Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 16 Jun, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Interest Rate Hikes Indicate Urgency Of Global Economic Conditions

Central banks’ monetary policy actions are intensifying concerns about the trajectory of the global economy.

In the U.S., inflation has continued at 40-year highs as the Federal Reserve aims to cool the economy down without freezing it, posing problems for policymakers and the outlook for the world’s biggest economy. The Fed raised the benchmark federal funds interest rate by 75 basis points (bps) on June 15, tightening monetary policy more aggressively than consensus expectations of a 50-bps hike. Fed Chairman Jay Powell indicated during the post-announcement press conference that another three-quarter percentage point increase could come as soon as July. Market participants are bracing for the U.S. economy’s potential hard landing as the likelihood of another recession swells.

The Fed has "shifted the baseline" for rate hike expectations and will likely approve 50-bps raises at its next three meetings pending any major inflationary movements, Ryan Swift, a U.S. bond strategist at BCA Research, told S&P Global Market Intelligence in an interview. "Eventually they will downshift to 25 [bps], but I think there is a pretty high bar for that.”

Despite the headwinds afflicting markets, U.S. corporate credit markets appear to show some signs of stabilization, and major lenders including Bank of America and Discover Financial Services see strength in consumer spending and credit, according to S&P Global Market Intelligence. Analysts at the investment bank D.A. Davidson see banks benefiting from the Fed’s recent 75-bps hike in the near-term.

“Rising interest rates are making it more expensive for companies and consumers to borrow money, signaling that the period of ‘cheap money’ that followed the Great Recession of 2008-2009 is finally coming to an end,” Nathan Stovall, a principal analyst at S&P Global Market Intelligence, said introducing a recent episode of the Street Talk podcast. “The biggest companies and wealthiest consumers are expected to weather the more expensive environment without significant distress. Many of the largest companies are flush with capital raised when interest rates were low and have pushed out the timeline for when their debts come due. Recessions hit households with lower incomes harder than they do more affluent households.”

In Europe, the outcome of the European Central Banks’ extraordinary meeting yesterday saw policymakers commit to keep spreads between the bloc member states’ bond yields from widening excessively. Meanwhile, the Bank of England increased its bank rate by 25 bps and the Swiss National Bank also tightened monetary policy and increased its key rate by half a percentage point, to negative 0.25%.

Inflationary pressures that are affecting economies across the globe are more pronounced in emerging market economies. S&P Global Ratings expects emerging markets’ economic growth to moderate later in the year due to pressure on real incomes and the fading effect of post-pandemic recovery.

“Major central banks are tightening monetary policy faster than initially expected, which is likely to make global liquidity scarcer and more expensive,” S&P Global Ratings said in a report this week. “Some emerging markets banking systems are exposed to this phenomena either directly through their own substantial net external debt or indirectly through exposure to corporates or sovereigns.”

Of the five emerging market banking systems S&P Global Ratings analyzed, Turkey's and Tunisia's appear the most at risk. Indian banks are likely to see their profits improve further in the current fiscal year as they benefit from rising interest rates, according to S&P Global Market Intelligence.

Today is Thursday, June 16, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

Listen: Street Talk | Episode 96: Considering Recession Risks, Prospects That The Fed Achieves A 'Soft Landing'

The Fed has committed to taming elevated inflation by tightening monetary at a rapid pace, stoking fears that the central bank will not be able to achieve a "soft landing" for the U.S. economy. In the episode, S&P Global Market Intelligence's news team highlights interviews with investors, analysts, and economists who say that a recession is a real possibility in 2023 and that small businesses and households with lower incomes, in particular, could feel some pain if that occurred. But the members of the investment community also suggested that large corporates, consumers, and banks have strong enough balance sheets to weather a storm—possibly even a "hurricane"—should it emerge.

