Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 10 Aug, 2023

Comcast Corp. consolidated revenue was up 1.7% to $30.51 billion in the second quarter, with EBITDA up 4.2% to a record high of $10.24 billion. Consolidated EBITDA margin hit a high of 34% in the quarter despite softness in the media, traditional multichannel video and advertising segments.

Bright spots for the company include residential connectivity, which grew its top-line revenue to $8.25 billion in the quarter. Theatrical/studios topped $3.09 billion in revenue while theme parks logged $2.21 billion, more than double the $1.09 billion it generated in second quarter 2021.

➤ Streaming service Peacock topped 24 million subs in the second quarter and logged its best EBITDA margin yet at negative 79%.

➤ Super Mario and Fast X drove theatrical revenue up over 66% annually.

➤ Theme park revenue was up over 22% year over year with the post-pandemic return of tourists. The Los Angeles park logged its highest EBITDA ever.

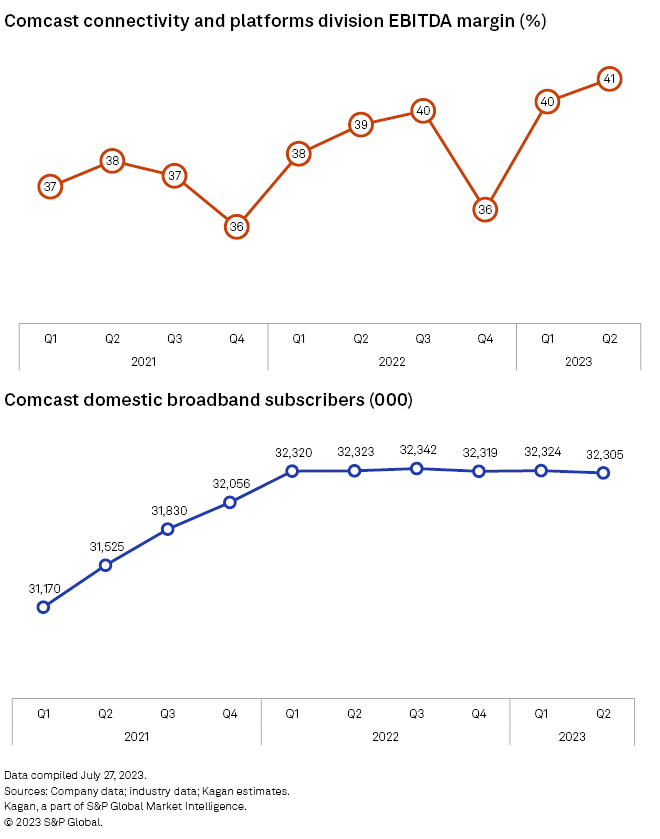

➤ Flat subscription growth at domestic broadband operations did not keep Comcast from driving its top-line revenue higher by 4.4% for connectivity and platforms as average revenue per user rose. International broadband revenue grew by 26.7% annually.

Connectivity and platforms

The story at the connectivity and platforms division remains the company's ability to charge existing broadband customers more as opposed to growing the base amid heavy competition in the US broadband market from fixed wireless, particularly from T-Mobile US Inc. and Verizon Communications Inc.

Strong broadband ARPU growth of 4.5% drove domestic broadband revenue up 4.4% annually to $6.38 billion, despite the second quarter representing the sixth consecutive quarter of basically no subscriber growth, which is stalled at about 32 million. Divisionwide connectivity and platforms EBITDA (including broadband, video, wireless, advertising and business services) was up 4.3% to $7.02 billion, logging a record high margin of 41%.

Another bright spot, thanks in part again to charging existing customers more, was international connectivity (SKY operations), which grew revenue by 26.7% year over year to generate over $1.00 billion in the quarter. Driving the accelerated top line again was strong broadband ARPU growth at SKY in addition to a growing subscriber base. Broadband is about two-thirds of Comcast's international operations with wireless the other third.

