Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 30 Oct, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Kazakhstan Thrives in Disrupted Oil Markets

Kazakhstan is a major oil producer and exporter that has become a vital source for Europe since Russia invaded Ukraine in 2022, resulting in sanctions on Russian oil. Though the war initially gave Kazakhstan a leg up, the conflict may spell trouble as concerns rise about the stability of the Central Asian country’s main oil trade route.

In 2022, about 80% of Kazakh oil exports traveled through the Caspian Pipeline Consortium (CPC), which connects Kazakhstan’s Tengiz field to Novorossiysk, a Russian port city on the Black Sea. The pipeline has seen little disruption amid the Russia-Ukraine conflict, but US officials recently expressed fears about escalating hostilities in the area, including an attack on a Russian naval ship near CPC loading facilities in August.

US Ambassador to Kazakhstan Daniel Rosenblum voiced concern Sept. 29, telling Kazakh media that a formal agreement should be reached to secure the CPC route, Nick Coleman, senior editor of oil news at S&P Global Commodity Insights, reported in an Oct. 4 article.

Industry participants seem much less worried. "CPC has been very stable, no problem at all," Frode Ljones, TotalEnergies’ country chair for Kazakhstan, said at the nation’s Energy Week forum in early October. At the same event, Magzum Mirzagaliyev, CEO of state-owned KazMunayGas, anticipated no major issues with the CPC. "This is the most sophisticated, very efficient route that we have been using for more than 20 years, and the fact is that this is the largest pipeline in the world," Mirzagaliyev said.

Speakers at Kazakhstan Energy Week were optimistic about the country’s oil market overall. According to Ljones, the Kashagan field, which is the second-largest contributor to CPC Blend oil, had “an excellent year.” Shell’s integrated gas and upstream director, Zoe Yujnovich, praised the Kashagan and Karachaganak fields, in which Shell has stakes. Yujnovich said the company plans to expand its upstream presence in Kazakhstan even further based on the success of those assets.

Still, the Russia-Ukraine war casts a shadow over the CPC, and Kazakhstan is exploring alternatives, according to S&P Global Commodity Insights analyst Natalia Sleta. Higher transportation costs and limited infrastructure mean there are no easy answers.

“The existing options for increasing Kazakhstan's oil exports … are incapable of replacing the volumes handled by the CPC pipeline,” Sleta said.

Today is Monday, October 30, 2023, and here is today’s essential intelligence.

Written by Claire Delano.

EMEA Structured Finance Chart Book: October 2023

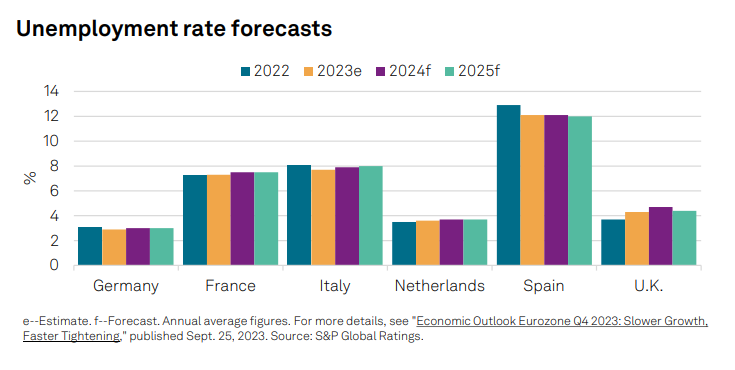

Investor-placed securitization issuance for September 2023 was €14.9 billion — up more than 75% on the same month in 2022 and one of the largest monthly totals since the financial crisis. Overall year-to-date issuance of €66 billion was still down at end-September, but now by less than 5%. European benchmark covered bond issuance has been robust throughout the year, reaching €147 billion year-to-date by the end of September 2023. In September 2023, S&P Global Ratings raised 18 of its ratings on European securitization tranches across a wide mix of sectors, including auto ABS, RMBS, CMBS and SME CLOs. There were only two downgrades in a single UK buy-to-let RMBS transaction.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Asia-Pacific Reinsurance Sector Update: Still In Recovery Mode

The Asia-Pacific reinsurance sector is seeing signs of stabilization post-COVID. "We expect premium rates and underwriting conditions to remain tight for rated Asia-Pacific reinsurers," said S&P Global Ratings credit analyst Trupti Kulkarni. "However, investment returns are improving, and capital buffers will stay adequate."

—Read the report from S&P Global Ratings

Access more insights on capital markets >

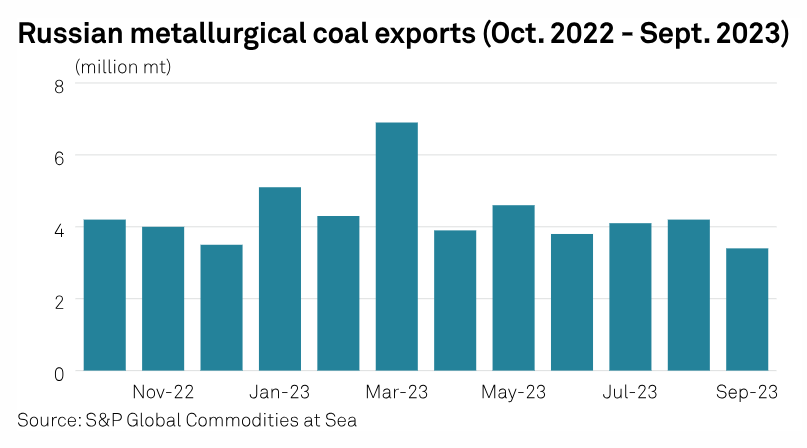

Russia's New Export Duties Pose Challenge For Domestic Coking Coal Miners; Limited Impact On Scrap, Steel

