Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 3 May, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

With Higher Prices, Upstream Comes Roaring Back

As investors contemplated the energy transition to low-carbon energy, underinvestment in oil and gas exploration and production became the new normal. While owning upstream assets such as oil and gas wells and rigs has always been a volatile business, no one wants to be stuck holding stranded assets when, and if, nuclear fusion comes online. But high energy prices associated with the war in Ukraine have renewed interest in upstream investment. As companies scramble to meet demand for new exploration and production, an extended period of underinvestment in the upstream is creating the specter of long-term shortages and higher prices. Even with the energy transition well underway, demand for oil and gas looks set to be healthy for decades to come.

Prior to the G-7 Ministers' Meeting on Climate, Energy and Environment in Japan over April 15–16, the International Energy Agency released a report calling for additional upstream investment in natural gas. While government initiatives in the US, Europe and Japan incentivize investment in clean energy and low-carbon fuels, the agency cautioned that additional upstream investment will be required, even assuming flat or declining natural gas demand. This demand is projected to climb in emerging markets over the next five years, but existing global capacity and recently approved natural gas projects will not have sufficient capacity to meet demand.

According to S&P Global Commodity Insights, the war in Ukraine has driven a sudden rush in upstream activity after an extended period of underinvestment. This activity is driving up upstream capital costs and operating costs. In 2022, the S&P Global Upstream Capital Costs Index — a measure of the capital costs for businesses that extract oil and natural gas — ended the year with an overall increase of almost 10%. Meanwhile, the S&P Global Upstream Operating Costs Index, which tracks and forecasts the cost of materials and services that must be procured for upstream operations, grew by just under 9.5% for the year.

"Production efficiency is dropping while operating expenditure is rising, project budgets and schedule milestones are being missed, and key suppliers are struggling to provide labor and materials on time," consultants at McKinsey & Co. wrote in a March research paper on oil and gas industry costs. "It's a vicious cycle: more work is carried out under emergency conditions, which is increasingly expensive."

The production cuts by OPEC and its allies are also likely to affect capital spending, rig count and output levels, according to S&P Global Commodity Insights. Upstream output is likely to increase for natural gas and oil, especially for private operators backed by private equity, who will want to take advantage of higher energy prices.

Higher demand and costs for upstream operations aren’t bad news for everyone. Halliburton, an oilfield services provider, has seen a substantial increase in revenues, and its projects are expected to experience strong demand through 2024.

"Everything I see today validates the strength and duration of this multiyear upcycle," Halliburton CEO Jeff Miller said during a first-quarter earnings conference call. "The commodity price volatility in the first quarter does not change our view of customer demand and a tight services market.”

Today is Wednesday, May 3, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

South Korea Resumes Positive GDP Growth In Early 2023

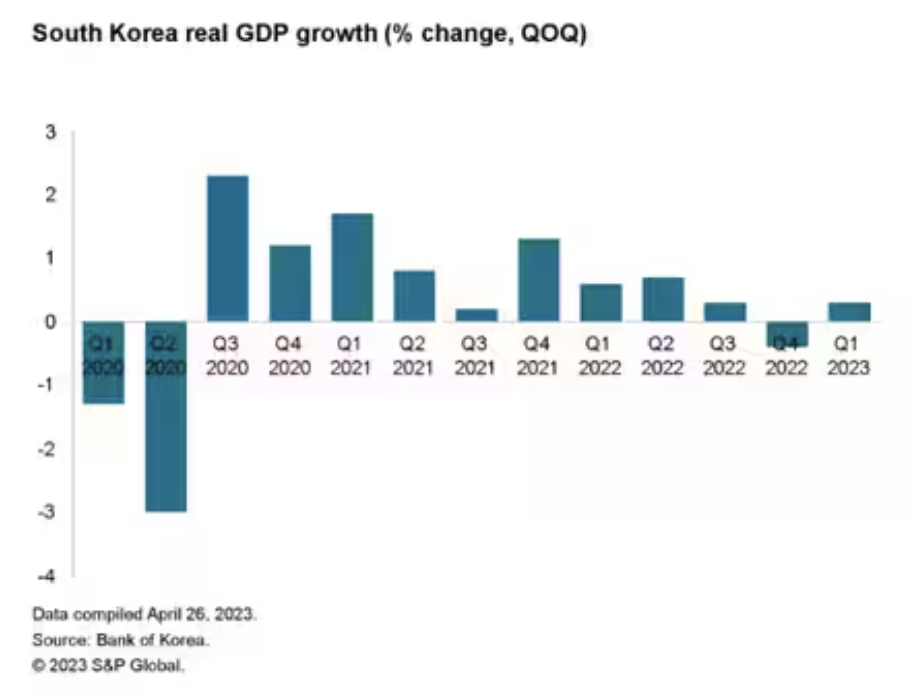

The South Korean economy returned to positive economic growth in the first quarter of 2023, albeit at a modest pace of 0.3% quarter-on-quarter. This followed a contraction in GDP of 0.4% quarter-on-quarter (q/q) in the fourth quarter of 2022. South Korea is expected to face continuing economic headwinds during 2023, due to the impact of weak exports and the cumulative transmission effects of monetary policy tightening by the Bank of Korea during 2022.

— Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Credit Trends: Global Credit Markets Update Q2 2023: Riding Out Higher Rates

Volatility may remain a strong undercurrent for financing conditions. Rating actions were less negative in the first quarter, although downgrades still outpaced upgrades. The health care and retail sectors had the largest net downgrades (downgrades minus upgrades), driven by the North American region. The downgrade ratio fell across regions in the first quarter compared with the previous quarter.

—Read the article from S&P Global Ratings

Access more insights on capital markets >

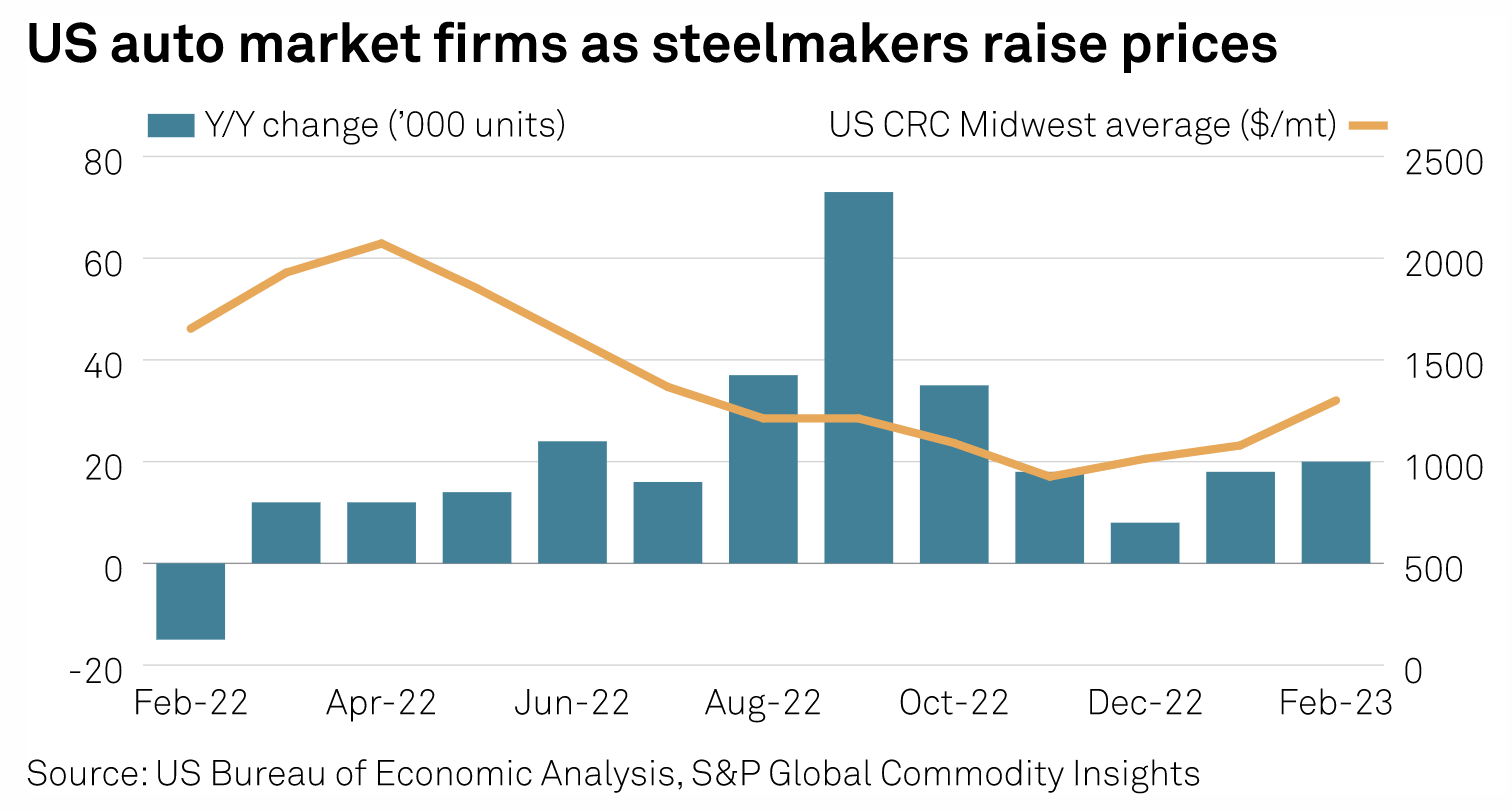

Around The Tracks: Automakers Race To Secure EV Battery Supplies

US automakers have intensified their cooperation with producers of both batteries and battery raw materials. South Korean battery makers have widened their plans to establish plants in the US. South Korea's LG Energy Solution signed joint agreements with General Motors under their Ultium Cells joint venture and with Japan's Honda Motor for a battery plant — both in Ohio. It also signed an agreement with Ford Motor Company for a battery plant in Ankara, Turkey.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

