Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Nov, 2021

By Tom Jacobs and Husain Rupawala

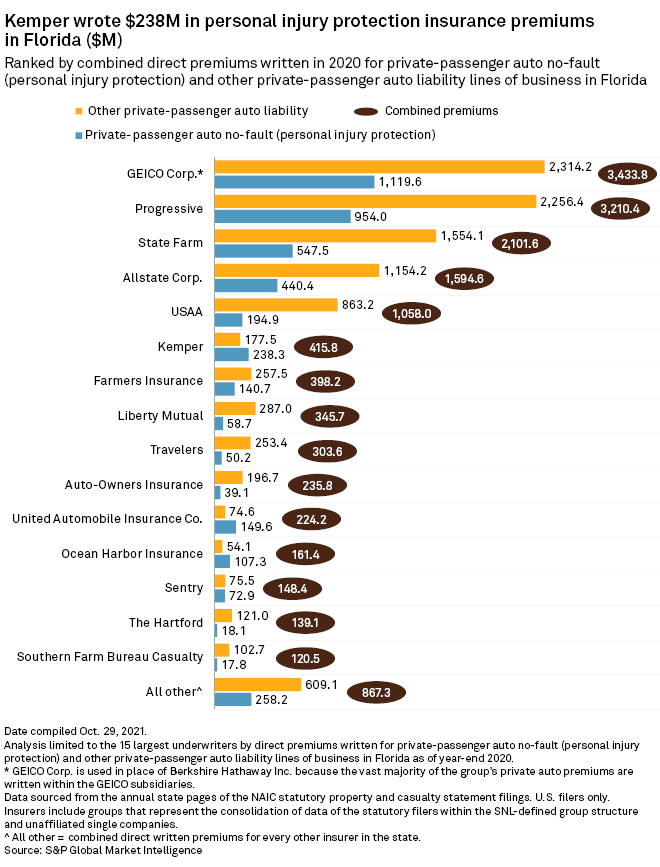

An unusual increase in personal injury protection court cases in Florida forced Kemper Corp. to take a $25 million reserve charge in the third quarter.

Kemper was a victim of a "double hump," Piper Sandler analyst Paul Newsome said. The company saw lawsuits spike up then tail off at the close of the second quarter, but as it was assessing those charges, there was another spike in litigation in the third quarter, according to the analyst.

The charge also was due to a ruling by the Florida Third District Court of Appeal in a lawsuit between The Allstate Corp. and a healthcare provider over Medicare reimbursements for diagnostic imaging procedures such as MRIs, Newsome said.

Allstate filed an appeal after it lost in the Miami-Dade County Court, but the appeals court affirmed the lower court ruling.

The change was in the interpretation of what the right level of reimbursement is relative to what Medicare pays, according to the analyst. The amounts Allstate had previously paid out were deemed insufficient and the company now must make up the difference.

"After Allstate lost the lawsuit, [Kemper] expected a large number of lawsuits to happen," Newsome said in an interview.

Kemper reported a third-quarter net loss of $75.3 million, or a loss of $1.18 per share, compared with a gain of $122.3 million, or $1.83 per share, in the prior-year quarter.

The adjusted consolidated net operating loss was $75.8 million, or a loss of $1.19 per share. The company posted net income of $90.9 million, or $1.36 per share, in the third quarter of 2020.

The company also recorded an 18% to 20% year-over-year increase in frequency, which

CEO Joseph Lacher during the previous quarter's earnings call touched on how social inflation has crept into Kemper's business.

Attorneys who had been focusing on higher-limit policies when frequency declined during the pandemic "started looking for other places and they moved more into lower-limit policies where we hadn't seen them before," Lacher said.