Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 7 Jun, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

A Hurricane Of Climate Concerns Heat Up From California To Texas

As climate change poses economic and financial risks to countries and companies, the dangers of worsening global warming are growing in consequence and cost for communities from California to Florida.

To protect the global economy from climate change’s effects, the international community will need to limit global warming to no more than 2 degrees Celsius relative to preindustrial levels by 2050. If the world doesn’t move to meaningfully reduce emissions by 2025, the risk of overshooting global warming of 2 degrees Celsius compounds, according to an S&P Global Sustainable1 analysis.

The physical effects of climate change are threatening businesses, governments, and communities—as extreme weather and other ramifications impact populations and assets. This summer is expected to see atypically hot weather affect the U.S. from June through August, while a high number of hurricanes are expected to hit the Eastern U.S. this year.

As a heatwave is imminently set to eclipse states from California to Texas with temperatures into the triple digits from June 11-15, natural gas and power prices across the Southwest are expected to spike. While market participants have taken some action to make energy grids more resilient to climate risk after last year’s extreme temperatures spawned severe system failures, whether places like California and Texas will be able to provide their populations with power during this summer is yet to be seen. Eastern U.S. power market operators may be better positioned from a reliability perspective, according to S&P Global Commodity Insights.

The National Oceanic and Atmospheric Administration predicts that this year will bring an above-average Atlantic hurricane season, marking the seventh consecutive above-average season with a likely range of 14 to 21 named storms, of which six to 10 could become hurricanes. Last year’s hurricane season was the third most-active on record, with 21 named storms and seven of which became hurricanes—preceded by 30 named storms in 2020. Because of Florida’s potential to be a hurricane hotspot and due to the fragmentation of its property insurance market, this above-average hurricane season may put more pressure on companies in the state, according to S&P Global Market Intelligence.

Rising insurance premiums from environmental physical risks have the potential to affect U.S. local government credit ratings, particularly in places that face increasingly frequent physical risks, according to S&P Global Ratings.

“Rising insurance costs for homeowners are unlikely to negatively affect our credit rating analysis for local governments in the short run as the visibility of the risk is not sufficiently material. However, over time, cost increases could lead to shifts in the social and economic composition of communities. S&P Global Ratings views coastal and wildfire-prone areas in Florida and California as particularly vulnerable to these transitions where already high housing costs, when compared to the U.S., could increase further as the exposure to physical risks potentially intensify, absent adaptation,” S&P Global Ratings said in a recent report. “Although robust economic growth and demographic trends have bolstered credit ratings in Florida and California, should fixed housing costs increase from a combination of higher insurance premiums and property tax increases required to support infrastructure investments, local governments may face revenue challenges.”

Physical climate risks could lower economic output by 3.3% by 2050 under the Paris Agreement’s climate pathway of warming well below 2 degrees Celsius, 4% under current policies, and 4.5% if no adaptation is undertaken and all risks materialize, according to S&P Global Ratings research. But the United Nations’ latest Intergovernmental Panel on Climate Change report sees the global economy’s current trajectory as likely to see global temperatures rise by 3.2 degrees Celsius this century—which would bring forth elevated risks of flooding and heat stress.

