Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Jan, 2021

By Gautam Naik

Large consumer companies armed with big cash stockpiles could propel a surge in M&A over the next 12 months as favorable monetary and fiscal policies and vaccine deployments increase the likelihood of an economic recovery.

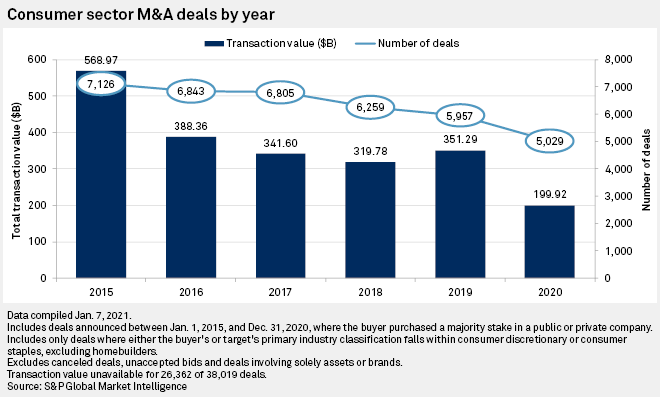

Consumer deal-making was markedly weaker in 2020 as lockdown restrictions and the economic slowdown hit the sector especially hard. The number of consumer deals fell 15.6% to 5,029 in 2020 from 5,957 in 2019, while the value of transactions plunged 43.1% to $199.92 billion from $351.29 billion over the same period, according to data compiled by S&P Global Market Intelligence.

The top three deals announced in 2020 were Seven & i Holdings Co. Ltd.'s $21 billion acquisition of Speedway LLC, Inspire Brands Inc.'s $11.3 billion purchase of Dunkin' Brands Group Inc. and Home Depot Inc.'s buyout of HD Supply Holdings Inc. for $8 billion.

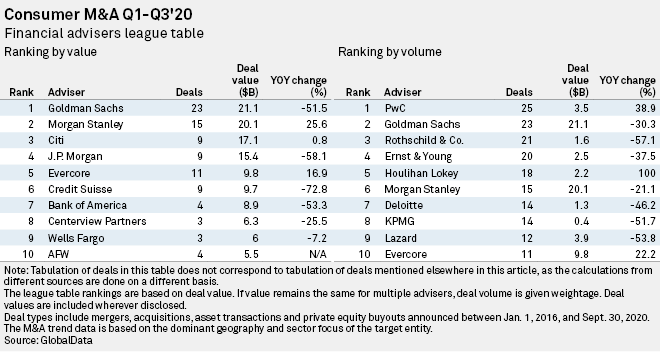

The picture could be very different over the next 12 months. "The environment for deals is very strong," said John Potter, a specialist in consumer M&A at PwC, in an interview. "The quality of balance sheets and the availability of cash and equities are setting the stage for a strong 2021. Consumer is also one of the main areas [of focus] for private equity, and the sheer magnitude of private equity dry powder waiting to be deployed" will add to momentum, Potter added.

The earliest indicator of this enhanced appetite for M&A came Jan. 13 when Canadian convenience store operator Alimentation Couche-Tard Inc. lodged a €16.16 billion bid for French supermarket chain Carrefour SA. However, that proposal was swiftly dropped in favor of an "operational partnership" after the French government objected to a takeover on the grounds of food security.

Consumer M&A in past recessions has typically been driven by low valuations and earnings multiples of target companies, allowing opportunistic acquirers to snap up desirable assets and generate significant returns down the road. This time, "those opportunities are more scarce," said Potter. Instead, deal-making will involve "those companies that have the ability to execute and who also have a strategic rational" for making an acquisition, such as boosting digital capabilities, strengthening core operations or increasing exposure to promising markets.

If consumer companies are emboldened to make more acquisitions, it is mainly because they expect demand to return with strength once COVID-19 is brought under control. In the U.S., for example, the savings rate is high and consumer spending has proven to be fairly resilient. Chinese demand for luxury goods has also shown a strong uptick.

Another driver is the push to take advantage of shifts in consumer behavior brought on by lockdowns, remote work and social distancing that are expected to persist long after the pandemic has receded. These include the surging demand for online purchasing and home improvement, as well as a newfound interest in home-centered activities such as cooking, fitness, gaming and entertainment.

Areas of the consumer sector that could yield the biggest number of deals in 2021 include luxury, snacks, frozen foods and plant-based products. Some large companies are keen to acquire assets to broaden their offerings, while others are more focused on disposing under-performing brands.

Speaking at the Barclays Consumer Global Staples conference on Sept. 9, 2020, Nestlé SA's CFO François-Xavier Roger noted that the company over the previous 18 months had sold more assets than it had bought but wanted to be "much more on the acquisitive side now." Roger said nutrition, health and wellness are among the categories of interest and any deal would need to provide a strong return on investment within five to seven years.

Unilever PLC, meanwhile, has acquired more than 35 businesses since 2015 and achieved a return on invested capital "in the high teens," CFO Graeme Pitkethly noted at a December conference hosted by Morgan Stanley. Pitkethly said that in 2021 the company planned to review all aspects of its portfolio and would likely "reduce the number of acquisitions we do, if we can, but increase the average ticket size."

In the luxury segment, 2020 was something of an outlier because some large transactions didn't go smoothly. LVMH Moët Hennessy - Louis Vuitton Société Européenne's 2019 agreement to acquire Tiffany & Co., for example, was delayed by mutual lawsuits and was only completed after the iconic U.S. jewelry maker agreed to reduce its price. Similarly, Ray-Ban owner EssilorLuxottica SA is embroiled in legal wrangling over its 2019 proposal to take over Dutch optical retailer GrandVision NV, a deal which has yet to close.

"Normally in luxury, you agree on the deal and you close the deal," said Francesca Di Pasquantonio, head of global luxury research at Deutsche Bank, in an interview. "In that sense, 2020 has proven to be more controversial, tougher and nerve-racking."

Deutsche Bank's research division expects more consolidation among luxury companies in the coming 12-24 months. "It's a cash-rich sector," said Di Pasquantonio. "When brands become available, irrespective of financial conditions, that's when M&A happens."

In normal circumstances, "founding families that control luxury companies have a strong attachment to them, so it's very difficult for [independent] shareholders to decide to sell the company," said Di Pasquantonio. However, the impact of the pandemic may now shake some assets loose. Family-controlled Prada SpA, for example, has been rumored to be a possible acquisition target, though in January 2020 it rebuffed reports that it was for sale. "The pandemic may now influence family-owned companies to consider relinquishing control more easily," said Di Pasquantonio.

In the past, consumer deal-making was often influenced by a quest for size, heft and market share. But post-pandemic, the motivations could be different. For example, companies such as L'Oréal SA that made sizable bets on digital technology in the past and were able to successfully parlay that prowess to maintain revenue during lockdowns, will likely seek to enhance those strengths, either by in-house innovation or by acquiring firms that have mastered the technology.

Similarly, the increased interest in plant-based foods could lead to more acquisitions of innovative, entrepreneur-run companies by larger food conglomerates such as Nestlé, Unilever, PepsiCo Inc., Mondelez International Inc. and The Kraft Heinz Co.

"The volume of deals will go up, the amount of capital [deployed] will continue to increase, and the average deal size will go higher," predicts Potter of PwC. "We'll see more $1 billion and $5 billion deals. These aren't scale plays — they are innovation and capability plays."