Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Feb 03, 2023

By Matt Chessum

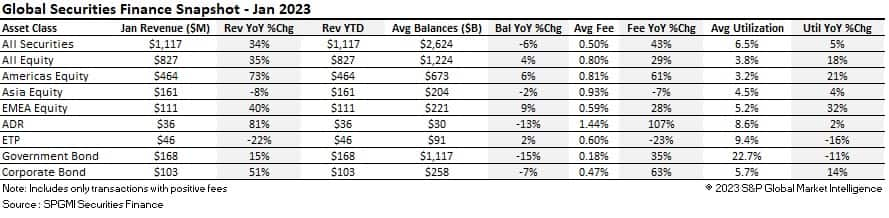

Securities finance activity generated $1.117B in revenues over the month of January. This represents a 34% increase YoY and 7% MoM. All asset classes outperformed YoY in relation to revenues during the month apart from Asian equities (-8%) and ETPs (-22%). Americas equities and corporate bonds significantly outperformed January 2022 with revenue increases of 73% and 51% respectively. These sizable increases were a result of a rise in average fees in these two markets as they climbed 61% and 63% respectively. Average fees in ADRs experienced an increase of 107% YoY. These were pushed higher by strong demand to borrow both Xpeng Automotive (XPEV) and Polestar (PSNY).

Americas equities

Securities finance activity across Americas equities remained robust despite stock markets rising strongly in January (NASDQ increased 13%, the Russell 2000 increased 11% and the S&P 500 increased just over 7%.). Securities finance revenues reflected these market increases ending the month significantly higher YoY. Revenues increased to $464m which represents a 73% increase on January 2022. Average balances grew 6% and average fees increased a staggering 61% YoY. Average utilization also increased to reach 3.2% (+21%).

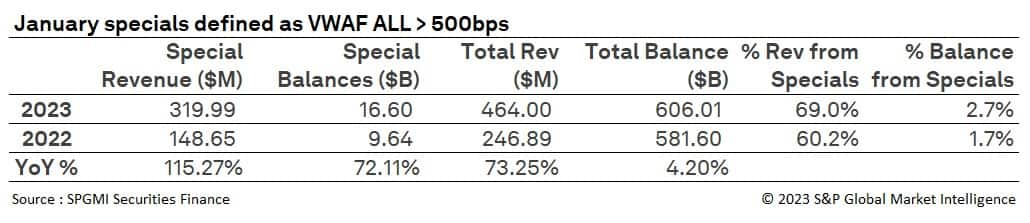

US equity specials activity remained strong throughout January. Over $319m of revenues were generated by lending stocks with a fee greater than 500bps. This equated to 69% of all revenues for Americas equities and represents an increase of 46% on December. Specials balances grew by 10% MoM. The only other time specials revenues were greater during the month of January was in 2021 when just over $365m was generated.

(VWAF = Volume Weighted Average Fee)

