Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Oct 05, 2021

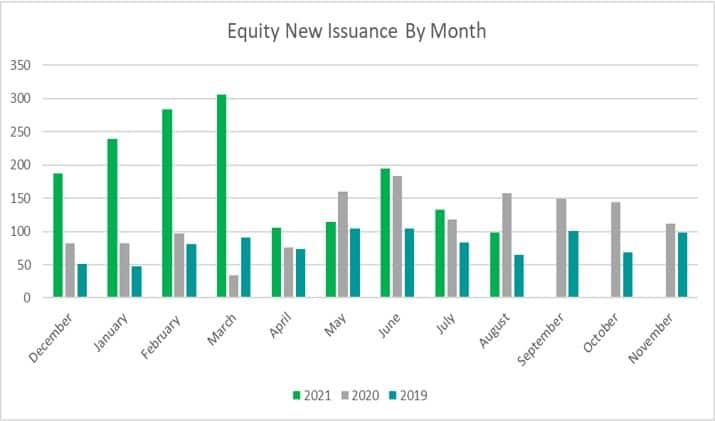

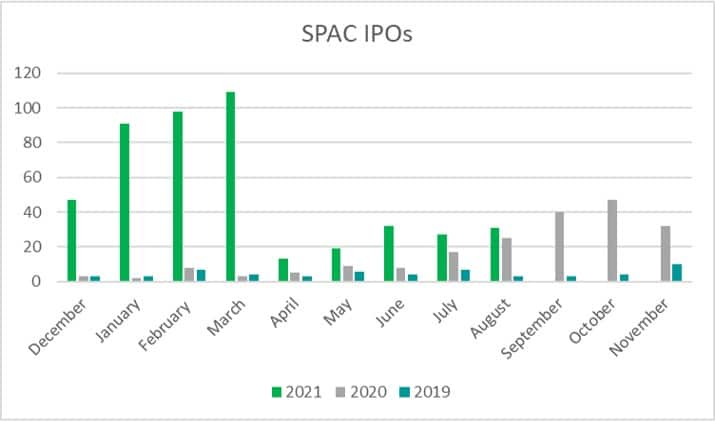

The Equity Market has had an unprecedented year in 2021, pricing a record 1,662 deals (776 IPOs, 749 FOs, 137 CVTs) year-to-date, surpassing the previous full year-record of 1,395 deals set in 2020.

The IPO market has excelled with 776 market debuts, by far the most of any year dating back to 2001, led by the 320 IPOs that priced in Q1.

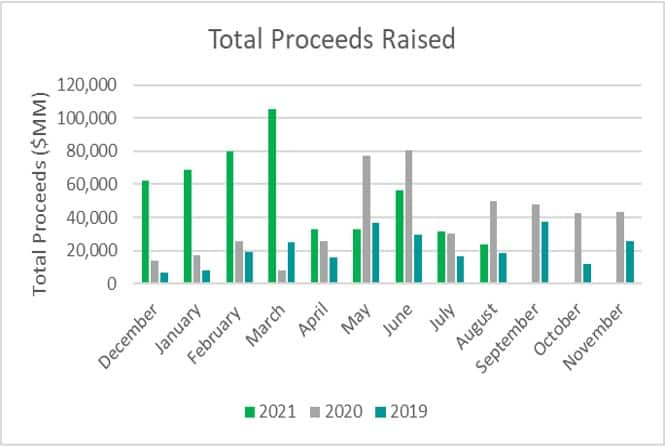

Looking at Q3, 426 deals priced that raised a combined $112B in proceeds, just shy of the 459 deals that raised $161B in Q3 2020.

Turning to Follow-Ons, Q3 priced 188 offerings for $40B in proceeds, declining 33% from 188 deals for $48B in the analogous quarter the prior year.

Lastly, 23 Convertible offerings priced during Q3 for a combined $12B in proceeds, bringing the year-to-date total to 137 CVT deals.

Source: IHS Markit

Source: IHS Markit

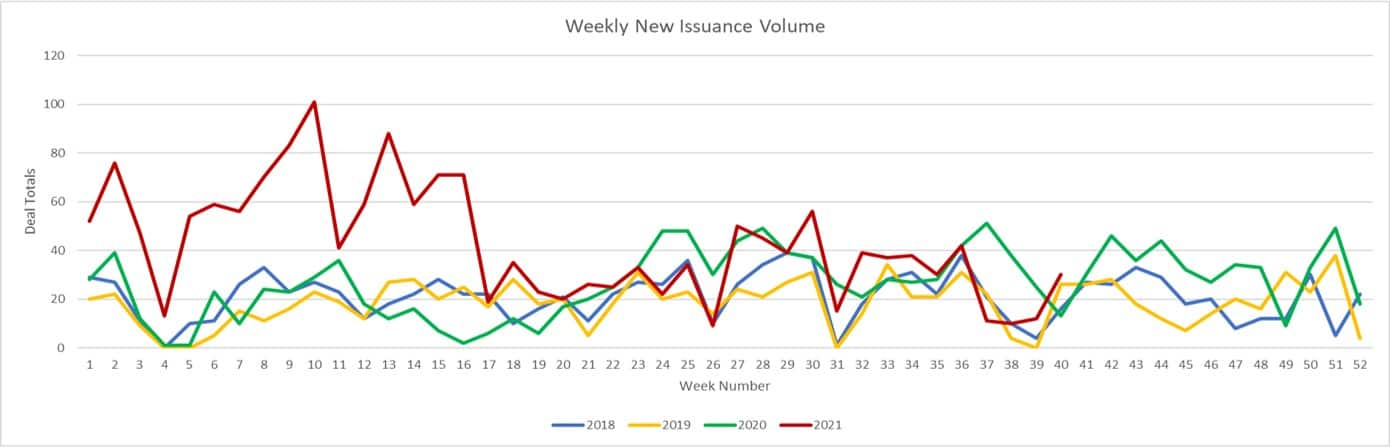

Looking ahead, the market is already seeing consistent volumes in Q4 akin to the prior three years, averaging 175 total deals for the quarter.

The deal pipeline is enriched with more Unicorn IPOs from the likes of Stripe, Rivian Automotive, Instacord, and Discord that are looking to come to market later this year and early 2022.

Source: IHS Markit

Source : IHS Markit

Please see our product page below

https://ihsmarkit.com/products/equity-issuance.html

Posted 05 October 2021 by Gina Kashinsky, Managing Director, Network & Regulatory Solutions, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.