 percentage points and 4 percentage points, respectively, in 2020, Eurostat's data showed.

"I definitely think we're not going back," Carl Faulkner, head of digital and channels at BNP Paribas, said during a March 23 panel discussion at the Finovate Europe online conference. "It's not a question of undoing things that we've done; we're just finding [during this pandemic] that digital is really good for simple mass tasks."

BNP Paribas SA, which does about one-third of its business in its home market of France, recorded more than 6.1 million active customers on its mobile apps in the fourth quarter of 2020, up 20.1% year over year. Its platforms recorded close to 4.6 million daily connections on average during the same period, a 41.5% year-over-year increase.

Eurostat data for internet banking usage in France in 2020 is not yet available, but penetration stood at 66% in 2019.

Slow connection

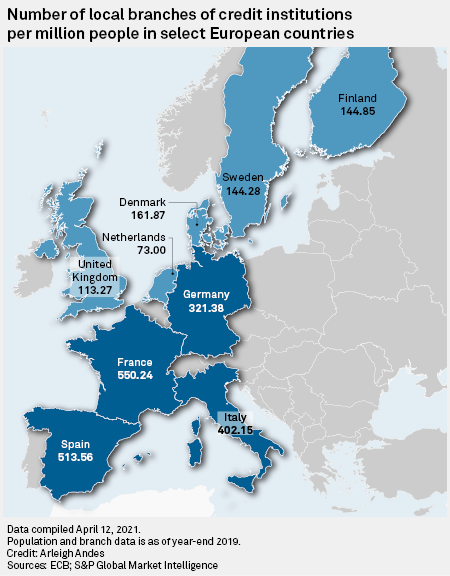

France is one of four major European markets where online banking penetration remains below 70%. Germany and Spain recorded internet banking usage of 65% and 62%, respectively, in 2020, Eurostat data shows. Italy's 2020 figures are not yet available, but the country recorded 36% penetration in 2019, 28th of the 39 European countries Eurostat data monitors.

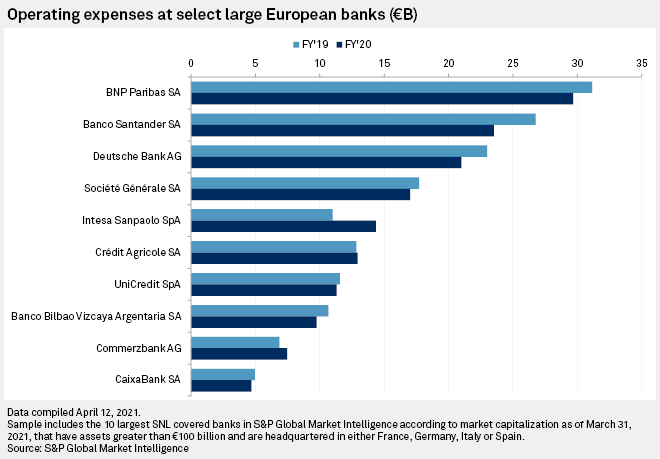

The enforced shift to online banking during the COVID-19 pandemic helped many of the major banks in these markets to reduce operating expenditure during 2020. Seven of the 10 largest listed banks by market capitalization across France, Germany, Italy and Spain recorded year-over-year decreases in operating expenses in 2020, according to S&P Global Market Intelligence data. The average decrease among those eight banks was 5.5%, the data showed, while Banco Santander SA enjoyed the largest reduction at 11%.

Santander has been slower in converting customers to its digital platforms than some of its Spanish peers, such as Banco Bilbao Vizcaya Argentaria SA, said Sam Theodore, an independent banking analyst and consultant.

By 2017, BBVA already had more digital customers than Santander has currently.

Santander, whose retail banking operations contributed to 46% of its underlying profit in 2020, recorded a 10% year-over-year increase in digital customers to 15.2 million in 2020,

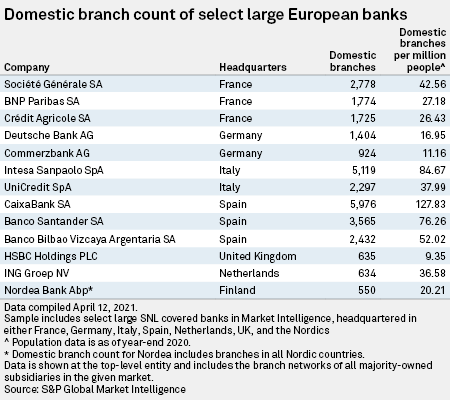

The pandemic-induced rush to Santander's digital platforms comes as the bank continues to scale back its branch network. In its latest round of closures, Santander announced that it will shut 111 branches in the U.K., its fourth-largest market by income, leaving 452 open.

Early adopters

The U.K. is among the European markets where online banking penetration is highest, Eurostat data shows. Some 80% of the country's account holders banked online in 2020, up 2 percentage points from 2019. The Netherlands also enjoys high penetration at 89%, although it was one of only four countries to record a fall in usage in 2020 among those for which data is available, dropping two percentage points.

The Nordic markets have by far the highest online banking penetration in the region, with Iceland, Norway and Denmark recording penetration of 96%, 94% and 94%, respectively.

While the pandemic has "accelerated things that were already there" in relation to the growth of digital banking, it has also exposed its limitations in some respects, said Faulkner. SME and corporate banking in particular can throw up "a lot of issues" and "personal situations" that require physical, face-to-face interaction, Faulkner said.

"People want to be reassured," said Faulkner. "They want advice. They want to talk to someone about a complex problem. And, unfortunately, in financial services there are a lot of complex problems."

Lenders might also encounter further resistance to digital banking from prevailing attitudes about tech and financial services within certain markets. A December 2020 study by consultancy Accenture that surveyed the attitudes toward online banking of 47,000 consumers in 28 markets found that France contained the highest percentage of "skeptics" at 63%.

Accenture defined skeptics as tech-wary, dissatisfied with their financial services provider and the least trusting of four "personas" that also included traditionalists, pragmatists and pioneers. France also had the highest combined percentage of traditionalists, defined as those who "value the human touch and avoid technology wherever possible," at 89%.

Still, bank executives should be thankful for the twist of fate that has pushed previously reluctant customers online in the last year, said Theodore. It has forced lenders to adapt faster to the demands of the digital market than they had initially planned, he said.

"With the pandemic, it's not like banks saw a chance," said Theodore. "They had no other choice. Their customers moved online, their employees moved online, so what else could they do?"