Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Feb 06, 2024

By Chris Rogers

Want to learn more? Come join Chris Rogers at TPM 2024 in Long Beach this March. View the agenda and register

The escalation of attacks on international shipping in the Red Sea is making itself felt in consumer goods supply chains. The furniture industry is no exception.

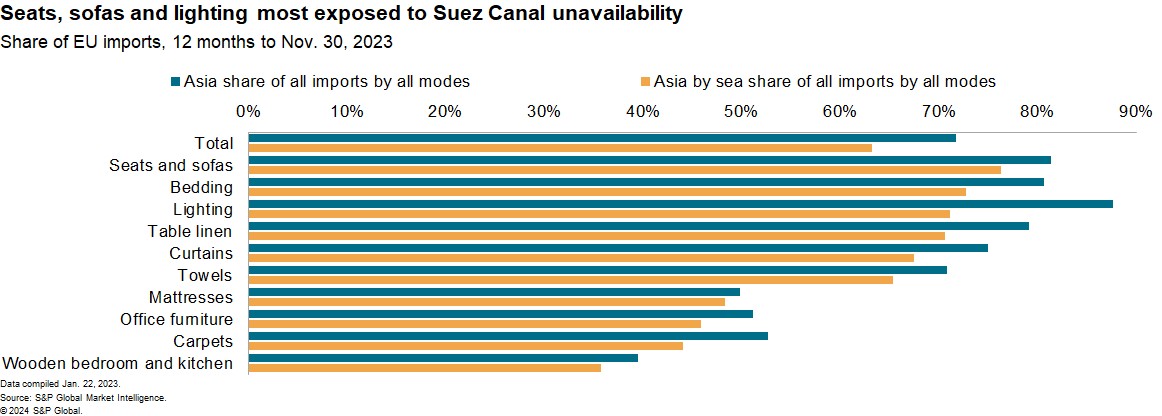

The delays and higher costs associated with the disruptions are being particularly keenly felt by smaller retailers. The European furniture retail sector is heavily exposed to imports from Asia by sea given there are fewer alternative transport mode options than for retailers in the US. Shipments from Asia by sea accounted for 63% of total EU furniture imports in the 12 months to Nov. 30, 2023, our data shows.

More exposed products include seats and sofas, bedding and lighting. Less exposed products include carpets, which are predominantly sourced from Turkey, and specialty furniture including office furnishing and wooden bedroom and kitchen furniture, where local design and premium production matter.

The exposure of US furniture retailers is lower given only shipping by sea from Asia into the US east coast is directly affected. Imports by sea from Asia accounted for 48% of US east coast furniture exports and 33% of total US furniture imports.

Trade flows of components and materials into Asia from Europe and North America will also be affected by delays and increased costs. Shipments from the EU accounted for 16% of mainland China's imports of wood in the 12 months to Nov. 30, 2023. That represents a marked increase from 3% in 2016. That increase reflects a jump in demand for softwoods as well as reduced imports from the US and Canada linked to retaliatory tariffs applied against US imports during the Trump administration.

Rerouting around challenges: Logistics options

The disruptions to shipping are unlikely to end during the first quarter of 2024, requiring firms to implement tactical, logistics-network based options to mitigate slower and more expansive shipping. These include early shipments, use of alternative transit modes (including hybrid routes) and alternative maritime routings.

At least one retailer is pursuing an early shipping strategy, though the need for such tactics in furniture is mitigated by the minimal seasonality in furniture shipments. Import data for the EU and US shows there is a small dip in the first quarter of each year (reflecting the Lunar New Year holiday in mainland China). Otherwise, shipments are constant during the year.

That may incentivize earlier shipping during the year to avoid getting caught by further price increases and less available capacity as the peak shipping season for other consumer goods — including electronics and leisure — gets started in the early third quarter of 2024.

