Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Dec, 2021

By Maera Tezuka

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Editor's note:

The global private equity industry wrapped up a record-setting year with a flurry of fundraising activity just before the holidays, with Ares Management Corp. and The Carlyle Group Inc. among the firms reporting closed funds in December.

Ares on Dec. 13 announced the close of an approximately $8 billion middle-market loan fund, Ares Senior Direct Lending Fund II. Commitments from eager investors pushed the fund well beyond its initial $4.5 billion target.

Carlyle also shot past the target for its ninth U.S. real estate opportunity fund, Carlyle Realty Partners IX, the firm announced Dec. 14. Aiming for a $6 billion fund size, Carlyle raised close to $8 billion, which it will funnel into opportunistic U.S. real estate investments.

Also announcing fund closes in the third-to-last week of 2021 were NVP Associates LLC, which raised $3 billion for its Norwest Venture Partners XVI LP, and BC Partners' BC Partners Credit, which secured $1.2 billion for its Special Opportunities Fund II. The former fund was assembled to make investments across the consumer, enterprise and healthcare industries, while the latter is a debt-focused fund targeted to primary and secondary loans in both the North American and European markets.

Private equity fundraising surged back in 2021 after being muted by the early waves of the pandemic, a rebound that began in the second half of 2020. The 10 largest European and North American funds to close in 2021 will all have raised at least $10 billion, according to S&P Global Market Intelligence data. The largest was more than twice that size: Hellman & Friedman LLC's $24.4 billion Hellman & Friedman Capital Partners X LP, which closed in June.

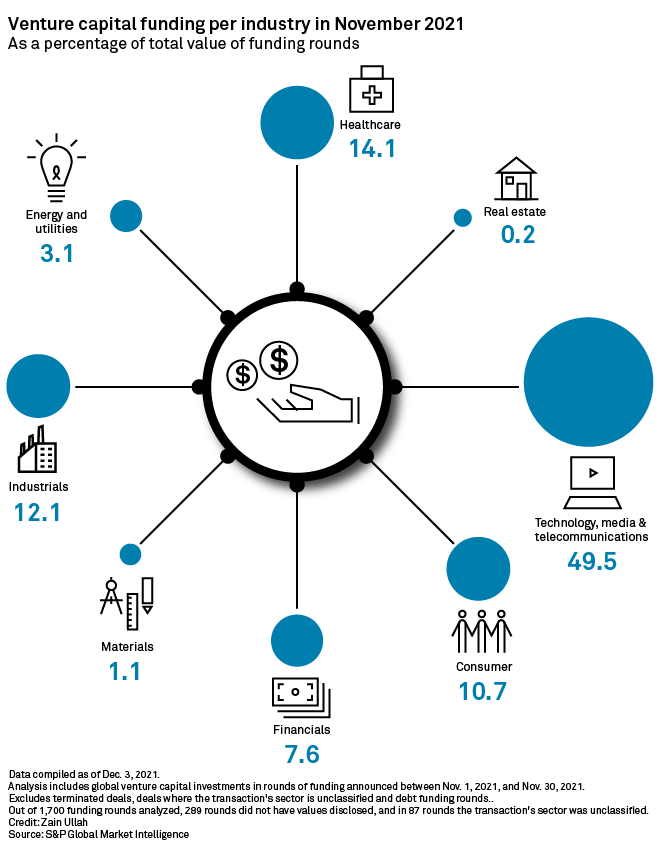

CHART OF THE WEEK: Venture capital funds flowed to tech in November

➤ Nearly half of the $51.84 billion in global venture capital deployed in November flowed to the technology, media and telecommunications industry.

➤ The healthcare sector got the next-largest portion, receiving 14.1% of the venture capital deployed in November, followed by industrials at 12.1%.

➤ North American companies were the biggest beneficiaries of venture capital funding in November, with investors pouring $27.44 billion into 644 transactions. Next came Asia-Pacific with $16.02 billion across 577 deals, followed by Europe with $5.32 billion across 337 transactions.

FUNDRAISING AND DEALS

* A fund managed by Ares Management Corp.'s Ares Private Equity Group, along with other shareholders, sold a stake in service-based systems integration company Convergint Technologies LLC to Leonard Green & Partners LP and Harvest Partners LP-managed funds.

* Funds managed by Blackstone Inc.'s Blackstone GP Stakes acquired a minority stake in middle-market investor Nautic Partners LLC.

* KKR & Co. Inc. set up a self-storage real estate platform called Alpha Storage Properties, which will buy assets in high-growth markets and strategic infill locations across the U.S. The firm agreed to buy a significant minority stake in technology group Körber AG, subject to regulatory approvals and other closing conditions. It also led a $350 million series D financing round for cryptocurrency banking company Anchorage Digital Bank NA, according to Dow Jones Newswires' MarketWatch.

* Apollo Global Management Inc., through Apollo Infrastructure Funds, will divest a 25% stake in power generation company CPV Fairview Energy Center to DL Energy Co. Ltd.

ELSEWHERE IN THE INDUSTRY

* Level Equity Management LLC obtained $775 million for the Level Equity Growth Partners V LP fund and $350 million for the Level Equity Opportunities Fund 2021 LP.

* Middle-market private equity firm The Halifax Group sold commercial playground equipment manufacturer BCI Burke Co. LLC.

* Parthenon Capital Partners signed a deal to buy a majority stake in global credit rating agency KBRA.

* Funds managed by Morgan Stanley Capital Partners exited digital marketing company 24 Seven Inc. to a general partner-led continuation investment vehicle managed by a Morgan Stanley affiliate.

FOCUS ON: INDUSTRIAL MACHINERY

* KKR wrapped up its acquisition of food processing equipment supplier Bettcher Industries Inc. from MPE Partners.

* A Lone Star Funds affiliate will buy machinery components maker SPX Flow Inc. in a cash transaction valued at $3.8 billion, including assumed debt.

* An affiliate of H.I.G. Capital LLC purchased Spanish plumbing company Standard Hidráulica SAU from Aalberts NV.