Today is Tuesday, June 7, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

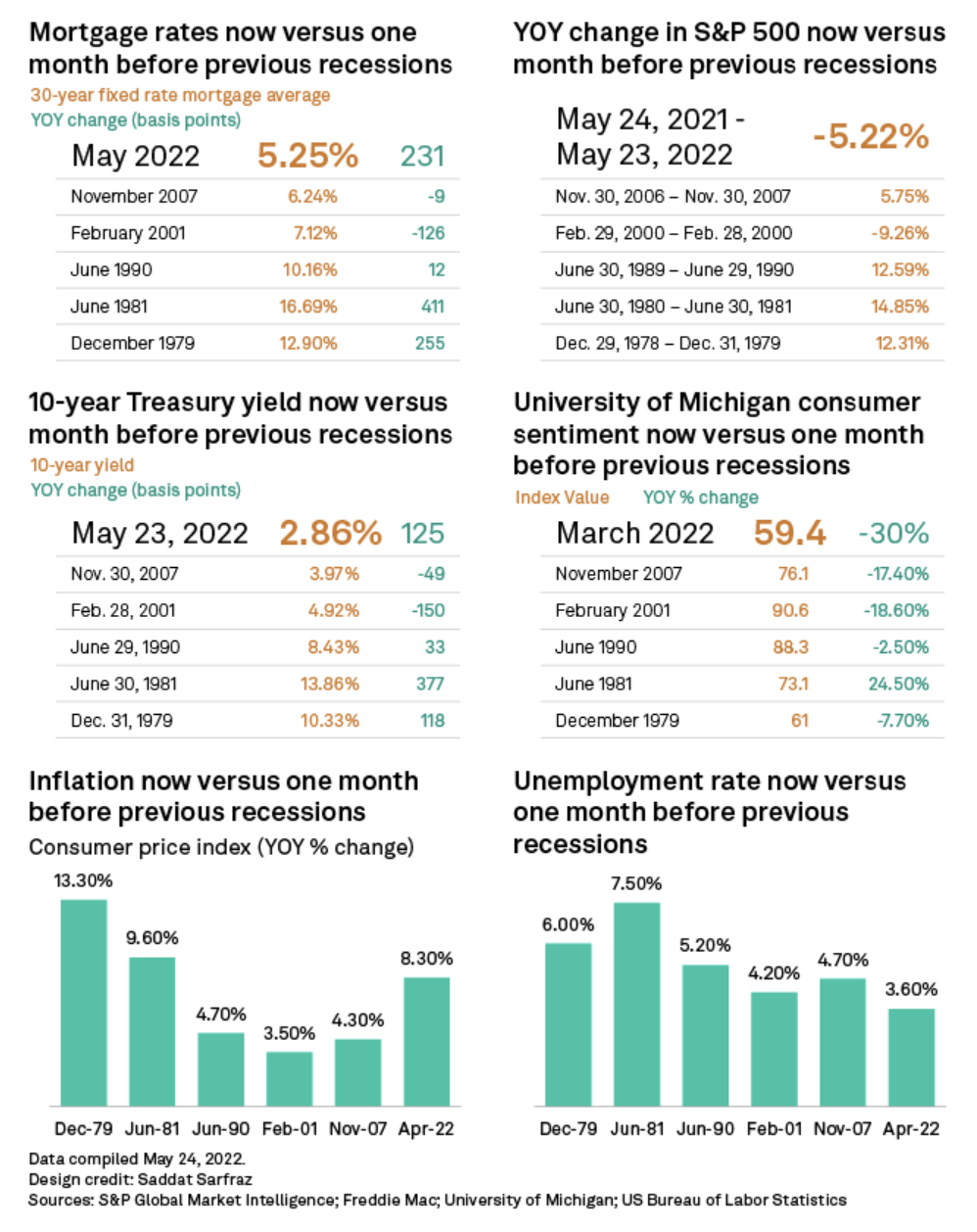

U.S. Fed Aims For Soft Landing As Economists See Recession Odds Growing

The Federal Reserve is trying to cool the economy without freezing it, a task economists believe is increasingly difficult as the likelihood of another recession grows. Fed Chairman Jerome Powell is aiming for a "soft landing" where demand is reduced by tightening monetary policy just enough to cause a decline in inflation without sparking an outright recession.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Listen: Leveraged Finance & CLOs Uncovered Podcast: Peer Holding III B.V. (Action) Upgraded ...

In the latest episode of CLOs Uncovered, Hina and Sandeep are joined by Lukas Brockmann, an analyst on action. Listen how a value discounter in Benelux, with improving geographical diversification, supports earnings resilience.

