Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 3 Aug, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Datacenters Turning Green

As remote work accelerated during the COVID-19 pandemic, the datacenter industry grew to accommodate increasing demand for digital infrastructure. To continue to grow, datacenters must get their energy costs under control and improve their sustainability footprints.

In a recent report, S&P Global Ratings said the datacenter industry is fairly recession resilient. Its explosive growth, especially in Europe and Asia-Pacific, is related to the ongoing digital transformation and the infinite appetite for business data. Rising inflation is most likely to hit the industry through labor costs and energy costs.

Datacenters use massive amounts of power to operate the equipment and provide the air-conditioning needed to keep servers running. By some estimates, datacenters use as much energy as the airline industry. This energy demand is projected to continue to rise as the global economy digitizes.

The level of exposure for individual operators to rising energy prices varies. Some contracts pass on power costs directly to clients through metered power. This reduces the cost for the operator, but clients end up paying more for the same service. One way to control these unpredictable energy costs is to purchase directly from renewable sources on longer-term contracts. S&P Global Ratings finds that facilities that run on green energy are better positioned to deal with inflation than facilities that run on natural gas or coal because of these fixed, long-term contracts.

Resilience in the face of inflation is not the only reason datacenter operators are looking to reduce their carbon footprints. Analysts at 451 Research, part of S&P Global Market Intelligence, believe that operators may need to reduce their carbon emissions to attract or retain clients committed to improving their sustainability footprints.

According to 451 Research, large private equity firms are targeting datacenters for acquisition. Private equity funds are likely to target companies with high environmental standards, and to reduce the environmental footprints of the datacenters they acquire during the holding period, to increase value and improve returns. In this tight fundraising environment, some investors favor private equity funds with more sustainable investment strategies. Because private equity funds tend to hold assets on their books for longer, they may be more exposed to transition risks. This makes funds that acquire less sustainable assets unappealing to investors.

Improving an investment’s environmental impact is often critical to achieving the most favorable exit for a fund’s investors, especially in the datacenter industry.

Today is Wednesday, August 3, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

