Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Aug 11, 2023

Inflation is falling and the U.S. economy is expanding at a faster-than-anticipated rate, but U.S. freight demand isn't rebounding.

Instead, the freight downturn that began in the fall of 2022 will likely last through the end of the year, and for the U.S. trucking sector, it could stretch into the second quarter of 2024, speakers said during a Journal of Commerce webcast Thursday. And even when demand rebounds, they expect modest growth, absent any unanticipated disruptions.

"We think the [truckload] spot market has hit bottom," Chris Caplice, chief scientist at DAT Freight & Analytics, said during the webcast. "We're set up to start a recovery, but I agree it's probably two quarters away, maybe three."

Lower manufacturing output and overstocked inventories are two reasons for the extended downturn, along with record levels of employment in trucking and the continued presence of excess capacity.

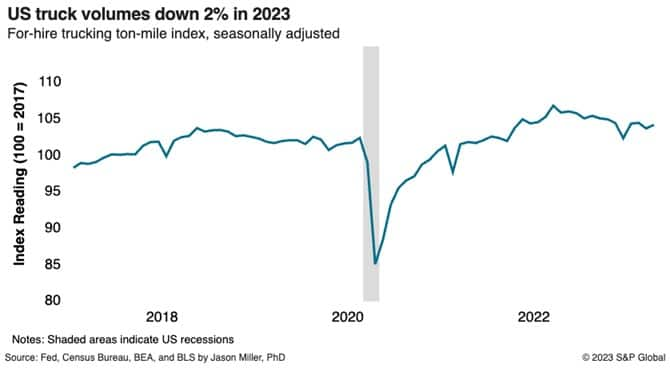

"When you combine a 2% decrease in ton-mile activity with a 3% to 4% increase in trucking employment, you've got a recipe for a very soft market," said Jason Miller, associate professor of logistics at Michigan State University.

For-hire trucking companies have expanded their payrolls by 7% since mid-2018, said Miller, based on U.S. Bureau of Labor Statistics data. Truck freight volume, on the other hand, is currently "about where it was at its peak in 2018," trucking's strongest year before the COVID-19 pandemic, Miller said.

Demand has to rise to change the equation, he said. "The auto sector is doing phenomenally well right now, but there are other manufacturing sectors like paper that are certainly hurting."

One of the few "green shoots" is housing demand, which Miller said has proved "shockingly resilient" to higher mortgage interest rates. "It's likely the housing recession is behind us."

The current freight market resembles the "soft patch" of 2012-13 or the slowdown of 2016-17, Miller said. "We're probably looking at another six to nine months before we start to get out of this."

U.S. nationwide truck shipment levels have now decreased for five consecutive quarters, according to Bobby Holland, director of freight analytics at U.S. Bank. Total volumes dropped 1.2% on a sequential basis and 9% year over year in the second quarter, he said.

Shipper spending on transportation dropped 8.3% from the first quarter and 10.9% from a year ago in the second quarter, Holland said.

Those declines in volume and spending weren't universal, however.

In the Southwest region from Texas and Oklahoma to Arizona, for example, shipment volume rose 2.9% from the first quarter and 14.8% year over year in the second quarter.

"The Southwest is a powerhouse," Holland said. "We attribute this to cross-border trade with Mexico, and oil production continues to be strong." He also pointed to a shift in imports from the West Coast to Port Houston.

In other regions, including the West Coast, Holland sees greater consolidation of freight affecting shipment volume. At the height of the pandemic, "people just wanted to ship stuff as soon as possible, get it on a truck and get it moved," he said. "Now there's a trend toward more consolidation."

By contrast, the Northeast saw shipment volume drop 9.2% sequentially in the second quarter and 27.1% year over year. Shipper spending in the region was down about 11% both sequentially and annually.

"Some regions are still faring badly compared to pre-COVID data," Holland said. "Right now, we're trending slightly below pre-pandemic levels" of shipments and spending.

Caplice said shippers are using the extended downcycle to rethink their supply chains. "What we've generally seen is that shippers are becoming more sophisticated" in how they use transportation modes and procure services, Caplice said.

In a typical downturn, spot market shipments drop to 10% to 12% of total shipments, with the rest moving under contract, he said. But in 2023, the spot market still accounts for 20% of shipment volume.

Rather than going to two to three contract carriers in a routing guide to secure capacity, shippers are going direct to the spot market in lanes where they have low or infrequent volume, a trend DAT first noted last year, Caplice explained.

"The spot market is being used strategically by shippers to avoid routing guides," he said. "Shippers are more willing to take advantage of the dynamic nature of the market and put up with some pricing volatility."

Caplice and the other speakers urged shippers to view the extended downturn in goods shipping to build deeper carrier partnerships.

"Hopefully, you're getting your relationships with your asset-based and non-asset carriers in place," Caplice said. "We all know the market will turn; it's not going to go on like this forever."

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthly Insights Newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

How can our products help you?