Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Nov 11, 2024

By Craig Matsumoto, Alexander Johnston, Rich Karpinski, Melanie Posey, and Bobby Clay

The widespread adoption of electric vehicles is accelerating the demand for EV charging infrastructure. Consequently, as more consumers and businesses shift toward sustainable transportation, the need for robust IT/OT infrastructure — integrating information technology systems that manage data and networks with operational technology that controls physical devices — has intensified. This evolution is essential for supporting seamless operation, safety and efficiency, and improving the customer experience when charging in the expanding EV ecosystem.

Despite a slowdown in the adoption of battery EVs in Europe and the US due to reduced incentives, rising prices, and the increasing availability of alternative powertrains like hybrids, EV charging infrastructure remains a critical area of development and investment for both the public and private sectors. In the US, the Biden-Harris Administration announced $521 million for more than 9,200 new charging ports across 29 states, while the European Investment Bank and European Commission allocated over €1.5 billion for alternative fuels infrastructure.

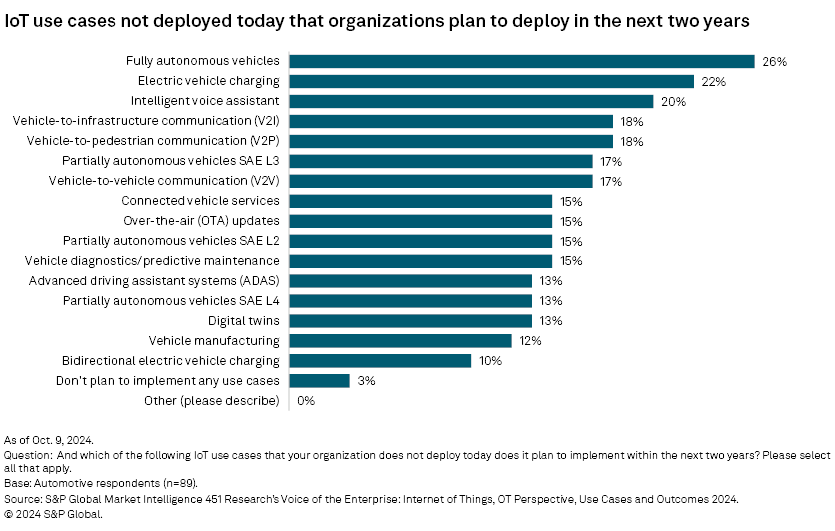

In the private sector, our data shows that EV charging is the second-most-popular internet of things use case planned for implementation within the next two years, underscoring its significance in the priorities of automotive companies (Figure 1). Scaling EV charging solutions not only supports sustainability and the transition to emissions-free transport, but also opens up significant economic opportunities. IT providers specializing in 5G connectivity, edge computing and cloud infrastructure need to position themselves to capitalize on this emerging market, while OT vendors have a key role to play in energy management and enabling EV charging hardware.

Context

The EV charging network ecosystem generally refers to the charging systems and hardware required to charge an electric vehicle, including the chargers themselves and the underlying power infrastructure. It also encompasses the IT infrastructure required to support and help deliver the service, including wireless connectivity; on-device, nearby or cloud compute and storage; and applications for managing everything from customer transactions to demand-response grid management.

For that reason, the market ecosystem for EV charging IT/OT infrastructure involves a diverse range of stakeholders, including technology providers, utility companies and automotive manufacturers. These groups collaborate to develop innovative solutions that enhance the performance and reliability of charging infrastructure, highlighting the importance of strategic planning and public-private collaboration.

Vendor market map

To better understand the market ecosystem for EV charging IT/OT infrastructure, we categorize vendors into three distinct groups.

– EV charging technology companies focus on developing charging technologies and methods.

– EV charging infrastructure companies provide the physical infrastructure for charging, including installation and maintenance.

– IT/OT infrastructure providers for EV charging offer the digital and OT support necessary for the functioning of the EV charging ecosystem.

Market players such as Blink Charging Co., Tesla Inc., ChargePoint Holdings Inc., ABB E-mobility Inc. and Siemens AG provide vertical services across the EV charging supply chain, creating a comprehensive ecosystem that includes charging technology, broader EV infrastructure and IT/OT support.

This vertical integration helps streamline operations and enhance service reliability, and offers solutions to meet the diverse needs of the EV market. In contrast, players like Ericsson ADR-Cradlepoint and Upstream Solutions may focus on specialized technologies such as network connectivity or cybersecurity for EV charging infrastructure.