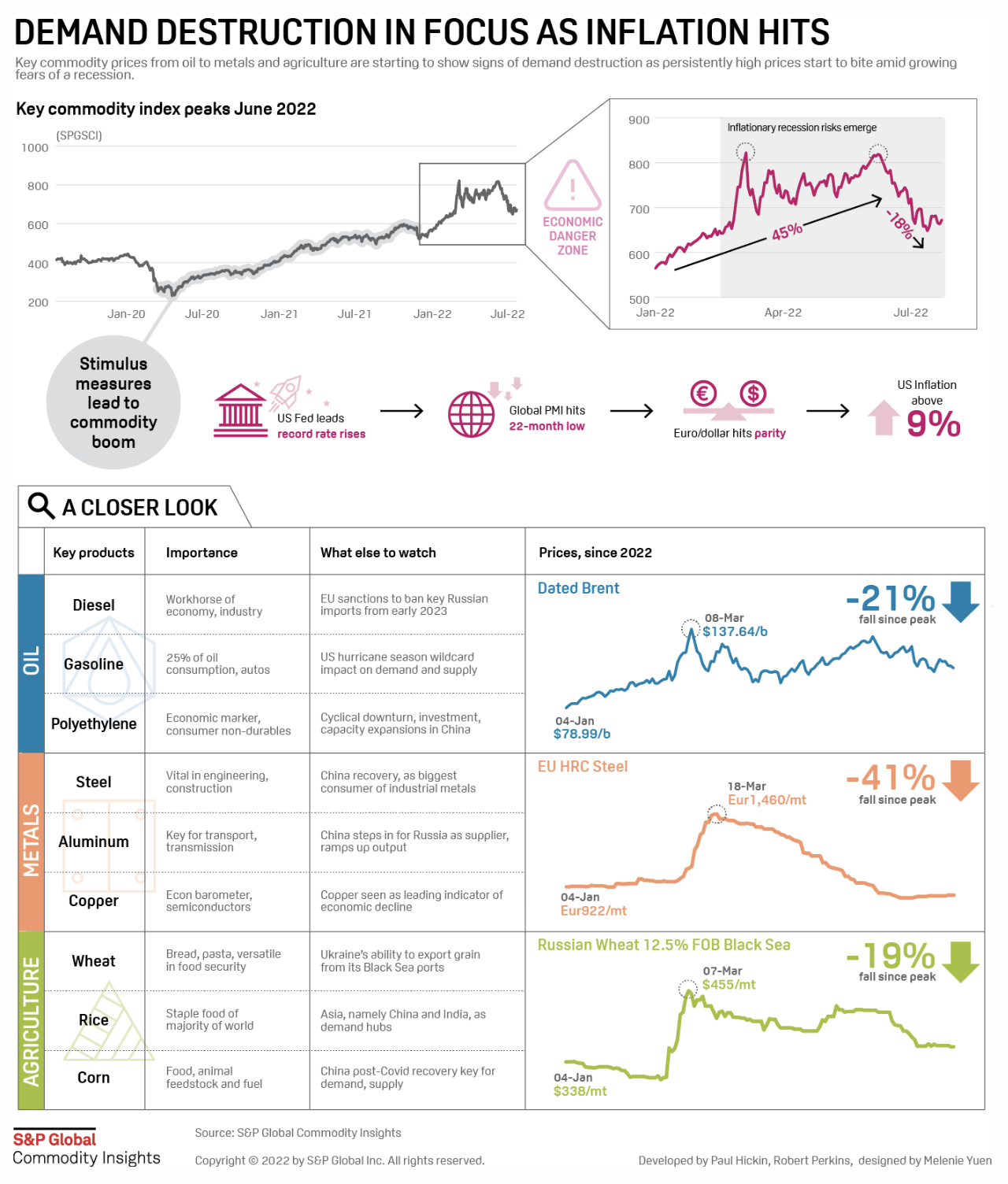

Fuel For Thought: Commodity Supercycle Theory Will Struggle To Pass Ultimate Economic Test

The commodity market boom is over. Energy, metals, and agriculture prices have all tumbled from their March peak on inflationary recession fears amid a slew of economic warning signs, but a commodity bust is far from inevitable. Since early 2020, more and more analysts have been championing the idea of a new commodity supercycle, with an economic recovery turbo-charged by low interest and pandemic-led fiscal stimulus measures, and as investment into decarbonization projects accelerated to meet net-zero targets.

—Read the article from S&P Global Commodity Insights

Access more insights on the global economy >

Credit Trends: Global Refinancing—Rising Rates And Slowing Issuance Drag On Corporate Funding Conditions

While rising interest rates and slowing issuance volumes provide for more difficult financing conditions, maturities for rated financial and nonfinancial corporate debt appear to remain broadly manageable. Companies lengthened maturities, and at historically low rates, during the more favorable financing conditions of 2021. As a result of last year's issuance, companies entered 2022 with less debt maturing over the next 18 months, and the largest annual maturities do not come due until 2025 and beyond.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

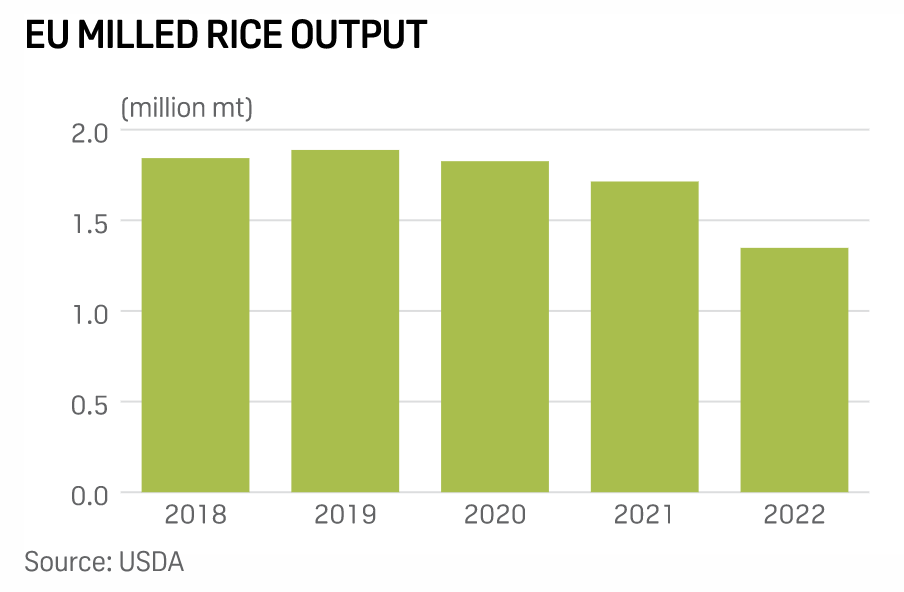

USDA Revises Down EU 2022 Rice Output Amid Widespread Drought

The U.S. Department of Agriculture has projected that 2022 EU milled rice output will dip by 21% on year to 1.35 million mt in its latest Grain and Feed update released July 29. In addition to the on-year drop, it also represents a 7.7% decline from its previous forecast. While the harvested area forecast was maintained at 357,000 hectares—down by 11% on year—both the average field yield and milling rate were revised down from previous forecasts.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