—Listen and subscribe to Street Talk, a podcast from S&P Global Market Intelligence

Access more insights on the global economy >

Some Renewables Stock Prices Set Up For Growth Despite Inflated Capital Costs

Renewable energy developers could still see significant stock price upside despite inflation triggering higher capital costs that could drag estimated future cash flows, Morgan Stanley analysts said. Since November 2021 when inflation concerns intensified, the iShares Global Clean Energy ETF has plunged more than 24% compared to the S&P 500's 15.5% loss as the threat of an economic recession has exacerbated existing commodities bottlenecks and trade policy uncertainty.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

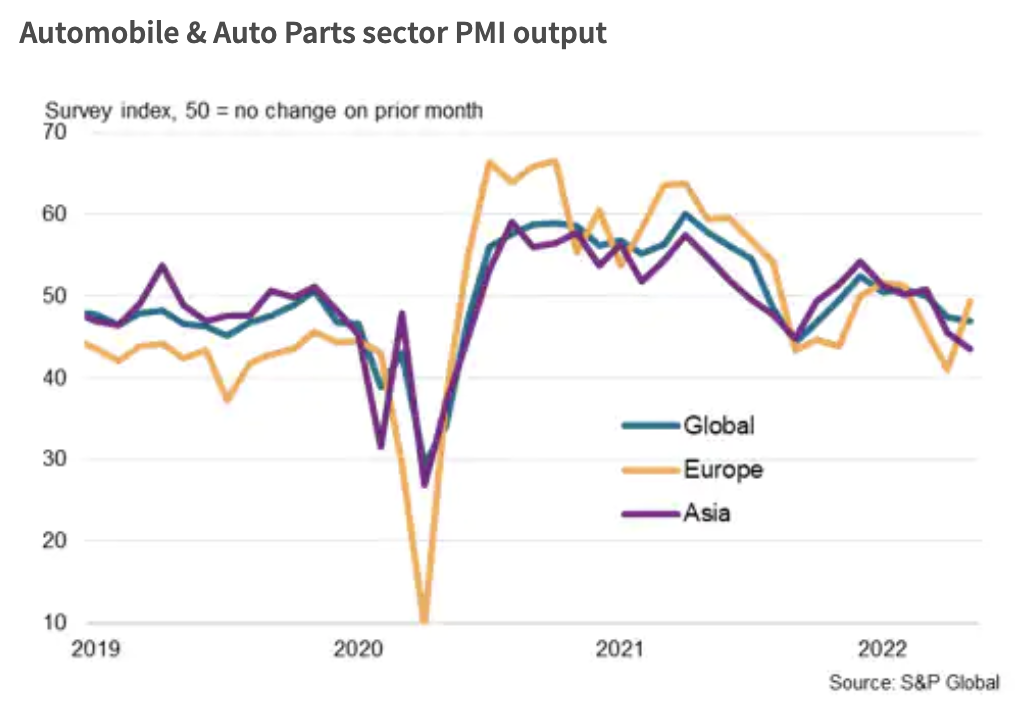

Global Automotive Output Contracts Faster In May Amid Uneven Regional Trends And Despite Further Signs Of Semiconductor Shortages Easing

The S&P Global Sector PMI™ revealed that automobiles and auto parts sector output contracted worldwide for a second successive month amid the sharpest reduction in new orders since the COVID-19 pandemic and renewed supply disruptions linked to the pandemic and Russia-Ukraine war. There were mixed trends by regions, Europe and Asia were the hardest hit, with the latter seeing output falling at a sharper rate in May.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

EU Banking Regulator Puts Spotlight On Climate Disclosures

Regulation is playing a growing role in shaping the direction of the environmental, social, and governance movement. Investors have been demanding more consistent disclosure and reporting on climate risks, in particular, and more regulators are paying closer attention to how climate change is affecting corporations and financial institutions. The European Banking Authority is one such regulator. The EBA recently announced it will make climate disclosures mandatory from December 2023, something it says will push banks to amass the information they need to manage climate risks.

