Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 5 Oct, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Smart Contracts Can Be Trusted in a Trustless Market

Smart contracts are gaining ground to replace traditional contracts, but adoption remains low because of a lack of comfort, knowledge gaps and inertia. “Smart Contracts Could Improve Efficiency and Transparency in Financial Transactions,” a new report from S&P Global, helps to address the first two issues. However, S&P Global has been reporting on smart contracts, particularly in commodities markets, for many years.

A smart contract is an application hosted on a blockchain with a predefined set of rules, written as code, which requires consensus from all parties. This means no single party can change the terms of the contract without the approval of others, and each party hosts a copy of the contract.

All contracts are ostensibly arrived at through consensus: This is the nature of negotiation. For a smart contract, that consensus is programmatic. If a party to the contract either changes or defaults on the coded terms, the contract is voided. Ideally, this would eliminate a certain amount of fraud or litigation, particularly in fast-moving and decentralized markets such as those for many commodities. Consensus-building algorithms that depend on protocols such as proof-of-work or proof-of-stake can use time-stamping and integrity checks to ensure contractual compliance.

Not all contracts should be smart contracts. Some legal agreements require an element of subtlety or flexibility that isn’t easily recreated in code. However, there is a set of use cases where smart contracts make a great deal of sense, for example, because they are already dependent on a blockchain or because their terms are relatively straightforward. Smart contracts are purpose-built for legal agreements governing decentralized digital securities, decentralized exchanges or decentralized autonomous organizations. However, insurance, supply chain logistics and registration of immovable property also lend themselves to smart contracts due to their simple terms and Boolean outcomes.

Regulation remains a challenge for smart contracts. A body of law has grown up around traditional contracts, and it is unclear how that could be repurposed for smart contracts executed programmatically on a blockchain. Another area of concern is oracles, which are trusted data sources that bridge a smart contract with the real world. An example of an oracle in a smart contract is an insurance payment being made based upon a certain quantity of rainfall. An oracle that pulls in rainfall data could be vulnerable to security or veracity issues. There is also the question of how to manage a smart contract when the counterparties use different protocols, languages or blockchains.

While there are challenges to converting to smart contracts, the benefits in terms of increased efficiency, greater transparency and reduced dependency on transaction counterparties are too great to ignore. More people in finance, energy and commodities markets are getting comfortable with smart contracts every day. The biggest outstanding issue is inertia.

Today is Wednesday, October 5, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

