Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Apr, 2021

By James Waldron and Michael Gibney

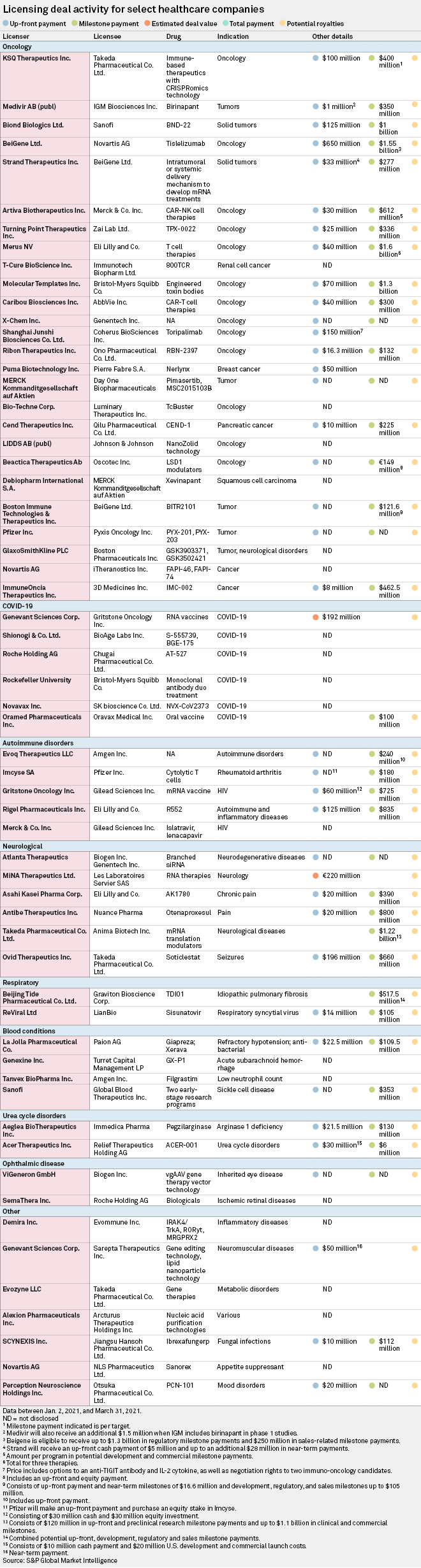

Cancer therapies dominated licensing deals in the first quarter of 2021, accounting for 26 of the 60 new arrangements covered by S&P Global Market Intelligence.

With an up-front payment of $650 million, Novartis AG's agreement to in-license BeiGene Ltd.'s cancer therapy tislelizumab in major markets outside China was the largest deal of the year to March 31. The PD-1 inhibitor is being evaluated in 15 clinical trials to treat different cancers including non-small cell lung cancer, gastric cancer and hepatocellular carcinoma.

"We view the collaboration with Novartis as highly strategic for BeiGene, helping BeiGene to get tislelizumab into Europe as well as build their presence in the U.S. through partially paid for co-detailing," Cowen analysts said in a March 22 report. "The payment structure is heavily front-loaded, a sign of confidence in tislelizumab's prospects from Novartis, who will deprioritize its own PD-1 inhibitor."

|

The second-largest cancer deal was Californian biotech Coherus BioSciences Inc.'s $150 million up-front payment for Shanghai Junshi Biosciences Co. Ltd.'s melanoma treatment toripalimab, another PD-1 inhibitor. The price tag also covered options to evaluate the Chinese company's T cell immunoreceptor-targeted antibody and next-generation engineered IL-2 cytokine as potential combination therapies with toripalimab, as well as negotiation rights to two early-stage checkpoint inhibitor antibodies.

Major immuno-oncology drug developers face strong competition in China from domestic manufacturers, Fern Barkalow, senior director of oncology and hematology at GlobalData, said in a Jan. 15 report.

"This may lead to an uptick in the numbers of partnership and licensing agreements utilizing creative strategies between local pharmaceutical companies in China and larger, international companies in order to reduce competition locally, and help China-based companies commercialize their drugs globally," Barkalow said.

Six of the deals S&P Global Market Intelligence covered during the quarter involved COVID-19 therapies. They included Gritstone Oncology Inc.'s nonexclusive license agreement with Genevant Sciences Corp. to develop self-amplifying RNA vaccines against the coronavirus for $192 million in up-front and potential milestone payments.

HIV interest

Gritstone also caught the eye of Gilead Sciences Inc., which paid $60 million up front in cash and equity to use the Emeryville, Calif.-based biotech's vaccine platform to develop an inoculation for HIV, offering hope of a long-sought-after first for pharma.

"I don't have a crystal ball, but what I can say is that we are closer than we've ever been," Gilead Senior Vice President and Virology Therapeutic Area Head Diana Brainard told S&P Global Market Intelligence in March. "There's continued commitment and a confidence that with the right science and the right attention, we can figure this out."

Gilead also announced a separate HIV collaboration with Merck & Co. Inc. to co-develop and co-commercialize the former's lenacapavir, an experimental capsid inhibitor, with the latter's islatravir, a nucleoside reverse transcriptase translocation inhibitor, as a potential two-drug treatment for patients with the virus.

Of the six deals for neurological conditions covered by S&P Global Market Intelligence, the largest up-front payment — and the second-largest of all deals covered — was Takeda Pharmaceutical Co. Ltd.'s $196 million fee to secure the global rights to Ovid Therapeutics Inc.'s investigational medicine soticlestat for treating encephalopathies, including Dravet syndrome and Lennox-Gastaut syndrome.