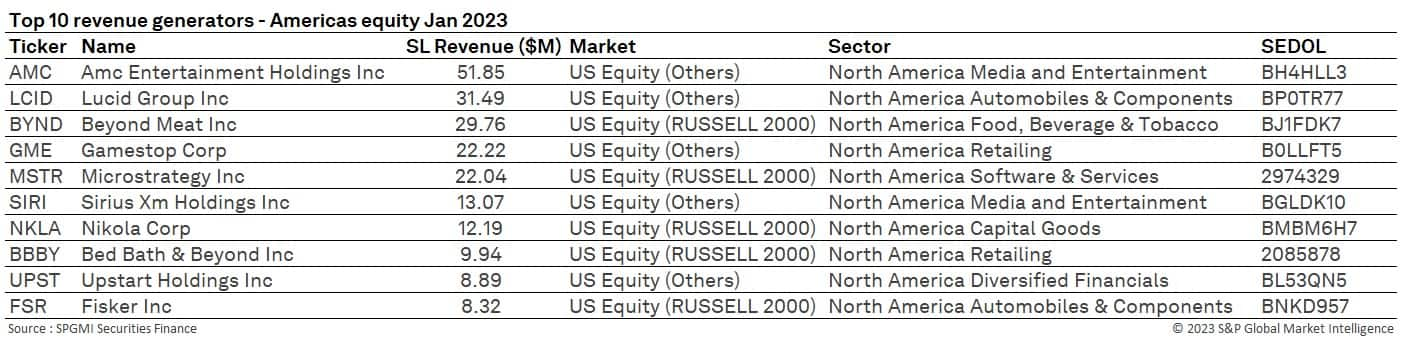

The top ten revenue generating stocks produced $209M in revenues over the month. This is 56% higher than December's top ten stocks. AMC Entertainment became very special over the period as average fees more than tripled. As part of its capital raising plans, the company recently announced proposals to merge its ordinary (AMC) and preference shares (APE). Due to the significant price difference of both lines, a considerable arbitrage opportunity has increased demand for the stock and driven lending revenues substantially higher. Revenues in Lucid group (LCID) increased over the month. Average fees moved higher towards the end of the month as rumours that the company could be a takeover target caused the share price to surge by up to 48%. Securities lending revenues in Bed Bath and Beyond (BBBY) also improved over the month as its average fee increased significantly. The company was reported to have missed interest payments on its loan facilities which caused the share price to fall and the borrowing fee to spike. The other stocks in the list generated revenues in line with those seen during the month of December.

APAC equities

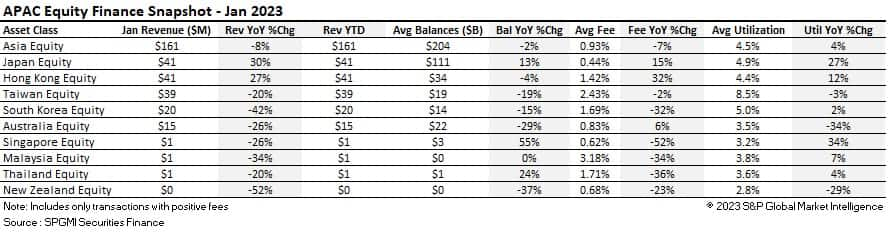

APAC equities generated $161m in revenues during January which represents a decline of 8% YoY and 10% MoM. Average fees and balances were also down YoY but average utilization increased by 4% to 4.5%. Hong Kong and Japan were the only two markets to experience increases in revenues over the month. Revenues increased 30% to $41m in Japan and 27% in Hong Kong to $41m. Revenues in Japan were in line with those generated during December despite a small decrease in average utilization (MoM). Average fees also declined across most markets YoY. In South Korea average fees declined 32% and revenues fell 42% to $20m. Taiwan, which has been a solid contributor to securities finance revenues within the region, suffered a 20% decline in revenues YoY and a 3% drop in utilization. This represents the lowest earning month for Taiwanese assets since June 2021.

The share price of Shanghai Junshi Biosciences Co Ltd fell over 20% during the month of January. This was due to the company announcing a decline in annual revenues of 64% due to a reduction in the income that it collects from its anti-COVID antibodies. The fall in the share price increased securities lending activity in the stock helping it generate $2.93m in revenues over the month. Tianneng power International Ltd (819) also became a focus of borrowers during January. Electric vehicle and battery manufacturers continue to be under pressure across all regions. Sourcing of raw materials for battery production remains challenging whilst competition continues to grow in the electric vehicle market. As seen in the news over the month, the US, Netherlands, and Japan are looking to agree on restricting microchip making technology to China. Nan Ya Pinted Circuit Board Corp (8046) is likely to be affected by this agreement along with United Microelectronics Corp (2303). Microchip companies across the globe remain under pressure from the expected economic downturn which is likely to reduce the demand for semiconductors and microchips. Smoore International Holdings Ltd (6969) became one of the most borrowed stocks in the APAC region over the month as lower selling prices of its products and higher research and development costs were reported to have weighed upon the company's recent results. The company's share price declined 2.7% over the month despite the S&P Asia Pacific Emerging BMI Consumer Staples Index increasing just under 4%. Koolearn Technology Holding Ltd (1797) remained the highest revenue generating stock despite average fees almost halving over the month as the share price increased over 20%.