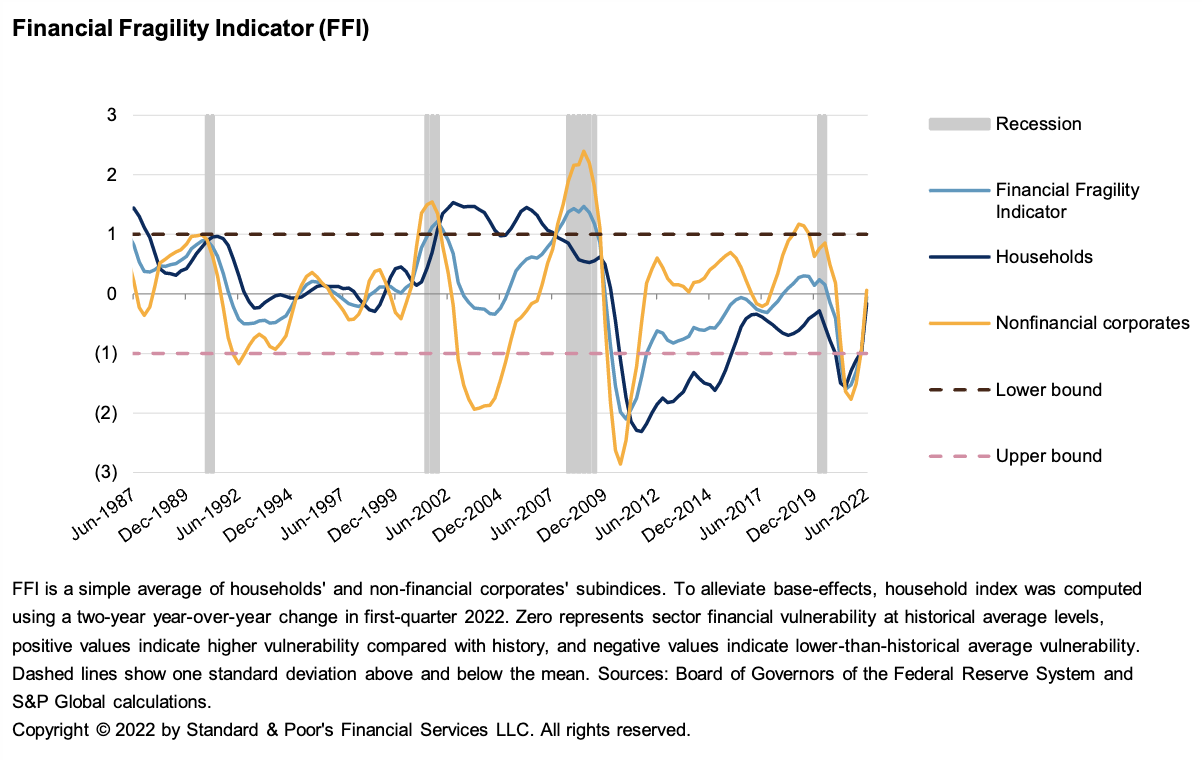

Economic Research: Financial Fragility Indicator Deteriorates Rapidly As Household And Firm Balance Sheet Weakness Approaches Historical Average

The FFI plummeted in the second quarter and is now on the precipice of the zero line — the historical average. From -0.95 in first-quarter 2022 and its cyclical low of -1.6 in 2021, it was -0.05 in the second quarter, indicating that financial conditions have weakened dramatically, as the private sector has tapped into its savings. Fortunately, the FFI is still in relatively healthy territory, though the speed in which the private sector reached its historic mean is worrisome.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Banks' Climate Plans Could Cause Economic Shocks – Bank Of England Exec

Banks risk causing economic shocks if they withdraw funding from polluting sectors too quickly, the Bank of England's head of climate has warned. Speaking at The Economist's annual Sustainability Week on Oct. 3, Chris Faint suggested that financial institutions should resist external pressure to withdraw funding from high-carbon clients as they execute their climate strategies.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

