Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 4 Dec, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Private Credit a Mixed Blessing for Indebted Companies

When inflation increases, central banks raise borrowing rates. The purpose of higher rates is to “cool off” the economy so that there is less money in the market to drive up prices. Higher rates reduce inflation by making it more expensive for companies and individuals to borrow money. For companies, that may mean they forgo new initiatives, such as building a new factory, since borrowing costs can exceed potential profit. But some companies aren’t using cheap debt to finance improvements. Instead, they are using cheap debt to stay afloat. When interest rates increase, more defaults occur, leading to bankruptcies and layoffs. Bankrupt companies and laid-off workers don’t spend much, which cools off the economy.

Given a choice, many companies would prefer to issue debt in public markets. The advantage of public markets is that there is a huge pool of money that large investors are willing to commit to broadly syndicated loans. These markets are quite liquid, meaning that individual investors can buy or sell their shares of these loans easily. This liquidity comes at a price: slightly lower interest rates and fewer conditions, known as covenants, placed on the loans. Companies like paying lower interest rates and generally prefer to avoid covenants, which can limit their scope of action.

However, businesses are increasingly seeing the advantage of issuing debt in private markets. In private markets, a single lender or a small group of lenders lend money to a company. This can create an alignment of interests between the company and its lenders since neither side wants the company to go out of business. This means that, although private market interest rates and covenants are typically more onerous, private lenders are willing to be more flexible and creative on repayment terms. For companies that have defaulted or are at risk of default in public credit markets, the private market can offer a reprieve.

According to a recent analysis by researchers at S&P Global Ratings and S&P Global Market Intelligence, companies that have defaulted and turned to private markets are not always better for the experience. Looking at 1,200 defaults since 2008, the researchers found that selective and repeat defaults increased for companies that accepted private credit funding. When a company undergoes a selective default, it fails to pay back some of the debt it has issued while committing to pay back some other classes of debt. A private lender is likely to insist that its debt is paid back before public market debt — this is an example of a covenant — so a company that had accepted private funding might selectively default on some of its publicly issued debt.

The researchers also found that companies that had defaulted and then accepted private debt funding also tended to redefault more frequently. The average time between defaults decreased for these companies. Again, this makes sense when considering that heavily indebted companies might be forced to borrow money in private markets even with the knowledge that the rates they would pay and the covenants they would accept might make them more likely to default in the future. Desperate companies sometimes take desperate measures. Some private credit investors don’t mind lending to desperate companies because their covenants usually stipulate that they get paid back first, with interest, and it doesn’t really matter to them if a company fails to pay back other creditors.

However, there are circumstances in which accepting private credit makes companies less likely to default and reduces the frequency of the defaults. When a company that has previously defaulted accepts private credit and uses that money to restructure, it outperforms companies that have previously defaulted but not accepted private credit. This type of debt financing is usually provided by private equity companies as part of a leveraged buyout. The private equity firm arranges debt financing to put the company on a more solid footing and forces management to make changes to business operations that can allow the company to weather challenging conditions more effectively. So, private debt can provide a net benefit if a company uses the extra breathing room to change its ways.

Today is Monday, December 4, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Non-US Social Housing Sector Outlook 2024: At A Turning Point?

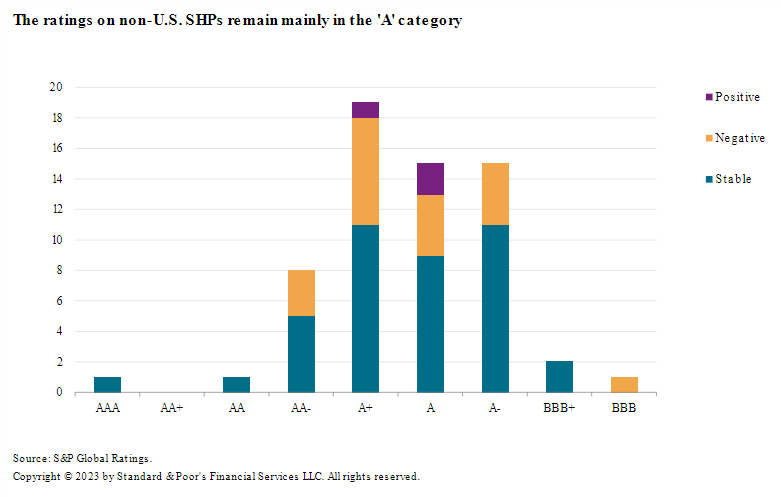

While S&P Global Ratings considers that the negative bias across non-US social housing providers (SHPs) will remain in 2024, it thinks the sector might have reached a turning point as mitigating factors should support more stable to gradually strengthening financial indicators. It forecasts investments in existing homes will rise at a slower pace, compared with the past two years. Expected growth in rental revenues and abating pressure on the cost base underpin our expectation that financial performance will recover modestly.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