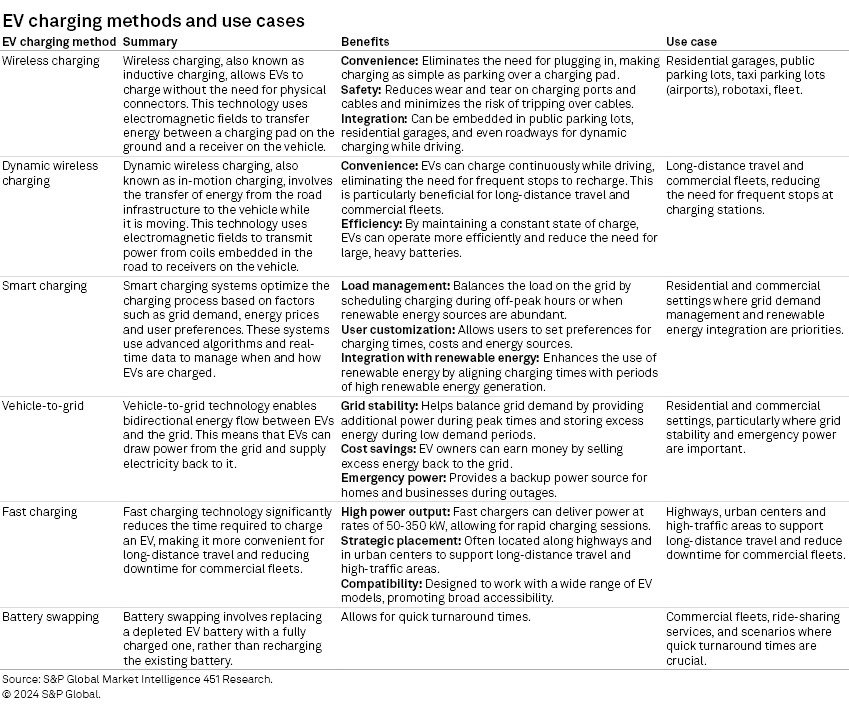

EV charging technologies

EV chargers include a variety of options, ranging from traditional wired solutions like level 1, level 2 and DC fast charging to new methods such as wireless charging, battery swapping and smart charging systems. Wireless charging offers a convenient alternative by using electromagnetic fields to transfer energy, eliminating the need for physical connectors and simplifying the process.

Each approach offers distinct advantages tailored to different environments, including residential, commercial, public and fleet applications. Emerging technologies like vehicle-to-grid (V2G) are further enhancing integration with the energy grid.

According to 451 Research's Endpoints & IoT Connected Hybrid & Electric Cars 2023 report, over half of EV owners show strong interest in emerging charging technologies such as wireless, V2G, smart charging and battery swapping.

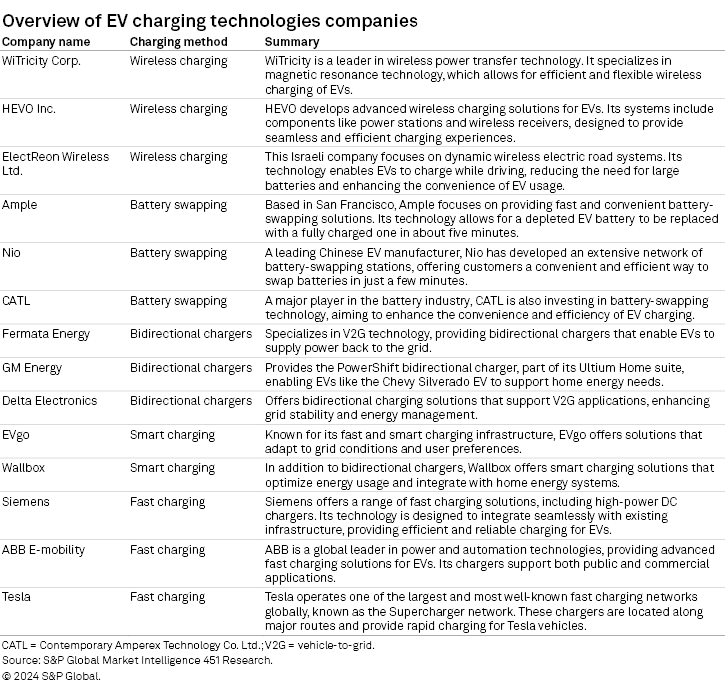

EV charging technology providers

These companies focus on developing the actual technology used to charge electric vehicles. This includes various types of chargers and innovative charging methods. Figure 3 provides examples of companies that are developing and implementing these EV charging methods.

