Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Dec, 2021

By Maera Tezuka and Dylan Thomas

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Private equity firms are spending more on take-private deals in 2021, as competition and robust corporate earnings push the average transaction value higher than it’s been in at least five years.

The 60 take-private deals global private equity firms announced or completed between Jan. 1 and Nov. 22 totaled more than $223.4 billion in value, according to S&P Global Market Intelligence data. That works out to an average transaction size of about $3.85 billion, compared to $1.20 billion in 2020 and $2.11 billion in 2019.

"It's everybody chasing the same deals," said Glenn Mincey, global and U.S. head of private equity for KPMG, who noted private equity firms are seeking to outbid one another as well as facing competition from strategic buyers and special purpose acquisition companies.

Read more about ballooning take-private deals here.

PE eyes midsize UK banks

Global private equity firms are making plays for midsized U.K. banks, but differing views on valuations are blocking deal-making.

Private equity firms are drawn to the country's midtier banks for their relatively low valuations, the result of prolonged low interest rates, meager profits and other factors. But a potential U.K. interest rate hike is looming on the horizon, and analysts say bank boards want any private equity firms considering an acquisition to take that into account.

In one example, Spanish bank Banco de Sabadell SA recently rejected £1 billion for its U.K. subsidiary, TSB Bank PLC, describing it as a "fire sale" offer from The Co-operative Bank PLC, which had backing from J.C. Flowers & Co. LLC and Bain Capital Pvt. Equity LP. But it hinted that sale discussions could resume in the future.

Read more about private equity's pursuit of midtier U.K. banks here.

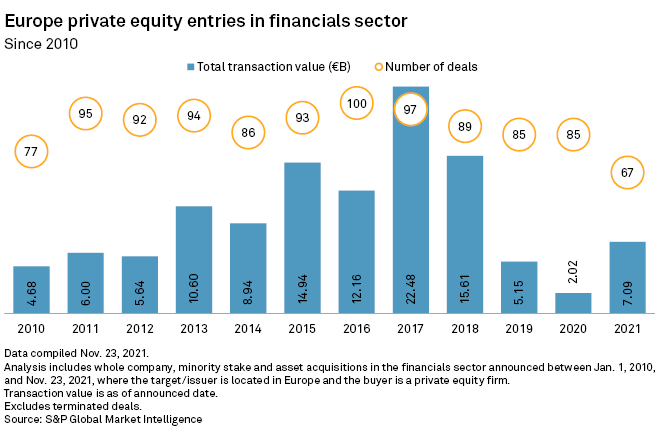

CHART OF THE WEEK: European financial sector deals heading for a fall

➤ Private equity transactions involving European financial institutions are poised in 2021 to slip to their lowest level in several years.

➤ Firms are attracted to the low valuations of European banks, but possible interest rate hikes hint at a potential for a turnaround in performance, and banks want prospective acquirers to take that into account.

FUNDRAISING AND DEALS

* Funds managed by Blackstone Inc.'s Blackstone Tactical Opportunities Advisors LLC unit will sell a controlling interest in specialist lending platform Aqua Finance Inc. to Apollo Global Management Inc.-backed Athene Holding Ltd. at a valuation of approximately $1 billion. The funds separately acquired Sustana Group, which makes specialty recycled fiber and sustainable packaging and paper products, from H.I.G. Capital LLC. Blackstone Energy Partners LP also agreed to buy cloud-based technology company Irth Solutions Inc.

* An investor consortium led by Razer Inc.'s founders and including CVC Capital Partners Ltd. proposed to buy shares it does not already own in the gaming equipment maker for up to HK$10.79 billion. A fund managed by CVC Capital also completed its acquisition of European alcoholic beverage company Stock Spirits Group PLC. The firm ended its buyout talks with investor administrative service provider Intertrust NV and a strategic merger with TMF Group Holding BV.

* Advent International Corp. signed a deal to buy a significant stake in clinical artificial intelligence technology company Iodine Software LLC at a valuation of over $1 billion.

ELSEWHERE IN THE INDUSTRY

* Manulife Investment Management raised $4.65 billion for Manulife Infrastructure Fund II LP at final close.

* Sapphire Ventures LLC secured $2 billion for Sapphire Ventures Fund VI LP and Sapphire Ventures Opportunity Fund III LP.

* Lime Rock Management LP obtained roughly $375 million for the Lime Rock New Energy LP fund, which had a $600 million initial fundraising target.

* Middle-market investor Pike Street Capital LLC injected capital into wholesale specialty food distributor Fair Market Inc.

FOCUS ON: INTERNET SOFTWARE AND SERVICES

* Asset visibility and security platform company Armis Inc. obtained $300 million in an investment round led by middle-market investor One Equity Partners, bringing its valuation to $3.4 billion.

* Sunstone Partners Management LLC provided strategic investment to background check and due diligence service firm Vcheck Global LLC.

* Veritas Capital Fund Management LLC will add school website and digital communications tool specialist Active Internet Technologies LLC, doing business as Finalsite, to its portfolio from Bridge Growth Partners LLC.