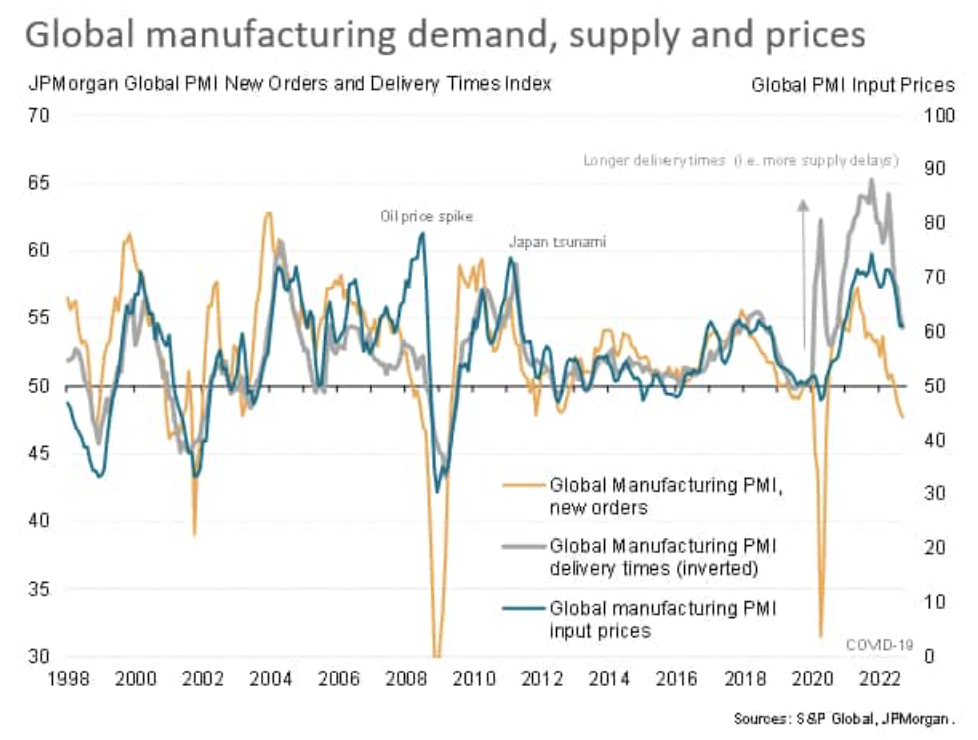

Worldwide Industrial Price Pressures Rise As Higher Energy Costs And Strong Dollar Offset Impact Of Cooling Supply Chains

The global manufacturing PMI survey found average input costs rising at an increased rate for the first time in five months in September, hinting at stubbornly persistent inflation within the worldwide factory sector. The renewed upswing in price pressures is being driven by higher energy prices and currency fluctuations, and as such was principally focused on Europe and Japan.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