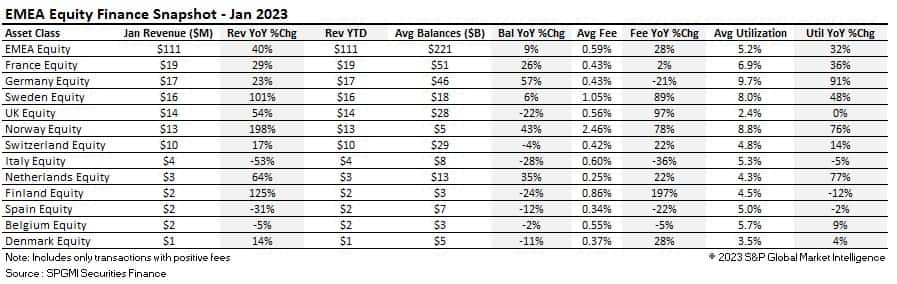

EMEA equities

Securities finance revenues across EMEA equities increased by an impressive 40% YoY to $111m in January. Revenues generated by the top three markets (France, Germany, and Sweden) accounted for approximately 45% of all revenues generated throughout the region. France was the top earning market as earnings from Total Energies (TTE), Orpea SA (ORP) and Casino Guichard Perrachon (CO) pushed revenues and average fees higher YoY. When compared MoM revenues declined 61% and average fees fell 27% from a 2022 high of 59bps. Sweden continued to generate impressive returns for lenders, producing an increase of 101% YoY ($16m). Average fees increased 89% YoY to 105bps and average utilization increased 48% YoY to 8%. Swedish stocks were heavily borrowed throughout 2022 and continued to be in demand during the month. In the UK $14m of revenues were generated. Balances declined (-22% YoY) but average fees increased 97% (YoY) to 56bps representing the highest fee than during any month throughout 2022.

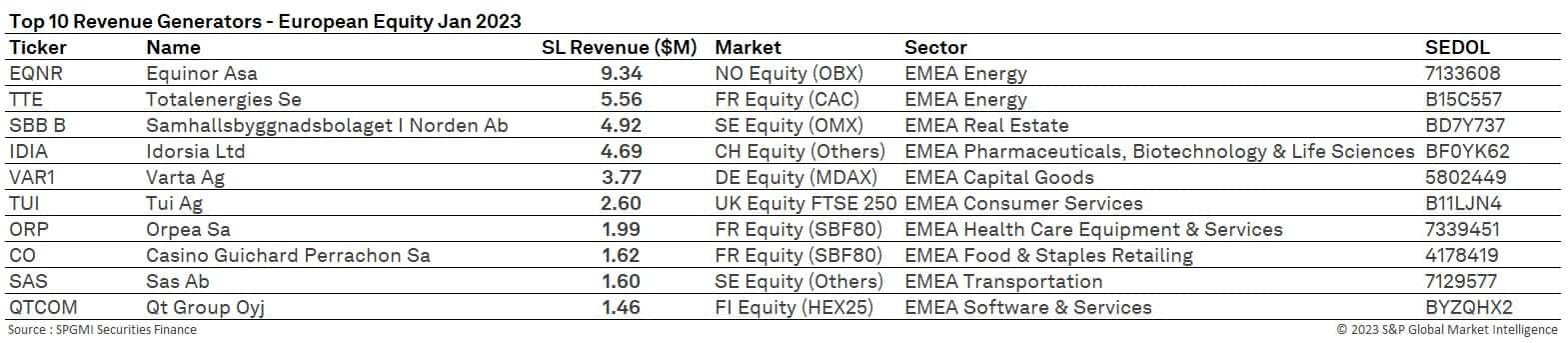

Specials activity across European equities increased over the month. $50.3m of revenues were generated from loans with average fees of over 500bps. This represents an increase of over 38% YoY. Approximately 45% of all EMEA equity revenues were generated from specials activity, representing 2.2% of all EMEA equity on loan balances. January 2023 was the second highest January since 2008 for special revenues.

