Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 18 Oct, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Black Mass Increasingly Popular

Black Mass is a thrash metal band founded in Boston in 2012. This article isn’t about them. Nor is it about the 2015 film of the same name starring Johnny Depp. The black mass that is becoming increasingly popular today is the shredded residue of used electric vehicle batteries or the residual material from the production of EV batteries. This residue can be processed to extract critical metals including lithium, nickel, cobalt, copper and manganese. A recent “Future Energy” podcast from S&P Global Commodity Insights, “Black Mass: battery recycling to play a critical role in EVs globally,” dissects the growing market for black mass.

Global battery manufacturers are headed for a critical shortage of materials. Given the lengthy delays in developing and permitting battery metals extraction and production facilities, many manufacturers are looking to the recycling of metals via black mass to make up the shortage and reduce the carbon footprint of their processes.

"If every one of the 300 gigafactories under development enters the market within the next three years as planned, there just won’t be enough raw material to supply them," Robin Brundle, director of UK-based battery recycler Recyclus Group, told S&P Global Commodity Insights.

In Europe, concerns about access to critical metals for a burgeoning EV industry have led to a wave of investment in battery recycling capacity as automakers and battery manufacturers seek to offset the anticipated global shortfall. More than a dozen additional European battery recycling projects are earmarked for completion before the end of 2026.

Battery recycler Li-Cycle, with facilities in the US, Canada and the EU, has more than doubled its production and sales of black mass. Electra Battery Materials, another Canadian black mass processor, announced the completion of a trial that yielded improved recoveries of high-value elements, higher metal content in saleable products and reduced use of reagents. The company, formerly known as First Cobalt, has also been extracting nickel, cobalt, copper, manganese, lithium and graphite from a black mass product recovered from recycled batteries.

"The metals used in battery production are finite, but by substituting raw materials mined from the Earth with recycled materials, we can not only cut the carbon footprint of batteries but enable the sustainable long-term use of [lithium-ion] battery technology," said Emma Nehrenheim, chief environmental officer of Sweden-based battery manufacturer Northvolt.

The challenge for the fast-growing black mass market is that different batteries have different chemical compositions, and not all recyclers are able to extract all the metals from black mass. This makes it difficult to apply a one-size-fits-all price to black mass. Platts, part of S&P Global Commodity Insights, launched nine daily black mass price assessments on April 17 aimed at bringing greater transparency to pricing of the battery raw materials market.

“The lack of standardization right now means that your cobalt content or nickel content or even your lithium content can vary. And the variance can be huge, at times incredible,” said Scott Yarham, S&P Global Commodity Insights’ global lead for battery metals, on the “Future Energy” podcast.

Today is Wednesday, October 18, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