—Listen and subscribe to CLOs Uncovered, a podcast from S&P Global Ratings

Access more insights on capital markets >

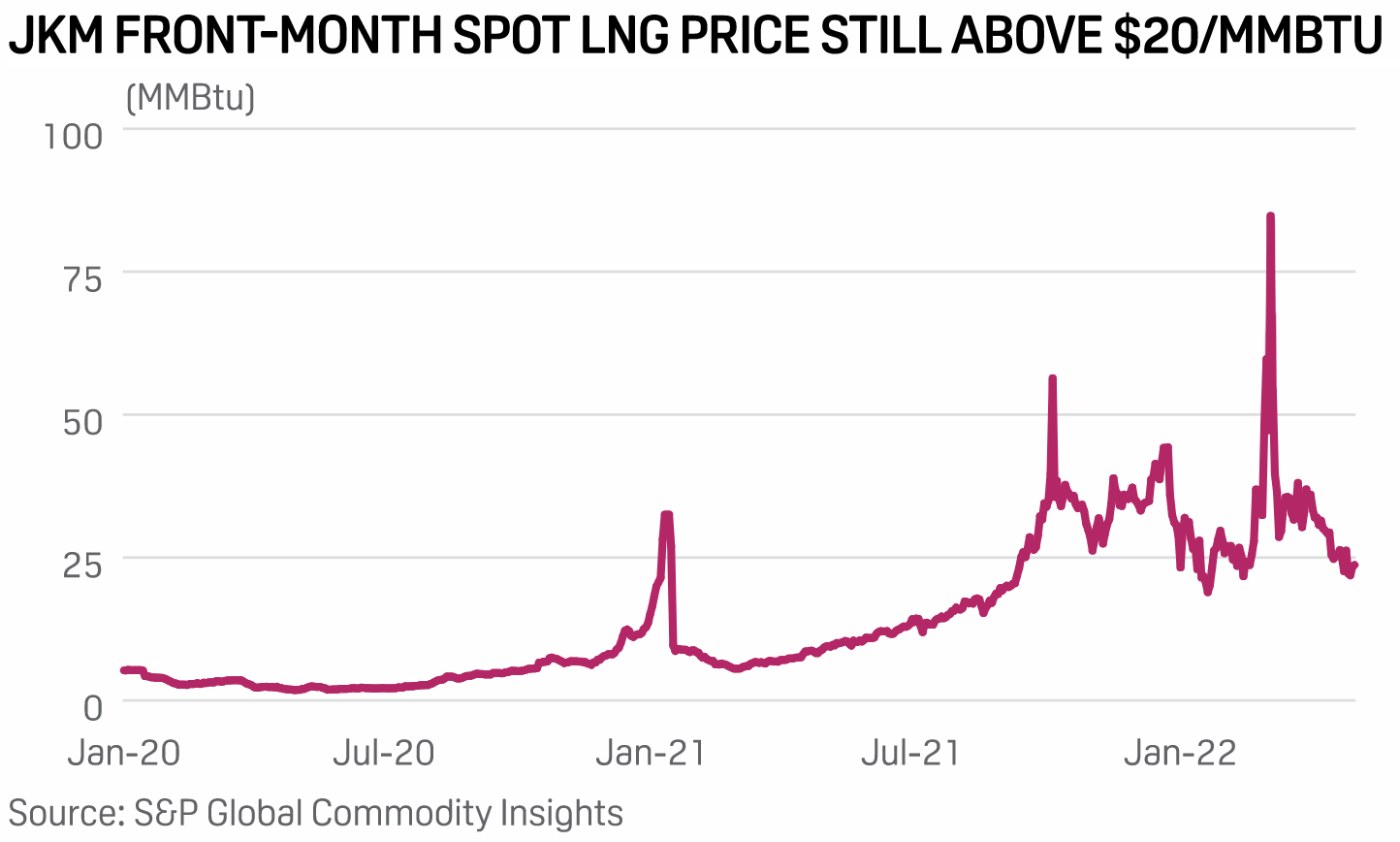

Egypt, Israel, EU Eye Political Framework Ahead Of Commercial Gas Supply Deals

Egypt, Israel, and the EU were working toward a trilateral agreement to allow for the export of Israeli gas to Europe, a spokesperson for Israel's energy ministry said June 6. The EU has intensified efforts to find alternative gas suppliers since Russia's invasion of Ukraine in February, with Israeli gas seen as a potential new source for Europe. However, there is no infrastructure in place to allow for direct Israeli gas supply to Europe, meaning deliveries would have to be facilitated via Egypt's two LNG plants.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