Over the month Equinor Asa (EQNR) was the highest revenue generating stock. The company paid a dividend on the 10th January. Short interest in the French care home operator Orpea Sa (ORP) continued to grow throughout January. Average fees increased throughout the month as the percentage of shares on loan continued to push higher. The company continues to look for refinancing options as rising costs and energy prices weigh on profitability. Shares in Casino Guichard Perrachon SA (CO) remained in demand throughout the month. Revenues hit a twelve-month high in this stock, increasing by 10% MoM. The indebted French grocer has been a well borrowed stock for several months and remains heavily utilized. The percentage of shares outstanding on loan of Qt Group Oyj (QTCOM) also grew significantly over 2022, peaking at 12.9% towards the end of November. Fees increased in line, plateauing during December.

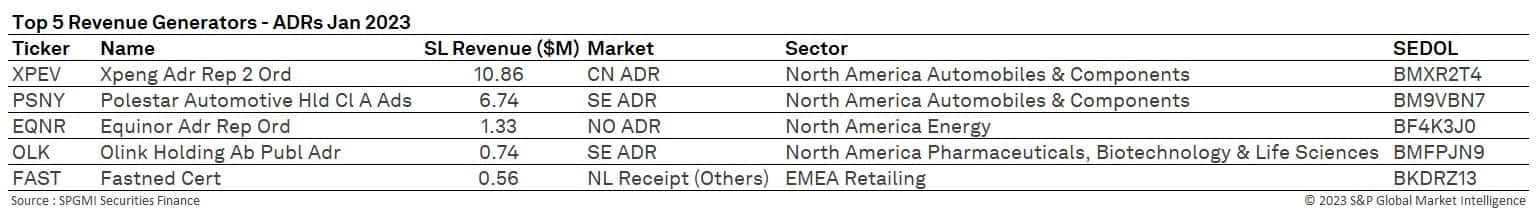

ADRs

Depositary receipts saw a steep increase in fees during January when compared YoY (+81%) but when compared MoM increased a more modest 1% ($32.9m Dec 2022). Average balances decreased YoY (-13%) but average fees increased 107% to 144bps. This represents the highest fee since March 2021.

Electric vehicle makers were well represented in the highest revenue generating stock table during January. Xpeng (XPEV) and Polestar (PSNY) are well known borrows in this asset class. Securities finance revenues in Polestar declined by 4% MoM whilst revenues in Xpeng grew 31%. January was the highest revenue generating month for this stock. Another EV related company, Fastned Cert (FAST), the electric vehicle charging company, also appeared in the table during January generating over $500k over the month.