Xfinity Mobile remains the sole bright spot for the division in terms of subscriber growth, up 29.7% year over year to 5.9 million subs for second quarter, up from 3.4 million the same quarter two years ago.

Content & Experiences

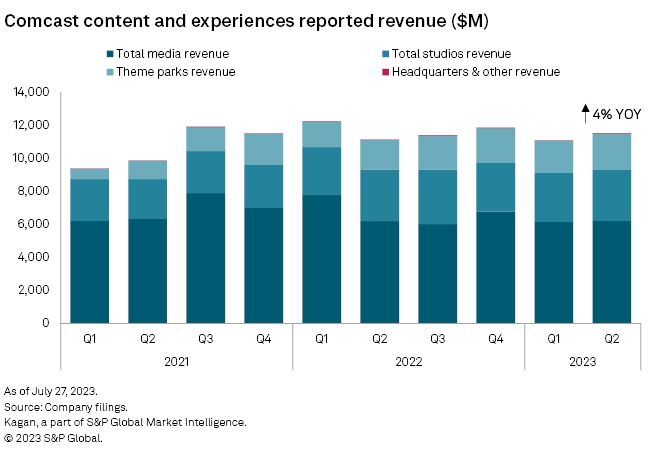

The company's content & experiences reporting segment generates revenue via three segments: media, studios and theme parks. Second-quarter revenues grew 4.0% in the quarter to $10.87 billion after eliminations, driven by a 22.5% gain at the theme parks segment, while media and studio revenue was relatively flat.

Media

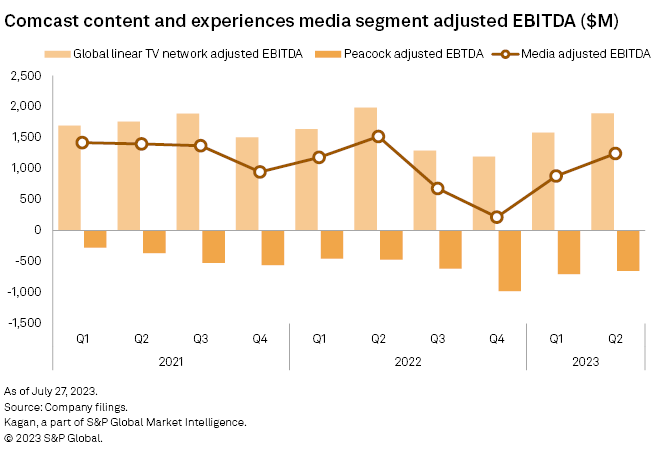

Media, the largest segment in Comcast's content and experiences subdivision, reported an 18.2% decline in adjusted EBITDA in the quarter to $1.24 billion; however, this is greater than the adjusted EBITDA of the previous two quarters combined. The segment's second quarter 20.1% adjusted EBITDA margin is down from 24.6% in the second quarter of 2022 but is greater than the previous three quarters. As highlighted in the chart below, losses at the Peacock streaming service have dragged down profits at the company's global linear TV network business.

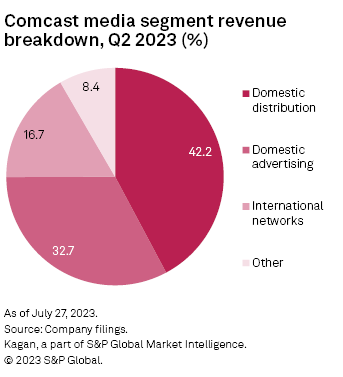

The media segment includes revenue from the company's full or partial ownership of 13 US basic cable networks, six regional sports networks (RSNs), two national broadcast networks, 43 TV stations, international TV networks and the Peacock streaming service. The company's domestic TV channel business accounted for an estimated 70.5% of total media revenue in the quarter. While the RSN industry has been under pressure as of late, the Comcast-owned RSNs are in a unique position to negotiate carriage deals due to their affiliation with the NBC broadcast and cable networks. The RSNs also have the added benefit of being vertically integrated with Comcast, which pays for carriage of the networks on its systems. While Comcast sold NBC Sports Washington in a sale to Monumental Sports & Entertainment that was completed Sept. 20, 2022, there have been no additional reports of the company looking to unload the remaining six NBC Sports RSNs.