—Read the article from S&P Global Sustainable1

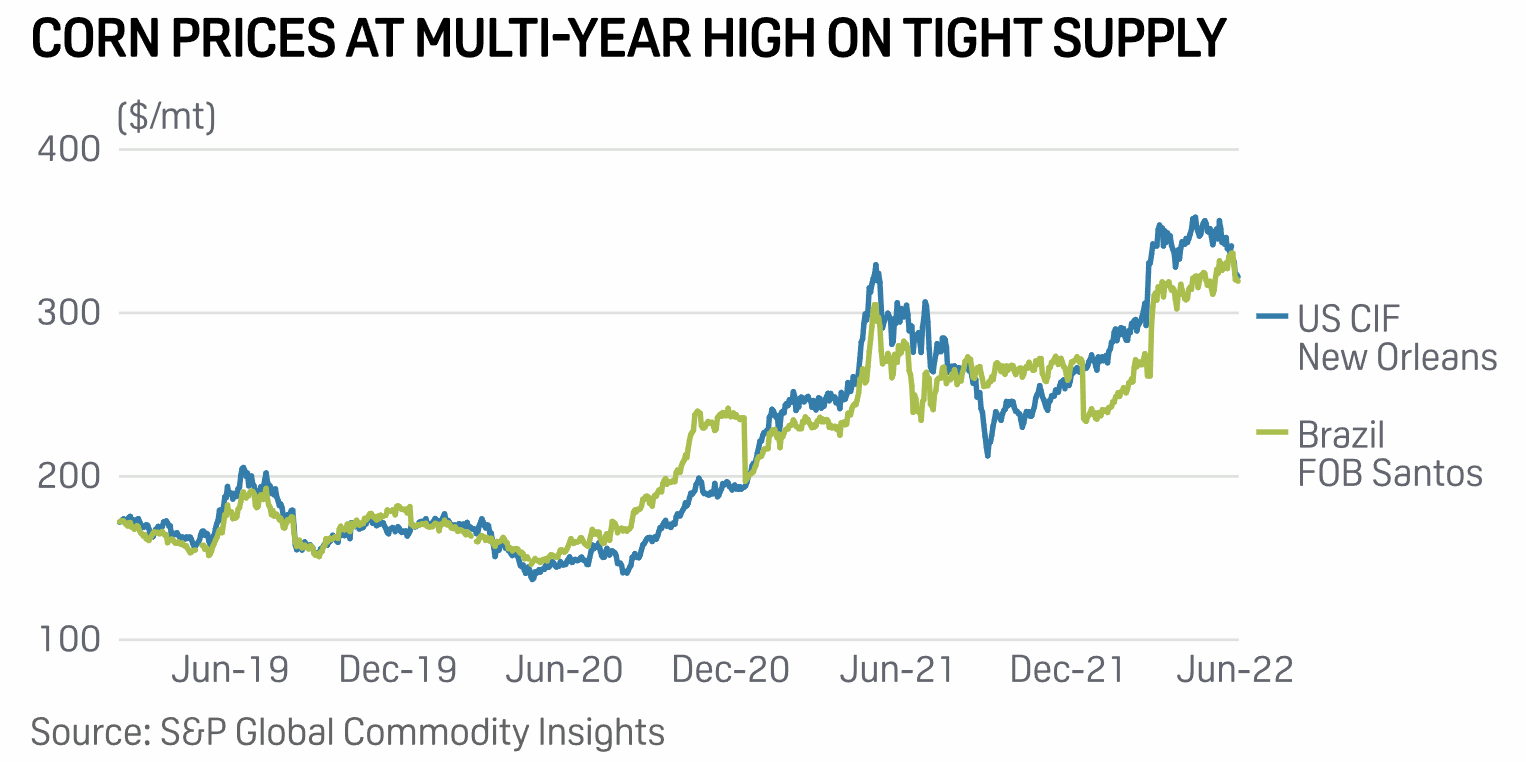

Consumers Heavy-Lifting Grains, Oilseeds Costs As Logistics Drive Up Prices

As the world grapples with high grains and oilseeds prices due to tight supplies, high input costs, and geopolitical conflicts, more expensive logistics in agricultural powerhouses U.S. and Brazil are also adding to overall cost of the commodities. And these expenses are further burdening consumers. The U.S. is one of the major suppliers of corn, wheat, and soybean, while Brazil is one of the largest exporters of soybean and corn.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Another Digital Divide: Americans Without Access To Devices

Affordable internet service is a major policy goal of the Biden administration, but cheap internet does not help families lacking a laptop or other connected device. The term "digital divide" has often been used to describe a lack of access to broadband, but as the White House and other agencies work to address internet access costs, many say enabling access to computers required for accessing the internet has not gotten enough attention.

—Read the article from S&P Global Market Intelligence