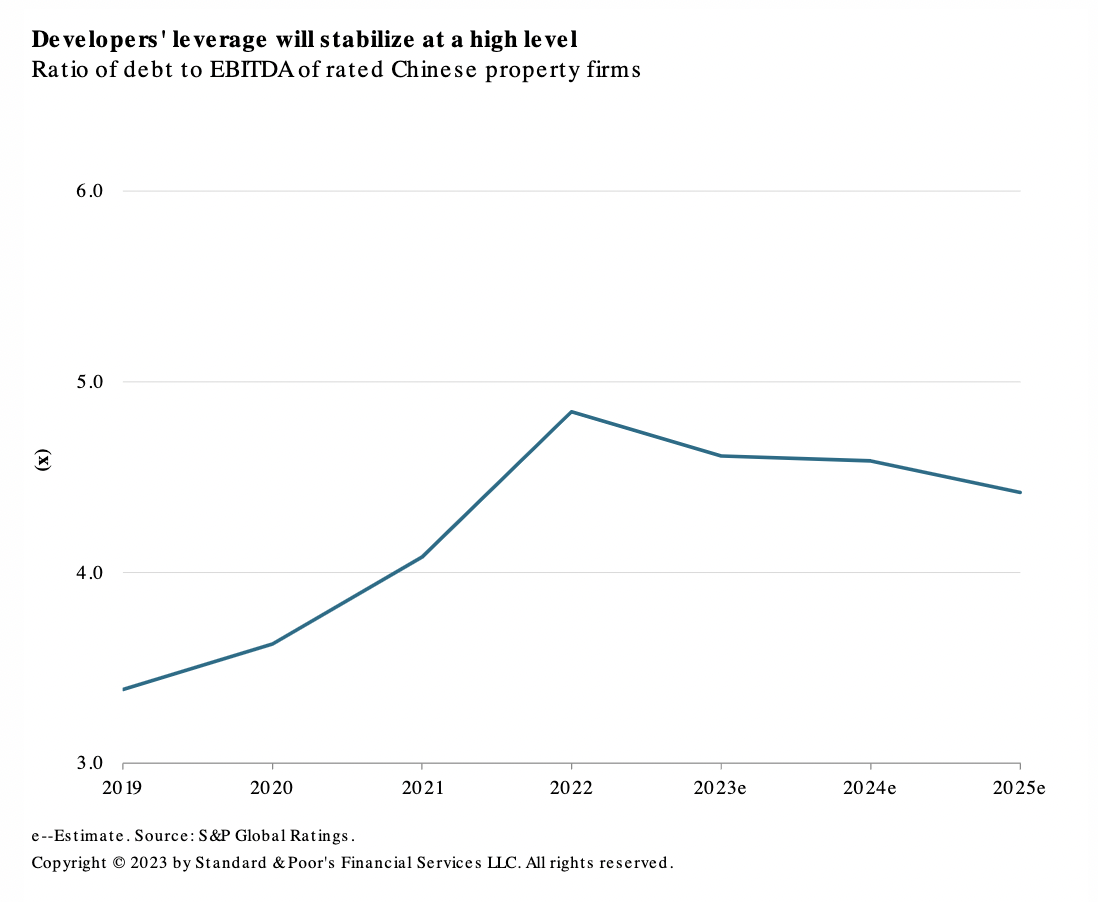

China Property Watch: A Slow, Sequential Recovery In 2024

The good news for China's property developers is that a bottom is in sight. The bad news is that the sector will likely bump along this floor for years. S&P Global Ratings expects that the low number of construction starts, an inventory overhang in lower-tier cities, and ever-tightening escrow restrictions will keep property sales depressed. The sector will continue to diverge. The government's continuous policy relaxations aimed at stabilizing the sector will benefit the upper-tier markets, the first-tier cities in particular. Lower-tier cities are contending with excess supply and depleted confidence.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

October US And Canada Summary Report: Leveraged Finance

Higher-for-longer interest rates, the possibility of a recession and lingering inflation suggest that the credit conditions for borrowers in North America will likely deteriorate. S&P Global Ratings rates approximately 40% of its North American speculative-grade issuers 'B-' and below, with health care and high technology having more than half of their rated portfolio in these lower-rated categories. Both sectors are highly concentrated in the US and are facing increased interest expenses, which is pressuring their margins and cash flow.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