Domestic distribution revenue accounted for 42.2% of total media revenues in the quarter and was up 2.2% on a year-over-year basis as a decline in linear subscribers was offset by rate hikes and subscription growth at Peacock. In fact, stripping out Peacock subscription revenue would have netted total domestic TV network distribution revenue falling by 3.8% in the quarter to $2.25 billion.

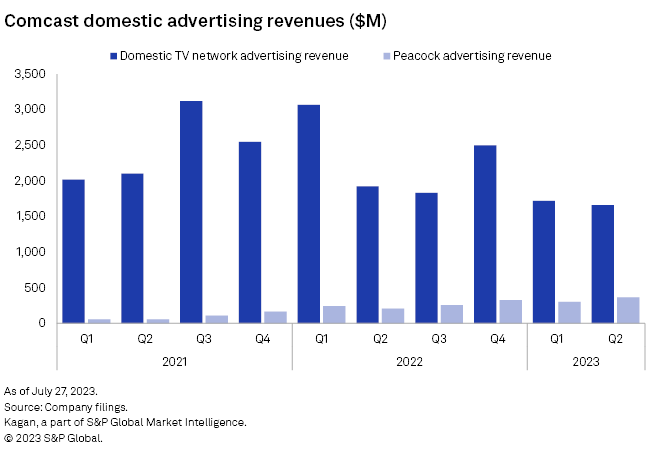

Similarly, second-quarter domestic advertising revenue fell by 4.9% overall; however, domestic TV network advertising revenue without Peacock would have fallen by 13.7% on a year-over-year basis. The decline in linear network advertising revenue was largely the result of ratings erosion at the basic cable networks combined with continued overall weakness in the ad market stemming from macroeconomic factors including rising interest rates, ongoing supply chain issues and recession fears in the US.

Ratings at Comcast's linear TV networks could erode even further in the coming quarters as the writers and actors strikes in Hollywood have suspended production of shows slated for the upcoming fall season. Speaking on the earnings call, President Michael Cavanagh said the longer the strikes last, the worse it will be, adding it's "going to have a negative impact all around."

The value of live sports content increases for the duration of these strikes as play will continue. NBC holds the rights to a slew of valuable live sporting events, including NFL Sunday Night Football and a new Big Ten college football deal that kicks off in the fall. NBC could add more top-tier sports rights to the portfolio via the NBA as the league's current deal expires at the end of the 2024-25 season. On the earnings call, Cavanagh called the NBA a "fantastic property" and mentioned that the company would be potentially interested in making a bid.

Walt Disney Co. CEO Bob Iger recently said he is looking for ESPN to partner with another media company in launching a direct-to-consumer sports product. Cavanagh threw cold water on speculation that NBC Sports could link up with ESPN, saying "that's very improbable" given the tremendous tax consequences.

