Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 8 Dec, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Global Plastic Glut

At first glance, there is an austere beauty to a windswept, rocky beach in winter. But a closer inspection will reveal a litter of brightly colored detritus in the Pantone shades of international commerce. This litter is composed of single-use plastics, usually of the high-density polyethylene (HDPE) variety. While recycling HDPE is possible, virgin resin is much cheaper than recycled resin, and most manufacturers prefer to buy at lower prices. In addition, new large-scale HDPE manufacturing facilities have introduced a glut of plastics to the market, creating an oversupply that has driven down prices. A recent “Commodities Focus” podcast from S&P Global Commodity Insights, “Buyers’ choice: Global oversupply of single-use plastics makes recycling uneconomical,” examined the conditions that led to this oversupply and the continued popularity of single-use plastics.

Plastics manufacturing capacity has ballooned in the past few months. In North America, 1.5 million metric tons per year of ethane-advantaged capacity will be added to the market between September 2023 and the first quarter of 2024. Chemicals manufacturer Dow also announced the development of a $6.5 billion net-zero ethylene, polyethylene project in Canada. Even before this capacity was added, the US and Asia were attempting to climb out of a price slump driven by oversupply and weaker-than-anticipated consumer demand.

“There are several new capacity units that are coming on stream,” said Colleen Ferguson, US associate editor for polymers at S&P Global Commodity Insights. “This includes two high-density polyethylene units in Monaca, Pa., at the Shell Polymers Complex. Those are each 550,000 metric tons a year. One is currently running and one is starting up in early 2024. … Other than that, there’s a high-density polyethylene unit starting in Bayport, Texas, that’s another 625,000 metric tons per year. So that’s more than a million metric tons per year of new capacity coming online, and demand has not reached a point where it is keeping pace with these new capacity additions.”

This global oversupply creates challenging conditions for recycled plastics, which struggle to compete with virgin resin on price.

“[Recycled HDPE] isn’t doing so great” said Antoinette Smith, senior editor of Americas chemicals and recycled polymers at S&P Global Commodity Insights. “The virgin prices are so low that it’s really discouraging to the market players that have the choice, which is quite a big segment of the market because there’s a lack of mandates in the US. Unless they are really sustainability-minded, the buyers are opting for the virgin resin because it’s about half the price of recycled resin.”

During the COVID-19 pandemic, demand for single-use plastics was elevated. However, in the summer of 2022, as restrictions eased, high interest rates and high inflation really started to weigh on the market for polymers. Prices have trended down since, only to be relieved when force majeure events created a temporary shortage. However, the new North American capacity makes shortages an unlikely prospect in the short and medium term. Instead, HDPE players will be selling into an oversupplied market, and recyclers will see their market further constrained by the price differential.

Today is Friday, December 8, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

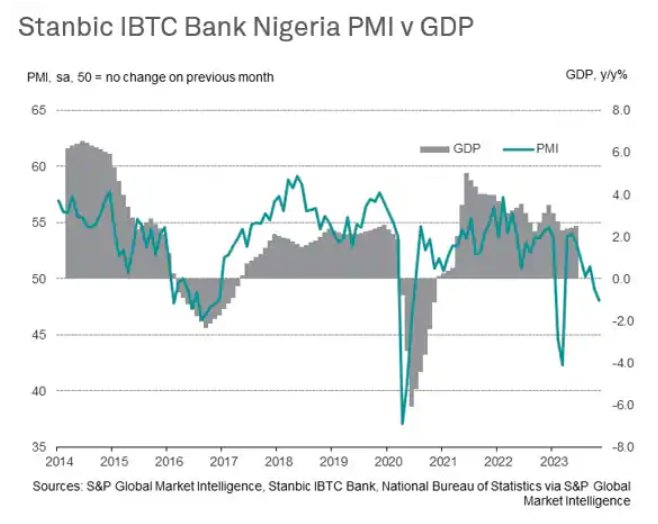

Twin drivers of inflation hit demand in Nigeria

November data pointed to a second successive monthly fall in new business in the private sector, the renewed downturn in the fourth quarter halting a period of recovery following the cash crisis at the start of the year. With demand waning, companies in Nigeria reduced their business activity again in November; the third time in the past four months in which this has been the case. The PMI data are therefore consistent with GDP growth slowing over the second half of the year, following a 2.5% year-on-year increase in the second quarter of 2023.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Quarterly Review Of Credit Risk In China’s Credit Bond Market — Q3, 2023

Throughout the third quarter of 2023, China’s credit bond market displayed varying risk characteristics and spread levels across diverse sectors and regions. Among all types of bonds, the largest issuances were in corporate and government bonds, totaling RMB3.44 trillion and RMB5.47 trillion, respectively. Furthermore, during the third quarter the coupon rates for newly issued corporate bonds were marginally higher than those for asset-backed securities, with an average coupon rate of 3.70% versus 3.51%.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

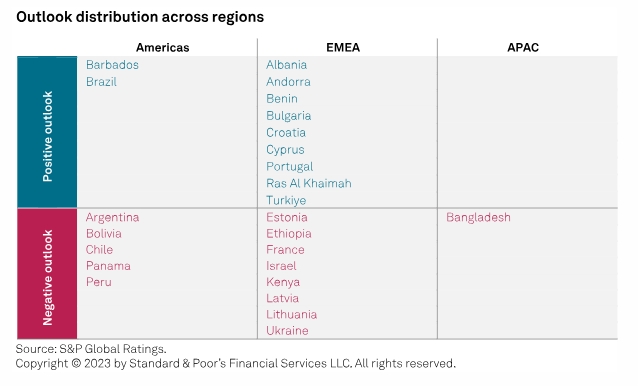

Sovereigns: What Are The Credit Implications Of Intensifying Conflicts And Political Disruption?