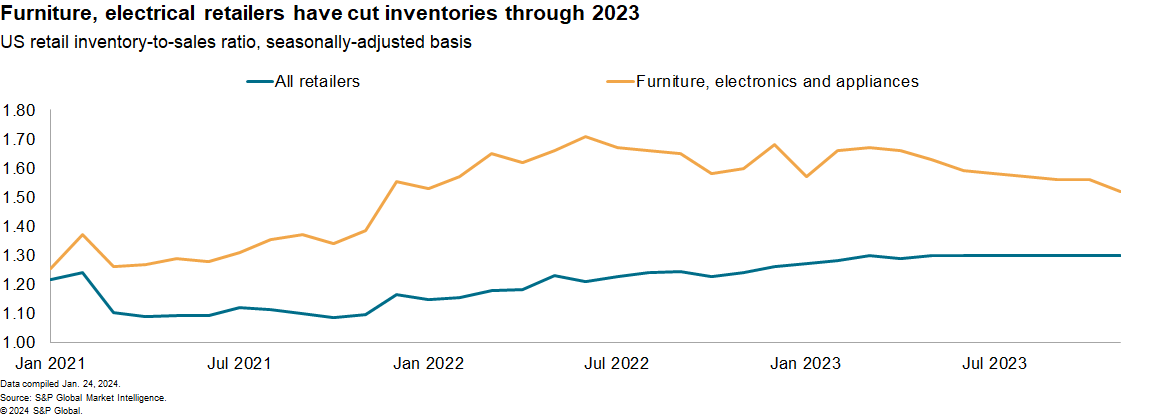

There may be additional capacity among suppliers, given US and EU imports of furniture were down by 10% year over year and by 19% versus their peak in 2022 in the three months to Nov. 30, 2023. Growth versus the 2016-2019 period was just 7%, suggesting low growth and need for a cost-controlled environment.

A degree of disruption will occur due to the late arrival of empty container equipment returning from Europe to meet the post-Lunar New Year reopening of manufacturing facilities in mainland China.

Rail may be an underused route for shipments from Asia to Europe, though it is small in the context of total shipments. Additionally, low time-sensitivity and low value-per-volume of many furniture products may make the use of alternative shipping modes prohibitively expensive. EU imports of furniture by rail from Asia only accounted for 1.5% of shipments in the 12 months to Oct. 31, 2023. That was down from a peak of 2.9%, reflecting the sanctions against Russia's railway firms.

The use of alternative shipping routes has already gotten underway in the US with shipping to the US west coast rather than the US east coast.

Another impetus for reshoring: Sourcing options

A protracted interruption to Red Sea shipping routes and elevated costs from alternative modes provide an impetus to long-term reshoring decisions, increasing the attractiveness of more local markets.

In the case of supplies into Europe, there's an added layer of complexity stemming from environmental regulations. The EU Deforestation-free Regulation has increased the burden of reporting for wood and derived products from deforested areas. Tropical woods aren't replaceable in Europe, though there is a case to simplify supply chain compliance by importing raw materials rather than finished products.

The EU's Carbon Border Adjustment Mechanism (CBAM) will only begin to bite financially from 2026, but reporting requirements have already begun, increasing pressure on firms to review their metals supply chains. The CBAM is particularly pertinent in context of metal upholstered seats including office chairs. Sourcing from outside Asia, principally within Europe and North America, shifts the operational risk challenges to labor, infrastructure and local cargo issues.

Mainland China is globally dominant with a 67% market share of exports in the 12 months to Sept. 30, 2024. Other major suppliers with labor costs below western Europe and US norms include Poland, Mexico, Turkey, Lithuania, Czechia and Hungary. The Baltic and eastern European states offer lower operational risks, including labor strikes and infrastructure disruption, although compensation costs are generally higher.

For supplies into US markets, the main additional regulatory issue comes from tariffs applied to imports from mainland China, applied during the Trump administration and continued by the Biden administration. The Section 301-based tariffs were applied against imports from mainland China in a series of waves through 2020. They've contributed to mainland China's share of US imports of furniture products covered by the tariffs falling to 26% of the total in the 12 months to July 31, 2023. That compares with 51% in 2018.

Shipments from the ASEAN group have picked up most of the difference, reaching a 27% share from 12% while those from Mexico improved to 21% from 17%. Most of the Mexican improvement has come in the past 12 months, suggesting a further review of sourcing in the wake of post-pandemic era demand decline.

Sign up for our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.