Peacock

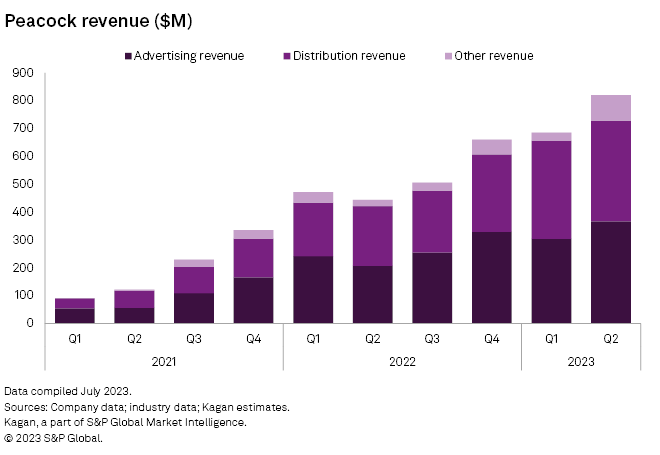

Peacock turned in another quarter of solid subscriber and revenue growth, with the addition of about 2 million net new paid subs pushing the service's subscriber base to about 24 million paid subscribers at the close of the second quarter. Quarterly revenue of $820 million at Peacock rose by 84.7% versus the prior year's second quarter, driven by a 77.3% gain in ad revenue, and subscription revenue swelling 68.7% on a year-over-year basis.

Company executives chalked up a significant amount of new subscriber gains in the quarter to successfully converting Comcast subscribers who had previously received Peacock for free, a perk that ended in June for most Comcast customers. Advertising growth at Peacock in recent quarters has outperformed Comcast's linear TV advertising results and also outperformed many other rivals (including linear network owners and streaming operators alike) battling for ad dollars in what remains a relatively soft advertising market in the US.

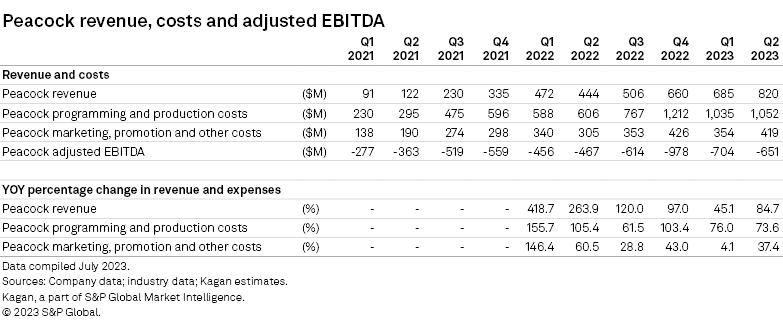

Despite a rapidly growing subscriber base and surging revenue, the Peacock service remains a drag on overall EBITDA due to heavy investments in programming. Programming and production costs of $1.05 billion and marketing, promotion and other costs of $419 million resulted in an adjusted EBITDA of negative $651 million for Peacock in the second quarter, with executives guiding for the service to incur a total operating loss of about $3 billion for 2023 overall.

The company has previously noted that 2023 operating losses should represent "peak losses" for the service before steady progress toward profitably as subscribers hopefully continue to grow and the initial ramp in programming costs following the launch of the service smooths out. Pricing increases for new subscribers at Peacock announced in July could also help the bottom line, with the monthly cost of the Peacock ad-supported tier rising from $4.99 to $5.99 while the Peacock ad-free tier will increase from $9.99 to $11.99 per month.

NBCUniversal Studios

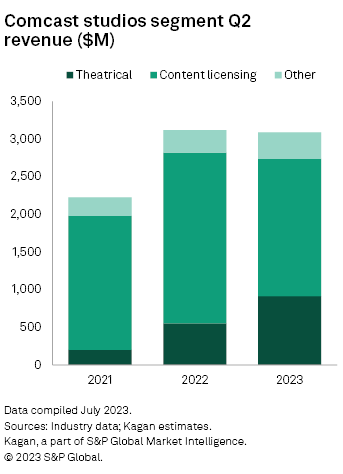

Comcast's studios segment ended the second fiscal quarter of 2023 with a 0.9% decrease in total revenue from $3.12 billion in 2022 to $3.09 billion in 2023. Content licensing is still the segment's largest source of revenue with $1.82 billion in the second quarter of 2023, but it declined 19.7% when compared to $2.27 billion in 2022. The availability of content under licensing agreements was attributed to the drop in revenue.

Theatrical revenue has managed to take up the slack from content licensing as the box office continues to recover and Universal released a pair of hit films in the second quarter. Theatrical revenue increased 66.0% in the second quarter from $550.0 million in 2022 to $913.0 million in 2023.

