Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — May 15, 2025

By Tim Zawacki and Husain Rupawala

Most publicly traded private auto insurers took a wait-and-see approach in their comments during first-quarter earnings conference calls to the impact of tariffs on loss costs, but timelines associated with the rate filing process may increasingly compel them to make judgments about potential inflation in the costs to repair and replace damaged vehicles. Two filings newly obtained by S&P Global Market Intelligence show that at least one carrier is seeking to incorporate its internal estimates of future tariff-related hits in its selected rates.

Industry participants and observers expect that private auto will be the property and casualty business most directly impacted by the Trump administration's tariffs on a wide range of goods due to the automobile supply chain's reliance on imported finished products and raw materials. And private auto insurers have recent experience with a bout of severe loss-cost inflation stemming from pandemic-era supply chain disruptions that led to historically unfavorable underwriting results and, in response, multiple rounds of large rate increases.

Geopolitical developments, political pronouncements and fluid deadlines over the past several months have made it difficult to gauge the magnitude and timing of the impact of various new tariffs on private auto loss costs. But while internal scenario testing has been ongoing around the industry for weeks, new filings in Virginia and Oregon by regional carrier Acuity A Mutual Insurance Co. provide one of the first public attempts to quantify and address through rate increases the effects at the coverage level.

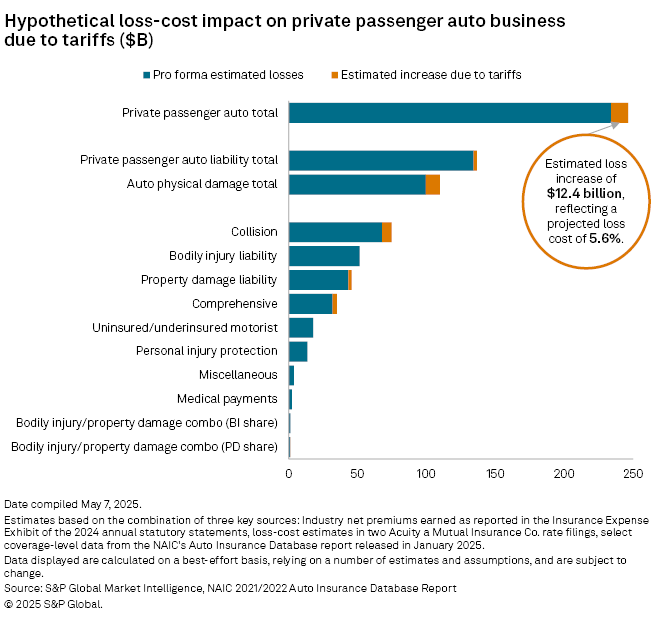

We extrapolated Acuity's projections, which specifically applied only to its books of business in those two states, to the industry level. When applied in a uniform manner against actual 2024 statutory financial results, we arrived at an estimated impact on US private auto net incurred losses of approximately $12.4 billion, representing an increase of about 5.6% over actual 2024 private auto incurred losses.

While private auto results improved materially in 2024, particularly in the coverages facing the effects of tariff-related inflation, we would expect carriers to attempt to recoup a significant amount of the associated costs in the form of rate increases. Acuity is seeking to raise rates by 7.5% in Virginia and 7.0% in Oregon, and most but not all of the underlying rate need appears to be associated with the estimated impact of tariffs.

It remains far too early for the effects of tariff policy to be reflected in the claims severity data that underlie private auto rate filings, particularly in a state like California that requires prospective trends to be determined based on historical experience. The six-month policy terms prevalent in the private auto business, in contrast to the 12-month terms associated with other lines, provides the opportunity for carriers to respond to environmental conditions with relative rapidity. But the industry's highly challenged underwriting results for 2021 through 2023 provide evidence of the potential mismatch that can materialize in a time of rapid loss-cost inflation between the amount of premiums carriers earn and the average claims severities they are facing.

Leading private auto insurers such as The Allstate Corp. and The Progressive Corp. have indicated that their companies are prepared to respond, if necessary, to increases in claims severity due to tariffs, though Progressive CEO Tricia Griffith said on May 6 that "I don't want to have to increase rates like we had to a few years ago based on the inflationary factors that came into play with used car prices and parts." Insurtech Just Insure Inc. warned of potential for "sharp" industry rate increases in the second half of 2025 due to tariffs in an Arizona rate filing that did not specifically quantify their contribution to the company's indications of rate need.

For approved rate increases filed within the past 12 months in Virginia and Oregon, based on an analysis of filings obtained by S&P Global Market Intelligence, it took a median of approximately three-and-a-half months between the dates of the filing's submission and when the approved rates took effect for renewal business. Both Virginia and Oregon have file-and-use provisions for private auto rate requests. States generally employ file-and-use, use-and-file, and/or prior-approval processes for private auto filings, and timelines for implementing filed rates can vary widely based on the specific methods employed.

