Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

RESEARCH — JULY 03, 2025

The Democratic Republic of Congo government announced June 21 that it is extending its initial four-month cobalt export ban until September. We forecast the export ban extension will remove a further 51,000 metric tons of cobalt mine supply from the market in the short term, potentially supporting prices.

➤ The DRC's extension of its cobalt export ban will bring the total ban period to seven months from its initial implementation in February.

➤ The resulting supply tightness will support cobalt prices.

➤ The export ban does not seem to be the end goal; however, transitioning to a quota-based system will be a complex and time-consuming process.

Despite the extension, the Platts-assessed cobalt spot prices in Europe and China did not surge June 23 — the first trading day after the announcement — likely because it is widely understood that the ban was extended to allow more time to refine the framework for a post-ban quota system. Platts is part of S&P Global Commodity Insights.

The next key steps involve allocating export quotas among producers, determining eligibility criteria, and establishing mechanisms for monitoring and enforcement. Negotiating and assigning quotas will be a complex and time-consuming process, as the key cobalt mining stakeholders have differing production capacities, ownership structures and affiliations.

We expect most of the exports that were shipped out of the DRC before the Feb. 22 ban to have already arrived in China, given that the shipment time from DRC mines to ports in China is two to three months, considering inland and ocean freight and customs clearance. New arrivals will start tightening, and Chinese refineries will need to consume domestic inventories.

The new cobalt supply disruption could be significant enough to push the cobalt market into a projected deficit in 2025 from a surplus if exports do not resume soon. For now, China still has inventories, and consumers are reluctant to pay higher prices, as they expect the surging quantity of stockpiled cobalt in the DRC to be gradually released to the market once the country eventually lifts the export ban.

CMOC Group Ltd. reported 48,600 metric tons of cobalt inventory in the March quarter of 2025, exceeding Glencore PLC's entire 2024 cobalt output of 38,200 metric tons. With such significant volumes sidelined, the structure of future export mechanisms will be critical to prevent a sharp market correction when exports eventually resume.

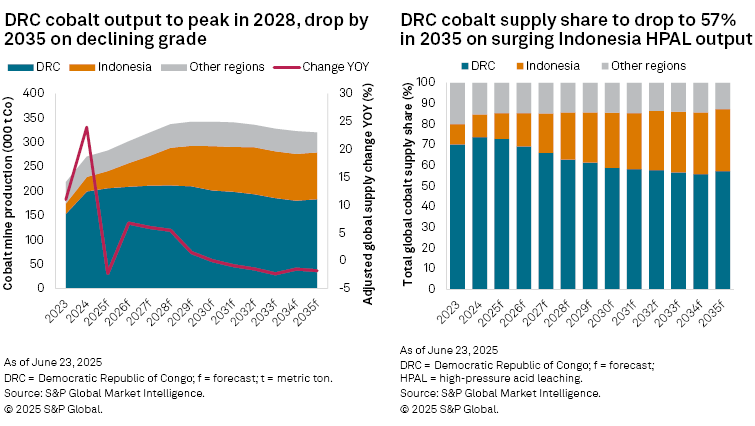

While the DRC remains the dominant cobalt producer, accounting for 73.6% of the global supply in 2024, its share is projected to fall 22 percentage points by 2035 on declining ore grades and rapid growth in Indonesia's high-pressure acid leach (HPAL) capacity. Unlike the DRC, Indonesia has no plans to regulate cobalt output.

We expect the cobalt price to remain supported and potentially increase as refineries with lower inventories need to procure supply from the market. The DRC government has indicated that it will decide whether to modify, extend or lift the export ban before the three-month extension ends in September. The longer it takes to transition to the quota system, the greater the potential is for cobalt prices to experience significant volatility, with the likelihood for sharp increases before a more pronounced price correction occurs once exports resume.

We believe the export ban is not the end goal, as higher cobalt prices are advantageous to producers outside the DRC, including those in Indonesia. Until the export quota is established, market tightness is expected to persist, and the coming months will be crucial for policy clarity and inventory management.

Background

The DRC dominates cobalt mine supply, accounting for 73.6% of global output in 2024, its highest recorded share.

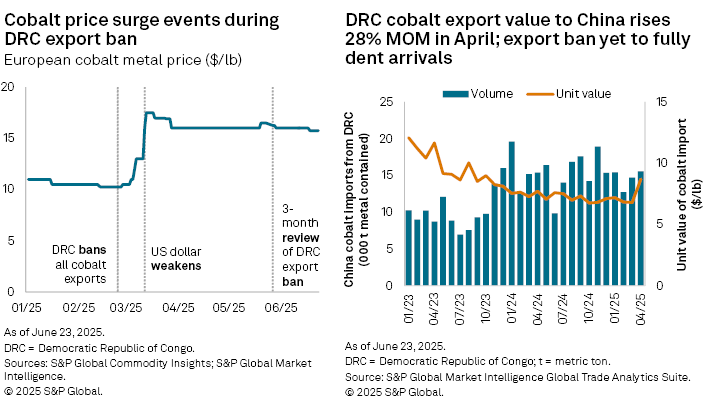

Prior to the export ban, cobalt prices had been on a downward trend; the Platts-assessed European cobalt metal price fell 74.1% from a peak of $39.53/lb on May 9, 2022, to $10.25/lb on Feb. 21, 2025 — the lowest level since 2016.

Between 2020 and 2024, cobalt exports to China doubled in volume; however, the average unit value of exports decreased 42.2%. Following the implementation of the export ban, DRC's cobalt exports to China increased from $192 million in February to $299 million in April, driven by the increase in both unit value and volumes that had already cleared DRC customs.

In the weeks that followed the DRC cobalt export ban on Feb. 22, spot cobalt prices surged. The European cobalt metal price rose more than 70%, peaking in mid-March at $17.50/lb before stabilizing in late March at $16.00/lb. Expectations ahead of the DRC's three-month review drove a short-term rally in May. However, in the absence of a formal announcement, prices quickly retreated and remained steady through June to date.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.