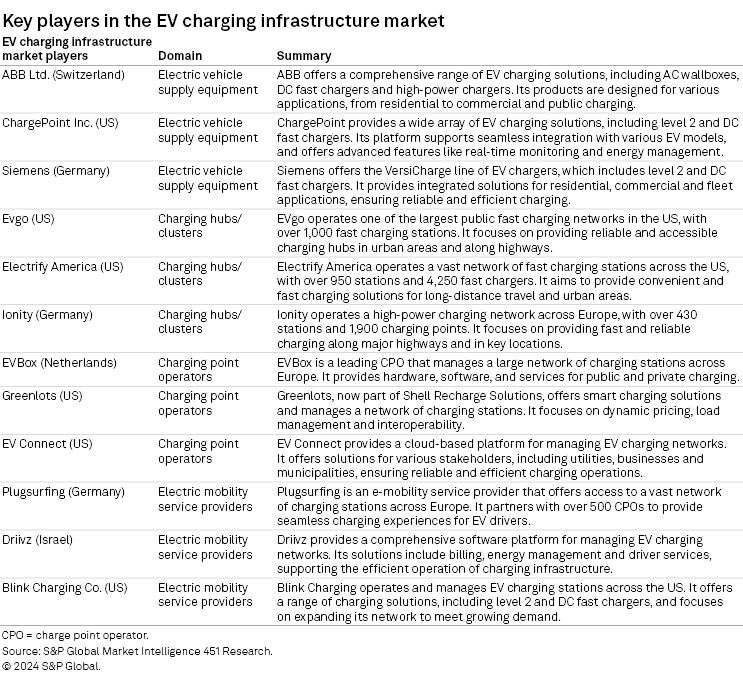

EV charging infrastructure companies

The EV charging infrastructure ecosystem is shaped by several players, including electric vehicle supply equipment manufacturers, charge point operators (CPOs) and electric mobility service providers. These entities work in synergy to create a dynamic and efficient charging landscape, catering to the varied needs of electric vehicle users (Figure 4).

Electric vehicle supply equipment refers to the infrastructure and components essential for charging EVs. This includes charging stations, connectors, cables and control systems designed to deliver electricity safely and efficiently to EVs.

Charging hubs or clusters are centralized locations where multiple EV charging stations are installed together. These hubs are often strategically placed in high-traffic areas such as shopping centers, highways and urban centers to provide convenient and efficient charging options for a large number of EVs simultaneously.

A charge point operator (CPO) is a company or organization responsible for the installation, operation and maintenance of EV charging stations. CPOs ensure that the charging infrastructure is functional, reliable and accessible to EV users. They manage the hardware, software and overall user experience at the charging stations.

Electric mobility service providers are companies that offer customers access to EV charging stations through a web or mobile app. They facilitate the connection between EV drivers and charging networks, manage payment for charging sessions, and often provide additional services such as real-time availability of charging points and customer support.