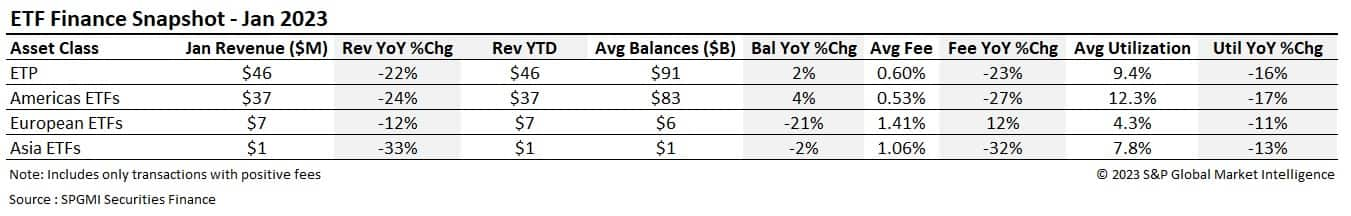

Exchange Traded products

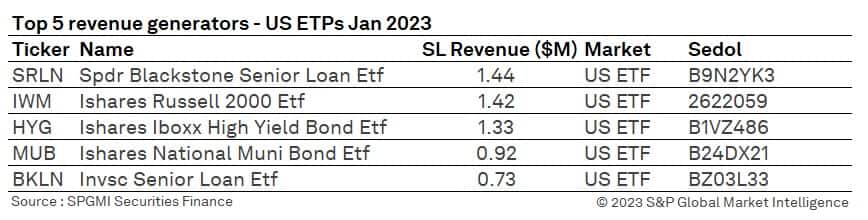

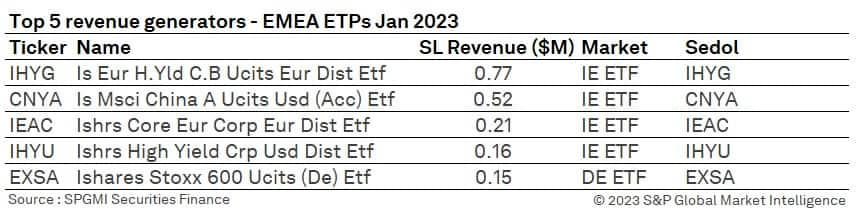

ETP revenues declined 22% YoY to $46m which is the lowest monthly revenue since April 2021. Revenues declined across all regions along with utilization. Average fees increased across European ETFs YoY to 141bps but fell across Americas ETFs (-27% to 53bps) and Asian ETFs (-32% to 106bps). Average fees across all regions were higher in December (European ETFs 144bps, Americas ETFs 56bps and Asian ETFs 123bps). As world equity markets moved higher through January and as inflationary concerns started to ease, average fees in hard to borrow names also reduced.

The highest revenue generating ETFs continued to follow the same trends as seen during 2022. Corporate bond proxies continued to be in demand along with main index equity trackers. Revenues in HYG were equal to those generated during December. Both months represent a significant decline when compared to the double-digit revenues seen during the summer months of 2022. In EMEA, revenues in the ishares MSCI China declined over the month despite an increase in the fee. Revenues in the iShares Stoxx 600 increased by 90% MoM.

In the US, the SPDR Blackstone Senior Loan ETF (SRLN) became the highest revenue generating ETF over the month. The world's largest alternative asset manager continues to suffer from redemption requests from investors who are concerned by the health of the global real estate market. Revenues in the iShares Russell 2000 (IWM) remained steady, equalling those generated during December.

Government Bonds

As global inflation fears start to recede, global bond markets have started to rebound. Talk of hard landings and recessions have softened during the last few weeks as economic data suggests that inflation is starting to come under control and any negative impact of the multiple interest rates experienced throughout 2022 is being effectively managed. Economic reports have moved from recession to "slowcession" which has been positive for fixed income assets. During the first month of the year fixed income assets started their recovery following last year's rout. The Bloomberg Global Aggregate Bond Index increased by 3.88% over January which is the largest rise in the index in the first month of the year since January 1991. The index fell by more than 16% during 2022.

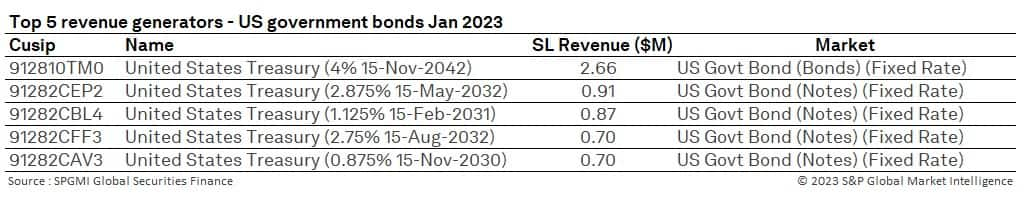

Government bond revenues increased by 15% YoY to $168m. As expected, this is reduction of 23% on December ($192.2m) but in line with revenues seen during November 20222 ($161.1m). Average fees also declined from their year high of 20bps over the month easing back to 18bps. This is the same as the fees experienced from September onwards. Utilization declined both YoY and MoM to 22.7%. This follows the trend seen since the beginning of 2022.