This Month In Credit: Rising Stars Reach A New High

Divergence within speculative grade is growing as the negative bias for 'B-' and lower is nearly double that of speculative grade. Tightening discretionary spending continues to weigh on consumer-facing sectors, including consumer products and media and entertainment. More than half of the 155 new potential downgrades (issuers with negative outlooks or ratings on CreditWatch negative) that were added in July-October cited high leverage as a factor. Rising stars reached a new monthly high for the year in October (with six), including Greece, Ford Motor Co. and British Airways PLC.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

Listen: The Wait Is (Still) On At The Panama Canal

Commodity Insights' Americas dirty products manager Patrick Burns sits down with Americas tankers reporter Catherine Rogers to discuss how shipping markets have been impacted by the continued conservation measures taken by the ACP, what upcoming restrictions mean for shipowners and how shippers plan to navigate the logistical bottleneck heading into 2024.

—Listen and subscribe to Platts Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on global trade >

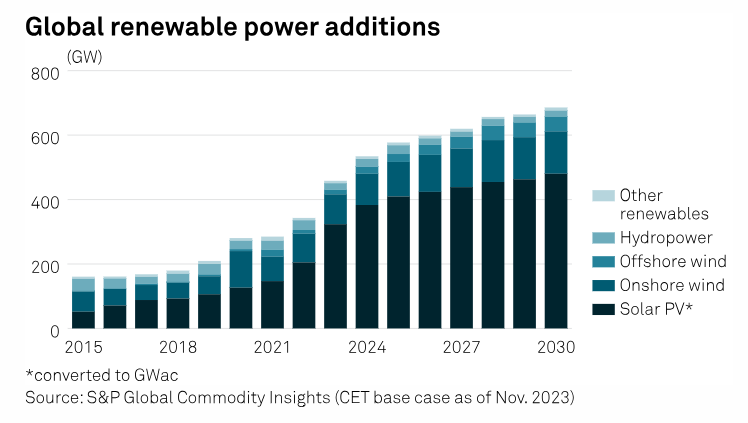

COP28: Pledge To Triple Renewables By 2030 'Ambitious But Achievable'

The tripling of global renewable generation capacity to around 11 TW by 2030 has become a key rallying cry of COP28 President Sultan al-Jaber in the run-up to the UN Climate Change Conference in Dubai. Despite impressive gains in wind and solar deployment in recent years, however, the target requires an unprecedented acceleration in deployment from today's 2.3 TW total for the two fastest growing technologies.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

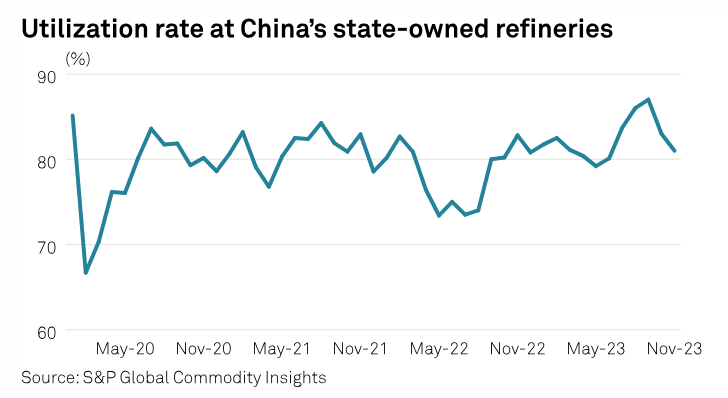

China's Crude Throughput To Continue To Fall In Dec On Weak Demand

China's crude throughput is set to continue the downtrend in December from the record high in September, due to weak domestic demand and a slump in oil product exports, information collected by S&P Global Commodity Insights showed on Nov. 29. Both state-run and independent refineries have cut throughputs in November, from 15.12 million b/d in October and the historical high of 15.54 million b/d in September, S&P Global estimated based on the data from China's National Bureau of Statistics.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

The Gold Standard of Indices Meet's Today's Technology

Meet the S&P 500 FC Index, an innovative index designed to adjust allocations based on intraday volatility signals as it seeks to increase stability and limit exposure to drawdowns, while optimizing exposure to the S&P 500 via BofA’s Fast Convergence technology.

—Watch the video from S&P Dow Jones Indices