EV charging IT/OT infrastructure providers

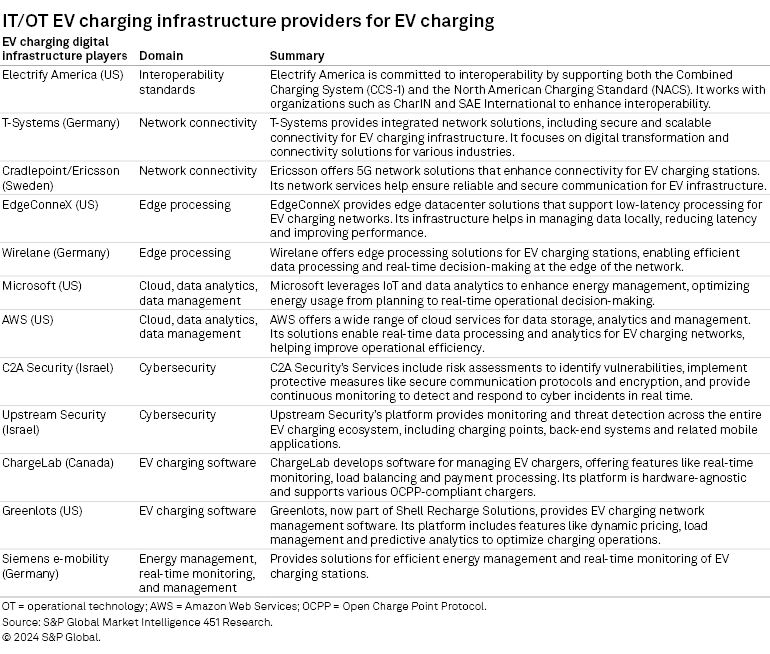

The EV charging IT/OT ecosystem is vast and poised for significant growth as new technologies like wireless charging, fast charging and smart charging continue to develop. This expansion needs a robust and adaptable infrastructure to support the needs of EV users and providers. Companies providing IT/OT infrastructure for EV chargers play a key role in this ecosystem, offering solutions that enhance interoperability, connectivity, data management, cybersecurity and more (Figure 5).

Below are the key requirements for IT/OT in EV charging.

Interoperability standards. Ensuring that different EV charging systems and components can work together seamlessly is key. This includes standardizing communication protocols and interfaces to facilitate compatibility across various manufacturers and service providers.

Network connectivity. Reliable and high-speed network connectivity is essential for real-time data transmission and communication between EV chargers, vehicles and central management systems.

Edge processing. Implementing edge computing capabilities allows for data processing closer to the source, reducing latency and improving the efficiency of real-time decision-making processes.

Cloud processing, storage and analytics. Leveraging cloud technologies enables scalable data storage, advanced analytics and centralized management of EV charging networks. This helps in optimizing operations and enhancing user experiences.

Data management. Effective data management practices are necessary to handle the vast amounts of data generated by EV charging systems. This includes data collection, storage, processing and analysis to derive actionable insight.

Cybersecurity. Protecting the EV charging infrastructure from cyber threats is paramount. This involves implementing robust security measures to safeguard data, communication channels and physical assets from unauthorized access and attacks. A separate report will cover this topic in more detail.

EV charging software. Developing and maintaining sophisticated software solutions that manage the entire EV charging process, from user authentication to energy distribution, is essential for smooth operations.

Energy management. Efficient energy management systems are required to balance the load on the grid, optimize energy usage, and integrate renewable energy sources into the EV charging ecosystem.

Real-time monitoring and management. Continuous monitoring and management of EV charging stations ensures optimal performance, quick issue resolution and enhanced user satisfaction.

Predictive maintenance. Utilizing predictive maintenance techniques helps in anticipating potential failures and addressing them proactively, thereby reducing downtime and maintenance costs.

Automated billing and payment. Implementing automated billing and payment systems simplifies the transaction process for users and ensures accurate and timely revenue collection for service providers.

Remote diagnostics and troubleshooting. Enabling remote diagnostics and troubleshooting capabilities allows for quick identification and resolution of issues, minimizing the need for on-site interventions and improving service reliability.

Enhancing the EV charging experience

The EV charging experience is becoming a central focus as the industry evolves, prioritizing convenience, efficiency and accessibility. Companies like Tesla exemplify this by offering a comprehensive ecosystem that integrates hardware and software to ensure a seamless customer experience both inside and outside the vehicle. Tesla vehicles and accounts are linked, enabling automatic authentication and charging as soon as the driver plugs in at Tesla Supercharger stations.

Meanwhile, technology firms like International Business Machines Corp. are using data analytics and AI platforms for real-time monitoring, predictive maintenance, and integration of payment systems with auto OEM and charge point operator mobile apps. This streamlines the process for users, removing the need for multiple apps or payment methods. Similarly, EV Connect, in partnership with BlueSnap, provides payment solutions for the EV charging industry, enhancing payment processing and pricing. ChargePoint also integrates payment systems within its software platform, supporting various payment options to simplify the user experience.

Outlook

As charging infrastructure expands, improvements in IT/OT systems and user experience are expected, driven by more accessible and efficient EV charging solutions. Smart charging systems will optimize energy use and provide real-time data on station availability, enhancing convenience for operators. Additionally, integrating payment solutions through smartphone apps and in-vehicle payment systems should streamline payment processes, improving the overall experience. However, robust cybersecurity protocols are crucial to protect user data and infrastructure integrity. Addressing these challenges is essential to maintaining confidence between auto OEMs and customers, to ensure the sustainable growth of electric mobility.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is a technology research group within S&P Global Market Intelligence. For more about the group, please refer to the 451 Research overview and contact page.

Location

Products & Offerings

Segment