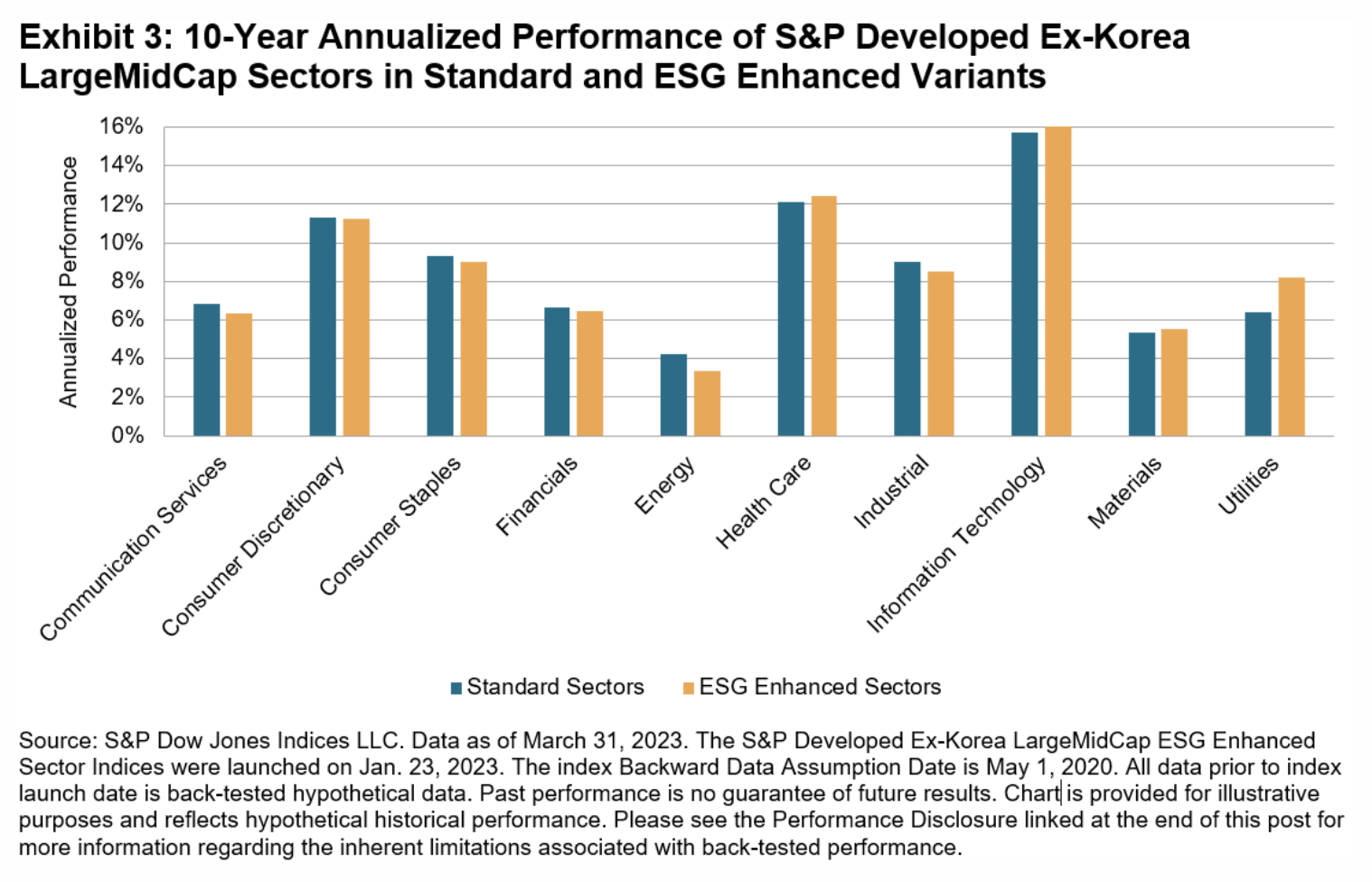

The Best Of Both Worlds: Sustainability In Sectors

Sector-based approaches have historically shown they can be valuable for diversification, among other investor goals, but, until now, sustainability-inclined investors have been presented with limited options. With the recent creation of the S&P ESG Enhanced Sector Indices and the subsequent licensing of the Information Technology, Energy, Financials and Health Care indices for a select range of ETFs in Europe, the potential for sector-based approaches to sustainable investing has increased significantly.