Coking coal producers in Russia are facing tough times following the Russian government's recent introduction of customs duties on exports outside the Eurasian Economic Union for a period of 15 months. First unveiled on Sept. 22, the additional customs duties include all ferrous and non-ferrous metals, and raw materials to produce them such as met coal and iron ore and others, and came into effect on Oct. 1.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Investigating The Premium Available To Factor Returns Via A Focus On Sustainability

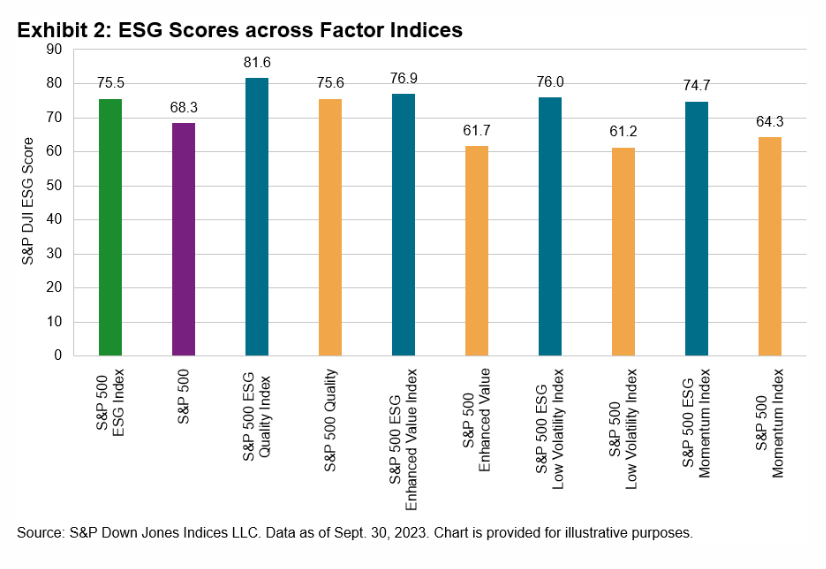

Factor indices aim to provide investors the means to access factor exposure in a cost-effective and transparent way. S&P DJI offers sustainability versions of factor indices that incorporate environmental, social and governance (ESG) scores, which allow investors to align their investments with their interests while seeking to improve risk/return dynamics. Launched in 2021, its suite of S&P 500 ESG Indices encompasses single-factor indices based on quality, momentum, enhanced value and low volatility.

—Read the article from S&P Dow Jones Indices

Access more insights on sustainability >

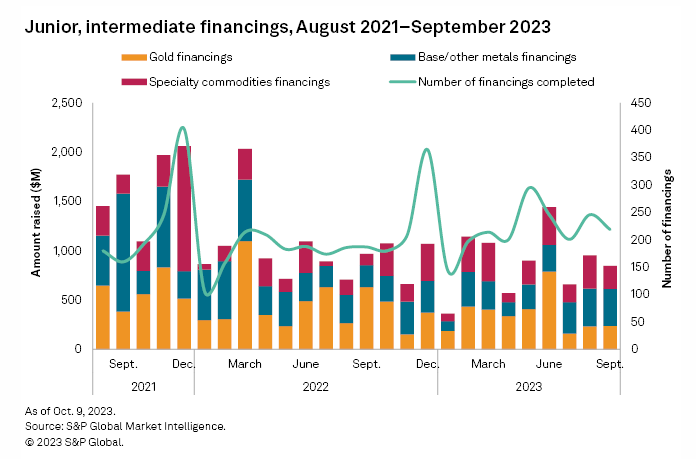

IM October 2023 — Exploration Still Lackluster

S&P Global Market Intelligence's Pipeline Activity Index (PAI) continued to show weakness in September, decreasing another 3% to 87, the lowest level since May 2020. Similar to August, the gold PAI increased slightly while the base metals PAI declined. The gold PAI rose 3% month over month from 110 to 113, while the base/other category dropped 12% from 73 to 64.

—Read the article from S&P Global Market Intelligence

Access more insights on energy and commodities >

Generative AI: Latest Breakthroughs And Developments

It was more than six months ago that a letter signed by a group including Elon Musk and Steve Wozniak called for a half-year pause on generative AI development. As S&P Global Market Intelligence monthly updates can attest to, this letter failed in its objective. The last six months have seen an array of announcements from the companies that kicked off the trend — OpenAI, Microsoft Corp. and Google — as well as the entrance of specialist startups and established technology companies. This month continues this trajectory, with releases from many of the better-known generative AI companies and a number of launches from new entrants — increasingly companies outside of the US.

—Read the article from S&P Global Market Intelligence