Looking at the combined results for the first two quarters of the year, theatrical revenue jumped 71.6% from $718.0 million in first half 2022 to $1.23 billion in 2023. Content licensing has dropped 11.3% to $4.17 billion in 2023 versus $4.70 billion in 2022. Overall, total studio segment revenue has increased 0.3% in the first half of 2023 to $6.04 billion.

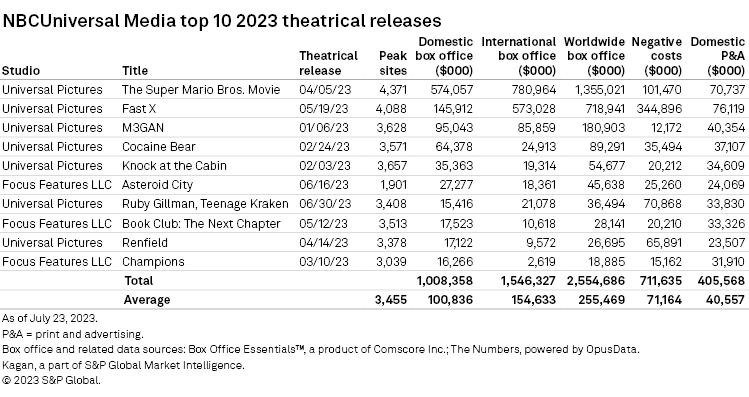

NBCUniversal, the Comcast subsidiary where all the production studios reside, released eight films in theaters in the second quarter of the year. They grossed $2.21 billion in worldwide box office through July 23, 2023. The biggest hit of the quarter was "The Super Mario Bros. Movie" with a $1.36 billion worldwide gross, $574.1 million domestically and $780.9 million internationally. The film is currently the highest-grossing film of the year at the domestic box office.

"Fast X" was the second-best film of the second quarter with a $718.9 million worldwide gross with $145.9 million in domestic gross and $573.0 million in international gross. NBCUniversal's top 10 films of 2023 have combined for $2.55 billion in worldwide box office through July 23, 2023. They have grossed nearly $1.01 billion domestically and $1.55 billion internationally.

NBCUniversal Theme Parks

Revenue rose 22.4% to $2.21 billion, with adjusted EBITDA ahead 31.8% to a segment record $833 million. The higher revenue base more than offset a 17.4% uptick in operating expenses, tied largely to costs associated with higher guest attendance. CFO Jason Armstrong attributed the improvement in gains at the international theme parks to a favorable comparison to the prior-year quarter's COVID-19-related closures and to gains at Universal Studios Hollywood.

Universal Studios Japan in Osaka notched record second-quarter EBITDA, behind the continued high demand for Super Nintendo World, which opened in 2021. The Beijing venue tallied its most profitable quarter to date, following strong improvement compared to last year when the park was largely closed due to the pandemic.

Comcast President Mike Cavanagh said the international growth materialized despite a stronger dollar and attendance that remains 30% below pre-pandemic levels. Comcast expects those trends to continue in the third quarter.

Domestically, Universal Studios Hollywood continued the momentum stemming from the opening of Super Nintendo World in the first quarter, leading to strong attendance and per capita spending growth. The result: the California park registered the best quarterly EBITDA performance in its history.

In Florida, results were mitigated by comparisons to unprecedented visitation levels in the prior year, when patrons flocked to Universal World Resort following the pandemic. Still, the company said the venue remains healthy, with attendance in line with pre-COVID-19 levels, producing revenue that was substantially ahead of 2019.

Cavanagh said the company was not surprised by the softening in Orlando given its prior-year rebound, and it feels good about attendance and guest spending levels at the property overall.

Capital expenditures in the segment soared 74.1% to $809 million, in large part tied to outlays for the construction of Epic Universe theme park in Orlando, slated to open in 2025.

Multichannel Trends is a regular feature from Kagan, a part of S&P Global Market Intelligence.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.