—Read the article from S&P Dow Jones Indices

Access more insights on sustainability >

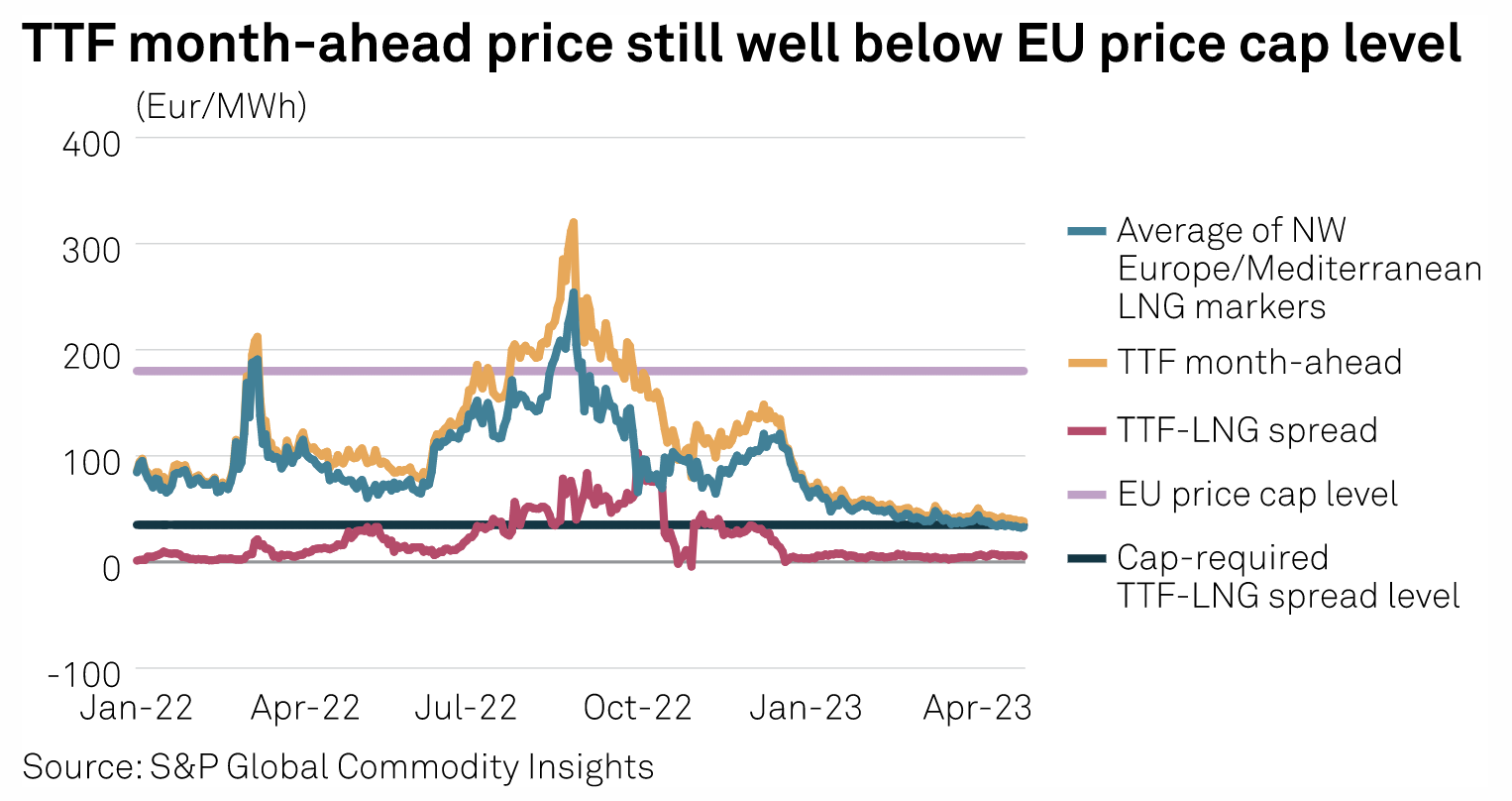

EU Gas Market Correction Mechanism Extension To Other Hubs Comes Into Force

The EU's gas market correction mechanism now applies to trading hubs other than the Dutch TTF after an implementing act adopted at the end of March came into effect on May 1. The implementing act adopted March 31 set out the technical details regarding the application of the mechanism to derivatives linked to other virtual trading points in the EU. Having the mechanism apply to more VTPs than just the TTF provided "an even broader shield from high and volatile gas prices," the European Commission said in March.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