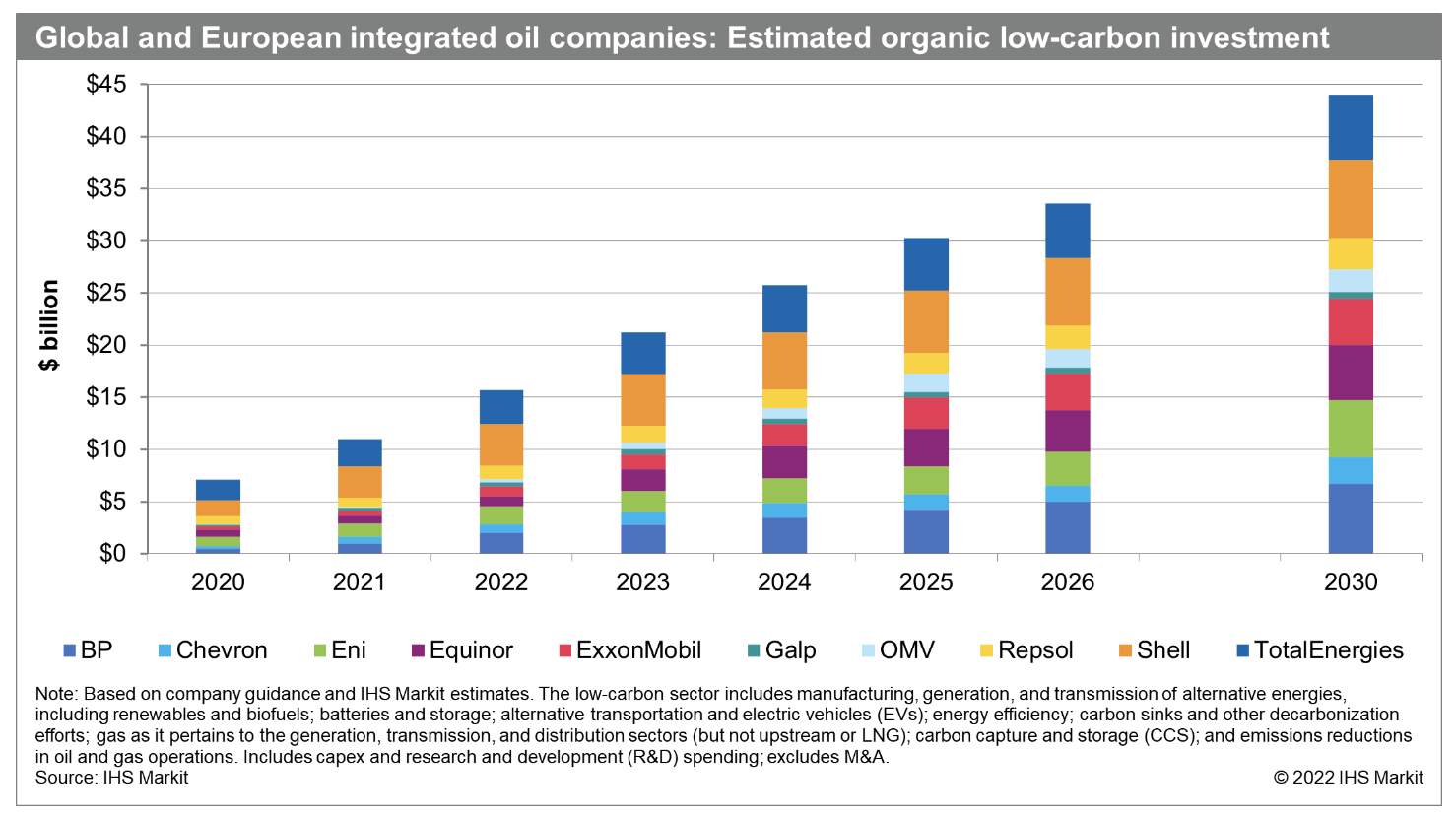

Staying The Course: Low-Carbon Spending Plans Remain Intact (For Now) Among The Global And European Integrated Oil Companies

Amid the current market environment, a key question has emerged around how existing conditions could alter low-carbon spending plans of upstream oil and gas companies. On the one hand, the surge in commodity prices could entice these companies to reallocate capital away from the low-carbon segment toward oil and gas; meanwhile, rising energy security concerns could lead to greater support from policymakers, capital markets, and the general public for increased investment in traditional energies.

—Read the article from S&P Global Commodity Insights

Listen: Will The Lights Stay Big And Bright, Deep In The Heart Of Texas?

The Texas Railroad Commission—which regulates the state's oil and gas industry, not railroads—just went through perhaps its highest profile election. Chairman Wayne Christian faced oil and gas lawyer Sarah Stogner who posed tough questions about his enforcement record and the commission's response to the 2021 Texas blackout. Christian