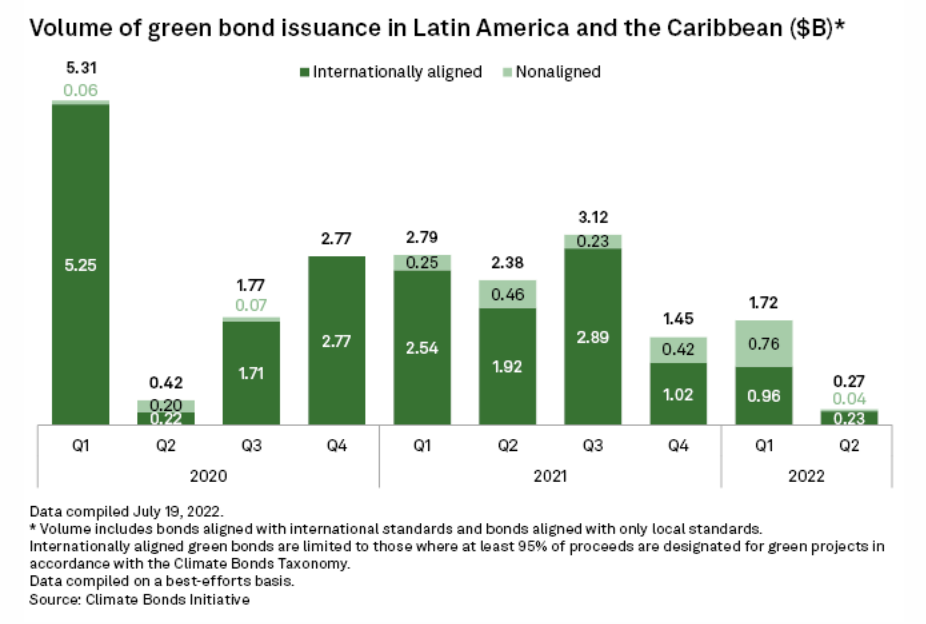

Green Bonds Lose Momentum In LatAm As Q2 Issuance Sinks Below $300M

Pure green bond issuance in Latin America plummeted to a three-year low in the second quarter due to greater risk aversion on global markets and a preference for other sustainable bonds by local players. Environmental-focused debt operations during the period fell 88.7% year on year to $270 million according to the Climate Bonds Initiative, a U.K.-based company that tracks green debt globally. The total was also considerably below the $1.72 billion in funding secured in the previous quarter.

—Read the article from S&P Global Market Intelligence

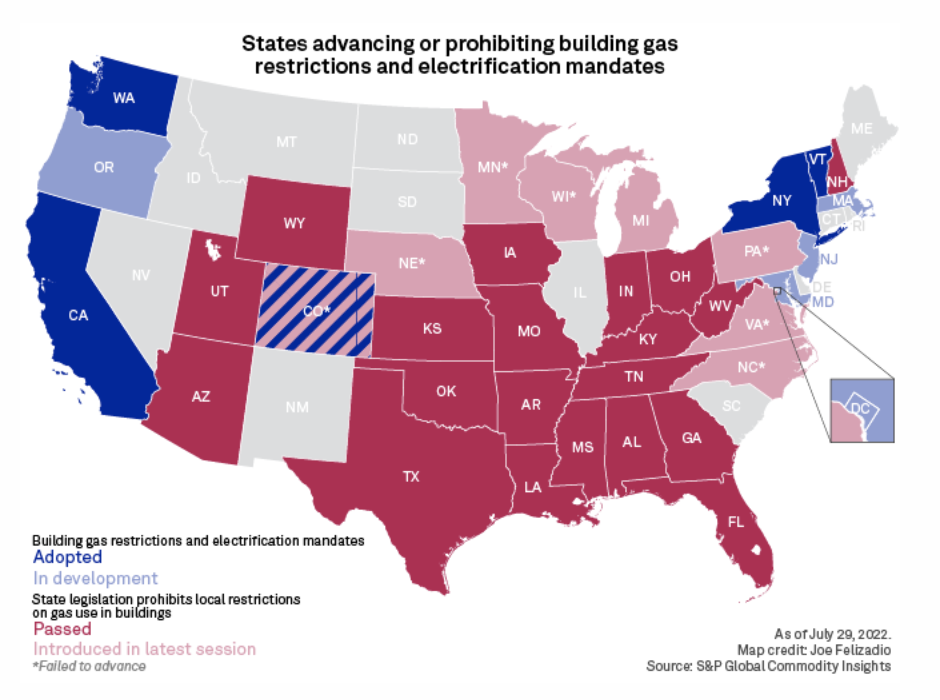

Gas Ban Monitor: East Coast Policies Advance; Pa. Gas Ban Prohibition Fails

Three years after the unofficial start of a movement to prohibit natural gas use in new buildings, West Coast-style policies are gathering momentum in the Eastern U.S. Strategies to require building electrification advanced in New England and Washington, D.C., while an effort to prohibit local gas bans failed in Pennsylvania, the nation's second-largest gas-producing state. Even as statewide gas ban legislation died in New York, policymakers created new opportunities to tackle building electrification.

—Read the article from S&P Global Market Intelligence

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 76: Inflation And Interest Rates: Complexity Abounds

Macroeconomic concerns are weighing on technology markets, but there are conflicting signals in the data from the latest outlook study. Research analyst Malav Parekh returns to pick through the complexities in inflation concerns and interest rates with host Eric Hanselman. Respondents say that they can’t hire fast enough but are also concerned about inflation trends. They’re worrying about borrowing and repayment, too. Will dreary impressions turn into self-fulfilling prophecies?

—Read the article from S&P Global Market Intelligence