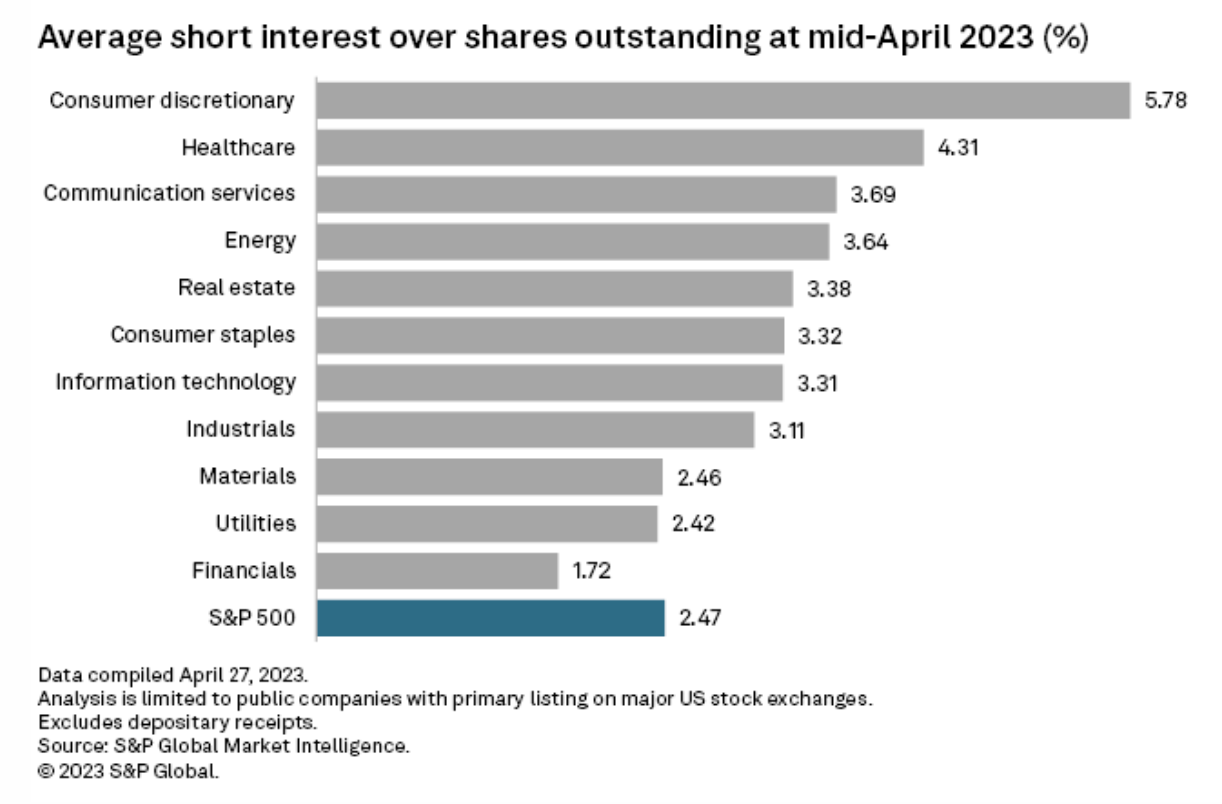

Short Sellers Increase Bets Against Tech Stocks In Mid-April

Short sellers are boosting their positions against tech stocks, likely betting that a recent rally in the sector will be short-lived. Short interest in information technology stocks was at 3.31% as of mid-April, the highest level since the end of October 2022, according to the latest S&P Global Market Intelligence data. Since the beginning of the year through April 28, the S&P 500's IT sector has climbed about 23.23% compared with the overall index, which has gained about 9.03%. The S&P 500 IT sector lost 29.63% in 2022.

—Read the article from S&P Global Market Intelligence