Acuity, in its May 1 filings in those states, has requested to implement its filed rates for renewing business beginning on Aug. 22. The filings seek to implement tariff adjustments to reflect what the company characterized as one-time prospective loss changes on the property damage, collision, and comprehensive coverages of 5.5%, 11.3% and 11.3%, respectively, which collectively boost the company's actuarial indications of collision and comprehensive rate need to 14.6% with tariffs from 3.0% without. Those adjustments contemplate increases in costs associated with various inputs, including the following estimates:

–17.5% for new vehicles reflecting increases of 25% for imported cars and trucks and 15% for vehicles assembled in the United States (as compared with a pandemic-era, calendar-year peak increase of 10.4% in 2022);

–9.3% for used vehicles based on an analysis of historical correlation between the new and used vehicle components of the Consumer Price Index (as compared with a 26.5% spike in 2021); and

–10.9% for parts, equipment, maintenance and repair based on the role played by parts imported from Canada and Mexico for use in auto repairs (as compared with a pandemic-era peak increase of 13.3% in 2022);

The Virginia Acuity filing calls for rate increases by coverage of 16.9% for comprehensive, 8.5% for collision and 7.0% for property damage along with other revisions to coverages not part of the company's tariff projections. When Acuity last filed rates in Virginia in October 2024, it selected increases of 12.9% for comprehensive, 3.5% for collision and 2.5% for property damage.

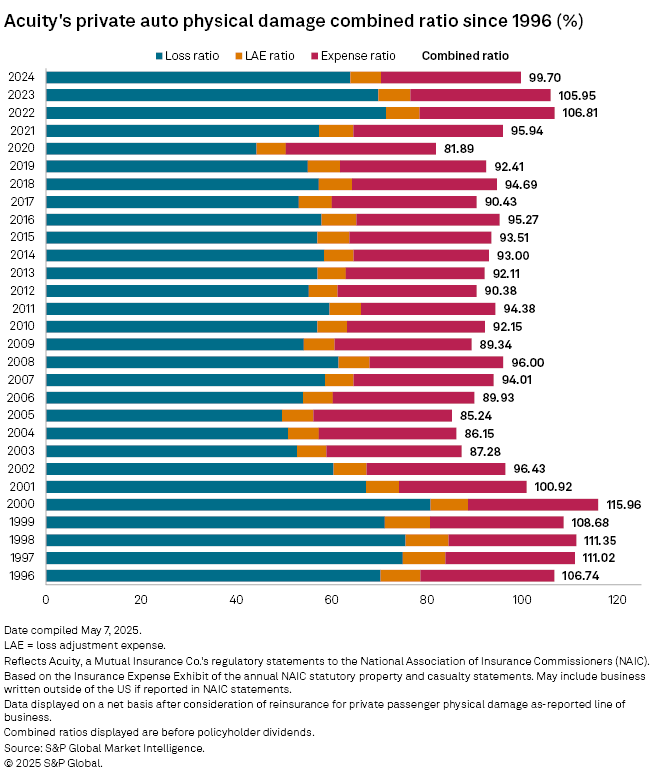

Like the industry as a whole, Acuity saw material improvement in private auto physical damage results in 2024 as compound rate increases more fully earned into its book. Its Virginia direct incurred loss ratio in the line declined by 21.3 percentage points to 70.3%. Nationally, its private auto physical damage combined ratio fell to 99.7% from 105.9%, though the 2024 result still remained multiple percentage points above pre-pandemic levels.

To arrive at our $12.4 billion countrywide estimate, we combined Acuity's selections with S&P Global Market Intelligence's P&C industry data on net premiums earned and net incurred losses from 2024 Insurance Expense Exhibits of statutory filings and data on earned premiums and incurred losses across private auto coverages reported in the National Association of Insurance Commissioners' most recent Auto Insurance Database Report. The former provides disclosures on private auto liability and physical damage results while the latter offers a more granular breakdown by liability coverages (bodily injury, property damage, underinsured/uninsured motorist, medical payments, personal injury protection and miscellaneous), physical damage (collision and comprehensive) and combined bodily injury/property damage single limits.

We then assumed no change in earned premiums as reported for 2024 while applying increases of 11.3% to incurred losses for the comprehensive and collision coverages, as estimated using ratios based on NAIC figures for 2019 and 2021, as well as 5.5% to the property damage coverage and our estimate of the property damage piece of the liability combined single limits coverage.

There are some limitations to this approach, including the NAIC's exclusion of various non-passenger car and truck policies from its report and the likelihood that the relative roles played by individual coverages in total private auto premiums and losses to have evolved since 2021 given the uneven frequency and severity trends they have experienced. We would also caution against applying our estimates to individual companies or geographies due to nuances associated with business mix and statutory coverage requirements.

There are also a number of factors that could cause our estimate of a 5.6% bump in pro forma industrywide incurred losses and, prospectively, a rate need of a comparable amount to be too high. The Travelers Cos. Inc. Chairman and CEO Alan Schnitzer on April 16 highlighted several potential mitigants to increases in claims severity, including advance inventory buildups, substitution of goods, reorganization of the supply chain, and lower tariff pass-through rates. In terms of aggregate impact on incurred losses and earned premiums, we would expect far less than a $12.4 billion bump in 2025 due to timing and underlying trends, particularly coming off of a 2024 in which private auto physical damage incurred losses declined by 6.2% while earned premiums surged by 17.1%.

The competitive response from insurers bears watching as stellar private auto physical damage underwriting results in 2024 and to date in 2025 may provide some potential for flexibility in rate selections even if a material rise in indications emerges.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.