Gilts dominated the Europe revenue table with short-dated bonds retaining their attraction amongst borrowers. The 1% April 24 Gilt remained the highest revenues government bond in Europe. Revenues increased across the top 5 EMEA borrows, reflecting higher levels of utilization and increases in average fees. In the US the UST 4% Nov 42 remained the highest revenue generator despite experiencing a significant decrease in revenues when compared with December. The 10 year on the run US treasury yield has declined about 35bps since the beginning of the year. In typical times this would seem impressive but is small when compared with the 236bps increase seen during 2022.

Corporate Bonds

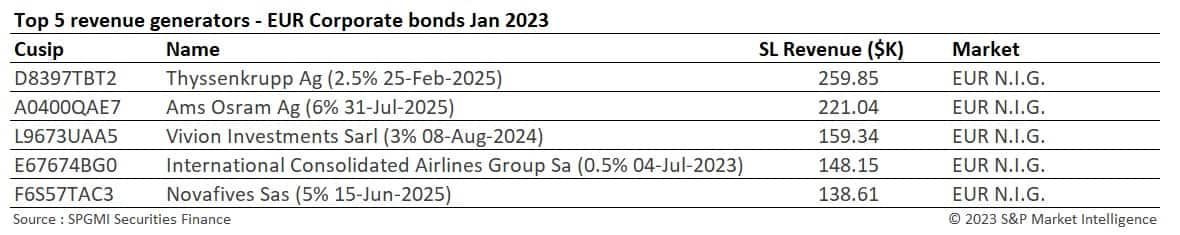

Corporate bond markets continue to be affected by the large interest rate rises of 2022. Despite this there has been a stabilization in yields as central banks start to signal to financial markets that the pace of future rate increases is likely to change and economic data starts to suggest that inflation has already peaked. The financial press continues to report that investors are seeing more value in corporate bond investments which is steadying prices. Reports suggesting that convertible bonds may see an increase in issuance as funding in equity markets becomes more challenging may provide good news for the securities finance markets and the asset class heading into 2023. As the corporate bond market recovers and improvements in fundamentals are seen across issuers, debt issuance in Europe has increased and is reported to have topped $150B in the quickest amount of time ever. More than 80 predominantly high-grade borrowers have piled into the market in January to lock in funding that is around the cheapest since the summer, according to data compiled by Bloomberg. As the ECB is expected to continue raising rates, bond issuers are looking to take advantage of current rates of funding.

Revenues continue to soar however with $103m generated throughout the month. This represents an increase of 51% YoY and 1bps on December. Average utilization continues to climb higher (+14% YoY) along with average fees which stood at 47bps for the month. Higher fees and higher revenues despite lower balances (-7% YoY and flat MoM) show the increase in value that corporate bonds are offering to borrowers. Over the month in the UK, retail bonds continued to see strong demand and private placements continued to dominate in the USD denominated bonds.

Conclusion

Securities finance revenues remained robust throughout the month following on from a strong 2022. Americas equities continued to dominate across equities as specials activity remained strong in the US and started to pick up in EMEA. In fixed income, corporate bonds and government bonds remained strong contributors to overall lending revenues despite a decline in balances. January marked a strong start for 2023 and sets the tone for a strong first quarter of the year.

Please ensure that you join us for our upcoming webinar: Securities Finance 2022 Annual Review and Beyond scheduled for Wednesday 8th February, - 2023 - 10:00am EST / 3:00 PM GMT and Friday 10th February in APAC 10:00am HKT. You can register by clicking HERE

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.