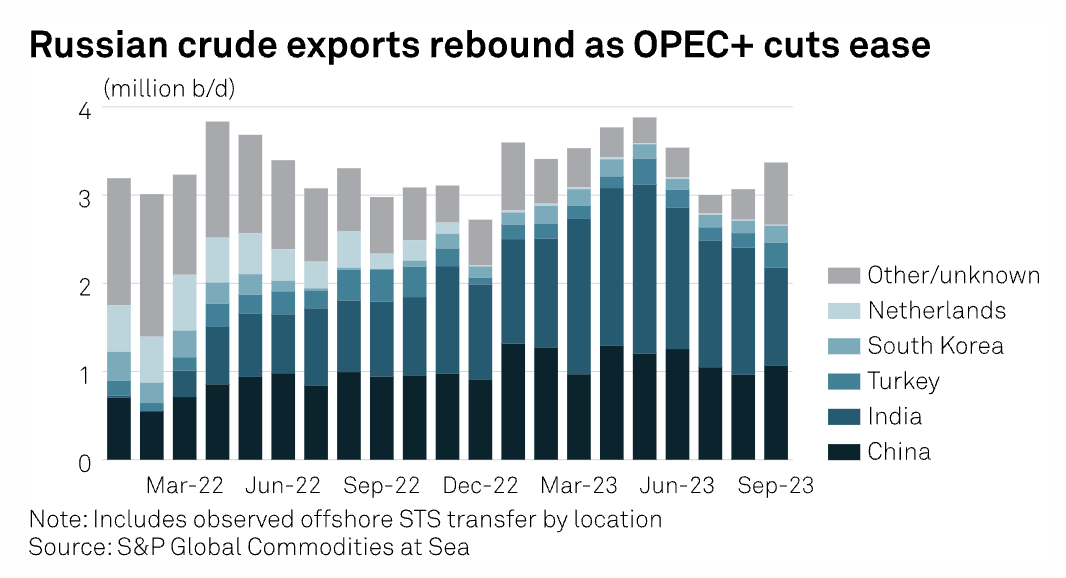

US Aims To Tighten Price Cap Enforcement By Targeting Non-G7 Shipowners

The US has targeted foreign tanker owners in its first clampdown on breaching the Russian oil price cap, a move designed to limit Russia's petroleum exports facilitated by non-G7 firms using Western marine services, sanctions specialists said. Since Dec. 5, the G7 and its allies have banned service providers subject to their jurisdictions from facilitating seaborne Russian crude exports unless the barrels are sold at $60/b or less. Similar restrictions have been placed on Russian oil products since Feb. 5 with different thresholds.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Tiny Nuclear Meets Big Oil: Can Micro Reactors Reduce Oil And Gas Operations Emissions?

Oil and gas production, transport and processing account for almost 15% of total energy-related greenhouse gas emissions globally, and the use of the oil and gas results in another 40% of emissions, according to the International Energy Agency. Powering upstream oil and gas facilities with low-emissions electricity is one way to cut emissions from the sector, the IEA said. James Walker, CEO of Nano Nuclear Energy, and Jay Yu, founder and executive chairman of Nano Nuclear Energy, joined the podcast to discuss the possible use of micro reactors to reduce emissions in the oil and gas sector.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on sustainability >

Listen: Confidence Returns To Copper Markets For Now, Outlook For 2024 Still Uncertain

Chinese copper markets are showing signs of recovering from the slump that hit the industry in the second quarter pf this year. The clean concentrate spot TCs are declining on increased demand for cargoes and cathode import interest are improving on tighter spot supplies. As the market heads into negotiation season, YuenCheng Mok, senior managing editor of nonferrous metals at S&P Global Commodity Insights discusses the key trends in the Chinese copper concentrate and cathode markets with Jesline Tang, editor with the nonferrous metals team, and Han Lu, senior editor with the team.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

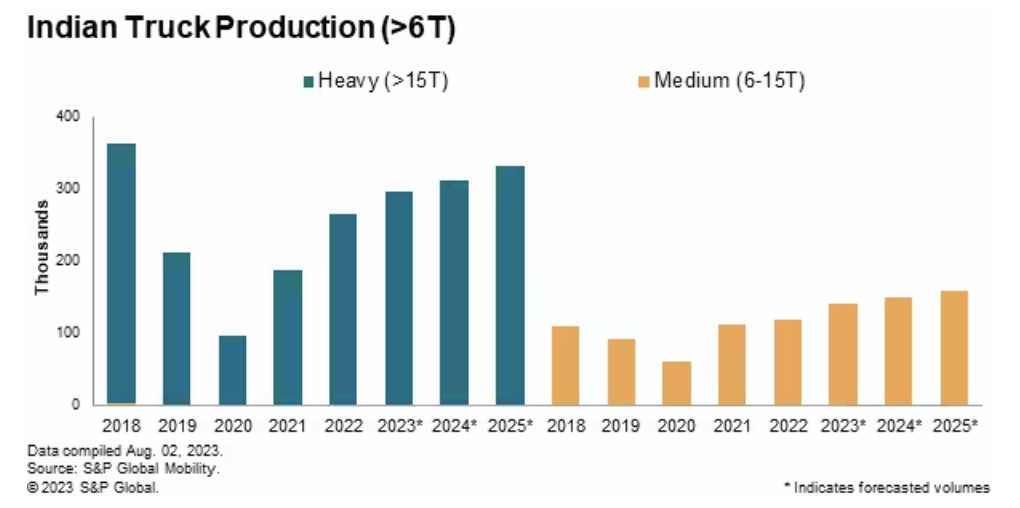

Will India’s MHCV Production Surpass Its 2018 Peak By 2025?

With the current push by the Indian government for major infrastructure and development projects, expansion of the e-commerce network, and strong replacement demand from the domestic market, India is expected to grow its truck and bus production to a new peak by 2025 — crossing its 2018 peak of 531,500 units. By 2025, MHCV production should reach its new annual peak of 566,900 units, according to S&P Global Mobility analysis. But lack of funds, and high raw material and commodity costs are the challenges OEMs must overcome.

—Read the article from S&P Global Mobility