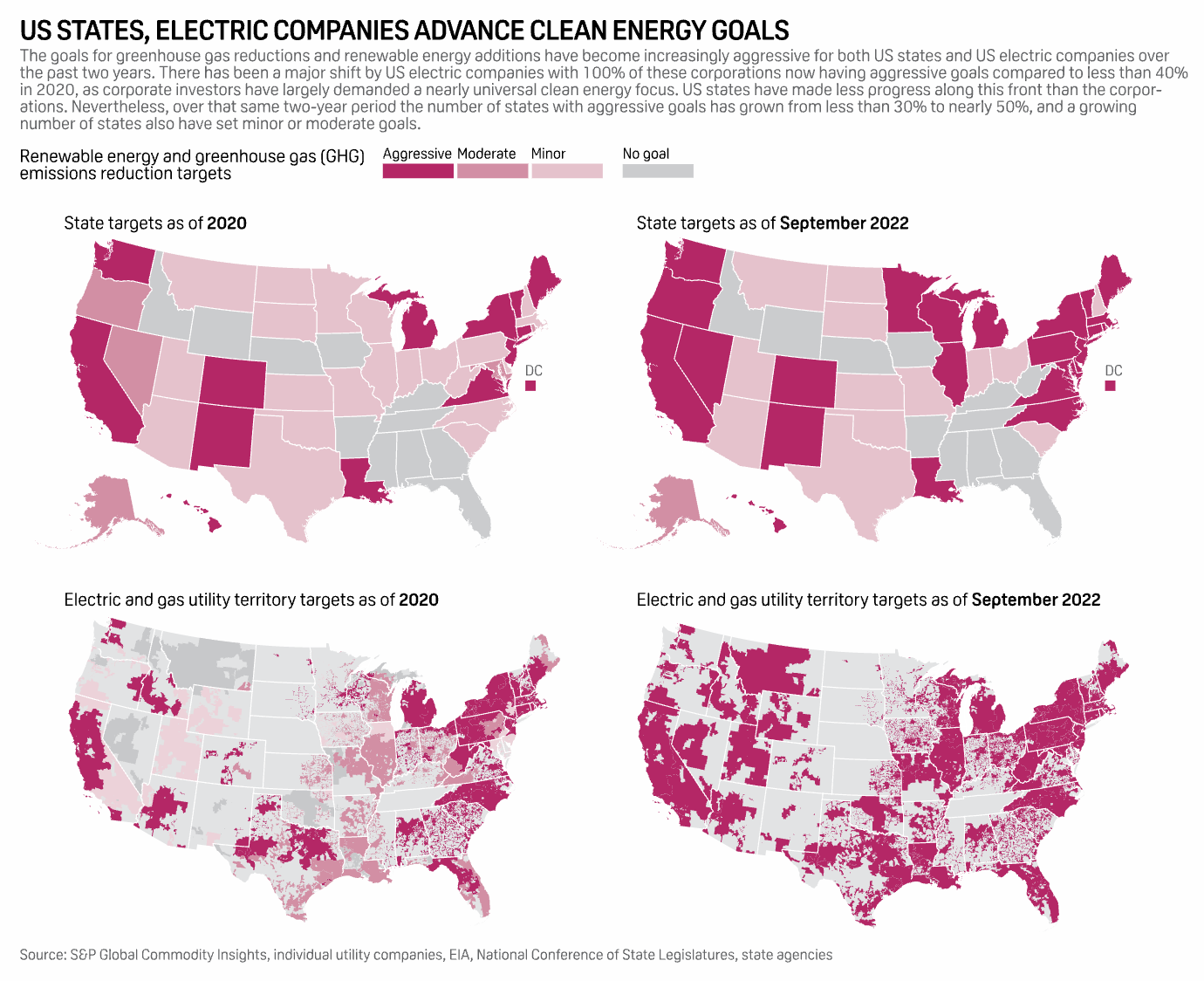

U.S. Electric Utilities Are Failing On Climate Progress Despite Goals: Sierra Club

Most electric utilities are not on track to reduce greenhouse gas emissions enough to avoid the worst impacts of climate change, and utilities with climate goals are doing only slightly better on climate issues than their peers without pledges, the Sierra Club said Oct. 3. "We need more than lip service to combat the climate crisis — electric utilities need to make progress towards a clean energy future," the Sierra Club said in a report.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Listen: Europe’s Energy Crisis: Is Storage Fit For Purpose?

As gas supply disruptions send shockwaves across the world, the ability and capacity to store energy has come under close scrutiny. Associate Director Paul Hickin discusses with gas and power editors Stuart Elliott and Kira Savcenko whether Europe has enough energy in reserve to get through the winter, the challenges of providing sufficient back-up from both fossil fuels and alternative sources, the knock-on effects to the rest of the world and whether we might experience déjà vu this time next year.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

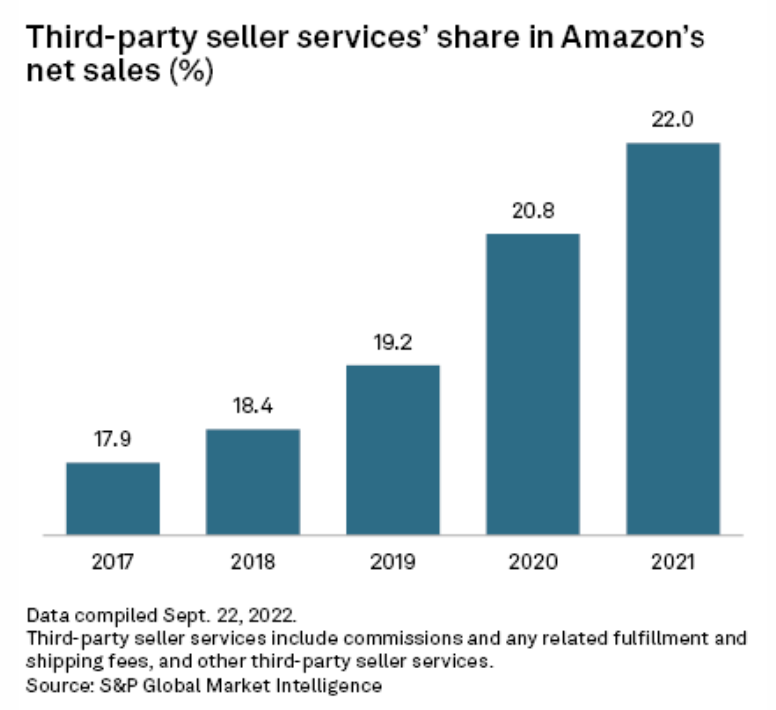

States Seen As Next Battlefield For Big Tech Antitrust Cases

State politicians impatient with the pace of federal movement on Big Tech antitrust concerns are likely to follow California in using their own laws and resources to take action, policy experts said. While divided federal government bodies often have difficulty finding consensus on matters like Big Tech antitrust cases, state governments in many cases are less divided and more able to step in, the experts said.

—Read the article from S&P Global Market Intelligence