Geopolitical uncertainties will affect global growth and inflation, consumer and investor confidence, trade and supply chains, and overall capital flows. These uncertainties come against a backdrop of the continuing Russia-Ukraine and Israel-Hamas wars, disputes over the South China Sea and upcoming national elections in more than 50 countries in 2024. Government and corporate borrowers alike could continue to face elevated funding costs while interest rates remain higher for longer.

—Read the article from S&P Global Ratings

Access more insights on global trade >

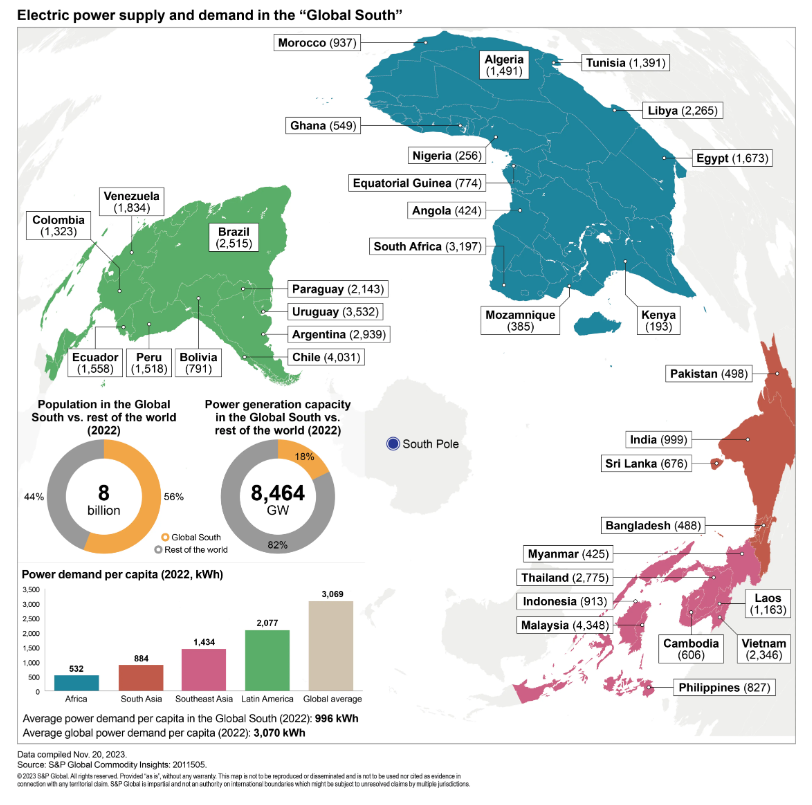

Clean Energy Investments In The “Global South”: Challenges And Opportunities In The Electric Power Sector

Population growth, urbanization and economic development will lead to very rapid electricity demand growth in the Global South — 300 TWh of additional consumption every year for the coming 25 years, according to S&P Global reference outlooks. How to decarbonize the power mix under these circumstances, in markets where public funds and foreign capital can be scarce, and where fossil fuels still produce 60% of electricity, creates a unique set of challenges and opportunities for private sector investments in clean energies.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Listen: Asian Aluminum, Alumina Markets Mixed On Demand Expectations, Cost Pressures

Asian aluminum markets continue to see lackluster demand and ample stocks pressuring premiums, though the sporadic reopening of the Chinese import arbitrage window is providing support across the region. Further upstream in the alumina markets, flat demand remains a drag on prices globally, but cost pressures and output curtailments are keeping significant declines at bay.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

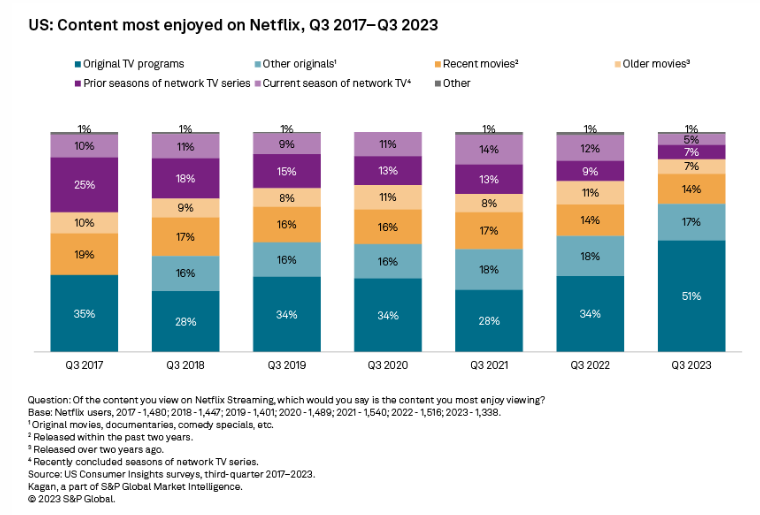

Content Most Enjoyed On Netflix, (US) 2023

The content that Netflix Inc. users reported most enjoying on the service has changed dramatically over the past year, as the share of subscribers selecting original TV programs increased to 51% from 34%. All the other content types declined in share compared to the previous year, and current season network TV and older movies declined the most.

—Read the article from S&P Global Market Intelligence