won with 65% of the vote, but the campaign raised the profile of the arguments against him. Now he's facing Democrat Luke Warford in the November general election. Senior editor Meghan Gordon spoke with Warford when he was in Washington, D.C., recently.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

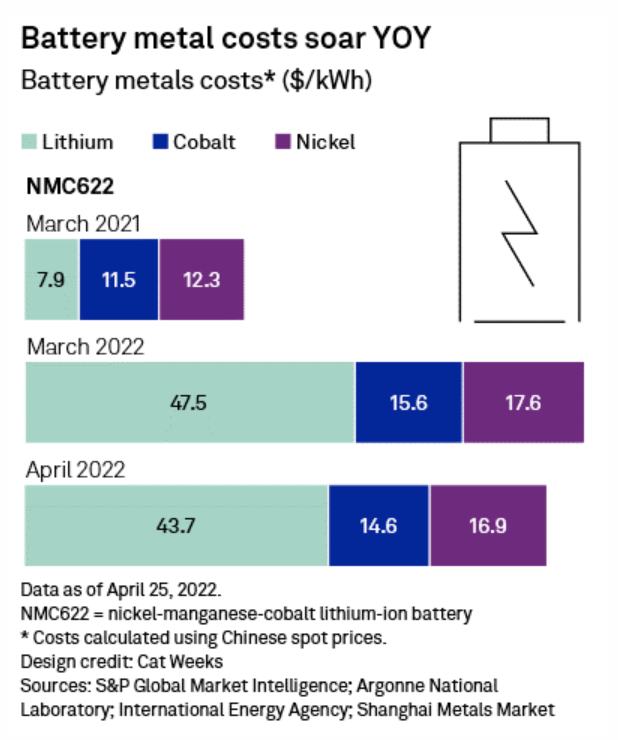

High Battery Metal Costs Add To Electric Vehicle Sale Slowdown

Rising battery metal costs have contributed to a slump in electric vehicle sales, slowing the transition to a low-carbon economy. The average cost of making lithium-ion batteries used for EVs is increasing for the first time in roughly a decade, largely due to the inflated cost of key metals including lithium, cobalt, and nickel. The trend has been toward lower costs for years as manufacturers scaled up production. But recent inflationary pressures on these raw materials have forced EV producers to increase the prices of their cars, together with pandemic-related lockdowns in China and supply chain challenges in the opening weeks of the second quarter.

—Read the article from S&P Global Market Intelligence